AMZN Stock Investment Report: Risks, Rewards, And Future Projections

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMZN Stock Investment Report: Navigating the Risks and Rewards of Amazon's Future

Amazon (AMZN). The name conjures images of instant deliveries, sprawling warehouses, and a seemingly unstoppable tech giant. But for investors, the question remains: is now the time to buy, hold, or sell AMZN stock? This report delves into the current state of Amazon, analyzing the inherent risks and potential rewards, and offering projections for the future.

Understanding Amazon's Current Landscape:

Amazon's dominance in e-commerce is undeniable. However, its vast empire stretches far beyond online retail, encompassing cloud computing (AWS), digital advertising, entertainment (Prime Video, Audible), and smart home devices (Alexa). This diversification is a double-edged sword. While it provides resilience against downturns in any single sector, it also complicates analysis and increases the overall complexity of the investment.

The Allure of AMZN Stock: Potential Rewards

- Market Leadership: Amazon's position as a market leader in multiple sectors offers significant growth potential. Continued expansion into new markets and innovative product development fuels investor optimism.

- AWS Dominance: Amazon Web Services (AWS) is the undisputed leader in the cloud computing market. Its consistent growth and high profitability are key drivers of AMZN's overall performance.

- Prime Ecosystem Lock-in: The Amazon Prime membership program creates a powerful ecosystem, locking in millions of loyal customers and generating substantial recurring revenue.

- Technological Innovation: Amazon consistently invests heavily in research and development, driving innovation across its various business units. This commitment to technological advancement positions the company for future growth.

Navigating the Risks: Potential Downfalls

- Increased Competition: Amazon faces increasing competition from established players and new entrants in each of its market segments. This competitive pressure could impact margins and growth.

- Regulatory Scrutiny: Antitrust concerns and regulatory investigations pose a significant risk to Amazon's future. Potential fines or mandated changes could negatively impact profitability.

- Economic Downturn Sensitivity: As a consumer discretionary company, Amazon is vulnerable to economic downturns. Reduced consumer spending can directly impact sales and profitability.

- Labor Relations: Amazon has faced criticism regarding its labor practices. Potential labor disputes or increased labor costs could negatively impact profitability and investor sentiment.

Future Projections: A Cautious Optimism

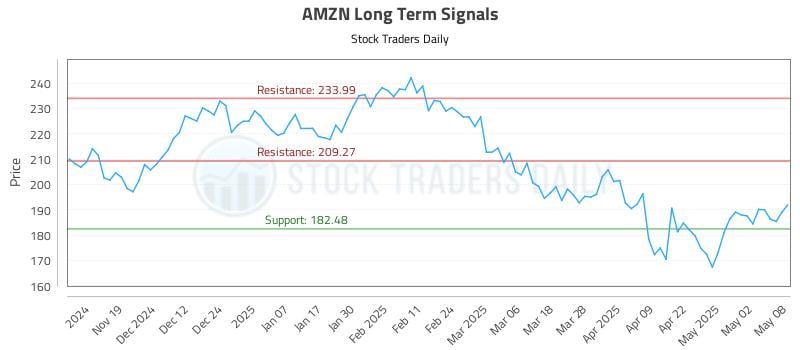

While predicting the future is inherently uncertain, several factors suggest a cautiously optimistic outlook for AMZN stock. Continued growth in AWS, expansion into new markets (such as healthcare and autonomous delivery), and ongoing technological innovation all point towards long-term potential. However, investors must carefully consider the risks outlined above.

Investment Strategy Considerations:

- Diversification: AMZN should only represent a portion of your overall investment portfolio. Diversification minimizes risk.

- Long-Term Perspective: Amazon is a long-term investment. Short-term market fluctuations should not dictate investment decisions.

- Risk Tolerance: Consider your individual risk tolerance before investing in AMZN stock. The inherent volatility requires a comfortable risk profile.

- Fundamental Analysis: Regularly review Amazon's financial statements and performance to make informed decisions.

Conclusion:

Amazon's future is complex, interwoven with opportunities and challenges. While the potential rewards are substantial, investors must carefully assess the inherent risks. A well-informed investment strategy, incorporating diversification and a long-term perspective, is crucial for navigating the complexities of AMZN stock. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMZN Stock Investment Report: Risks, Rewards, And Future Projections. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Distrust In Digital Voting Impacts Overseas Filipino Worker Participation

May 12, 2025

Distrust In Digital Voting Impacts Overseas Filipino Worker Participation

May 12, 2025 -

Rugby League Comeback Taylan May Announces Return For Next Week

May 12, 2025

Rugby League Comeback Taylan May Announces Return For Next Week

May 12, 2025 -

Could Ai Replace Irs Workers Examining The Impact Of Recent Layoffs

May 12, 2025

Could Ai Replace Irs Workers Examining The Impact Of Recent Layoffs

May 12, 2025 -

New Developments In Film Television And Weapons Technology

May 12, 2025

New Developments In Film Television And Weapons Technology

May 12, 2025 -

Concertgoers Clash Tina Arena Show Turns Ugly

May 12, 2025

Concertgoers Clash Tina Arena Show Turns Ugly

May 12, 2025

Latest Posts

-

The Papal Name Leo Xiv An Artificial Intelligence Connection

May 13, 2025

The Papal Name Leo Xiv An Artificial Intelligence Connection

May 13, 2025 -

2024 Amzn Investment Report Key Performance Indicators And Financial Outlook

May 13, 2025

2024 Amzn Investment Report Key Performance Indicators And Financial Outlook

May 13, 2025 -

May 28th Catalyst Why This Ai Semiconductor Stock Is Poised For Growth

May 13, 2025

May 28th Catalyst Why This Ai Semiconductor Stock Is Poised For Growth

May 13, 2025 -

Darknet Laundering And Bybit Hack German Authorities Target E Xch Crypto Platform In E34 Million Seizure

May 13, 2025

Darknet Laundering And Bybit Hack German Authorities Target E Xch Crypto Platform In E34 Million Seizure

May 13, 2025 -

Online Voting Success More Overseas Filipinos Casting Their Ballots

May 13, 2025

Online Voting Success More Overseas Filipinos Casting Their Ballots

May 13, 2025