Analysis: 30% US Tariff, 10% China Tariff – A Trade Truce?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: 30% US Tariff, 10% China Tariff – A Trade Truce or Temporary Calm?

The recent announcement of a 30% tariff on certain US goods and a 10% tariff on specific Chinese products has sent ripples through the global economy. While some hail it as a sign of de-escalation in the ongoing trade war, others view it as a mere temporary truce, masking a deeper, more complex conflict. This analysis delves into the implications of these tariffs, exploring whether they represent a genuine step towards resolution or simply a tactical maneuver in a prolonged trade battle.

The Shifting Sands of the Trade War:

The US-China trade war, a protracted conflict marked by escalating tariffs and retaliatory measures, has significantly impacted global markets. The imposition of a 30% tariff on select US goods, coupled with a 10% tariff on certain Chinese products, represents a significant development in this ongoing saga. While seemingly asymmetrical, both tariffs target strategically important sectors, suggesting a complex calculation rather than a simple escalation.

Understanding the 30% US Tariff:

The 30% tariff on US goods is primarily focused on [insert specific goods here, e.g., agricultural products, technology components]. This targeted approach suggests a strategic attempt to [insert the likely strategic goal, e.g., pressure China to make concessions in specific areas, protect domestic industries]. The impact will likely be felt most acutely by [insert impacted industries or groups, e.g., American farmers, tech companies], potentially leading to job losses and increased consumer prices.

Deciphering the 10% China Tariff:

The 10% tariff imposed on Chinese goods is similarly targeted, focusing on [insert specific goods here, e.g., consumer electronics, textiles]. This lower percentage could indicate a more measured response, aiming to [insert the likely strategic goal, e.g., avoid excessive escalation, maintain a degree of economic stability]. However, even a 10% increase can still significantly impact consumer prices and supply chains.

Is This a Truce or a Tactical Maneuver?

The question remains: is this a genuine attempt at a trade truce, or a carefully orchestrated tactical move? Several factors suggest the latter:

- Ongoing Trade Disputes: Underlying issues regarding intellectual property rights, technology transfer, and market access remain largely unresolved.

- Retaliatory Potential: The potential for further retaliatory measures from both sides remains high, depending on the outcome of ongoing negotiations.

- Political Context: Domestic political pressures in both the US and China continue to influence trade policy decisions.

The Road Ahead: Uncertainties and Opportunities:

The future trajectory of US-China trade relations remains uncertain. While the recent tariff adjustments might offer a temporary reprieve, the underlying tensions persist. The situation requires careful monitoring, with potential impacts including:

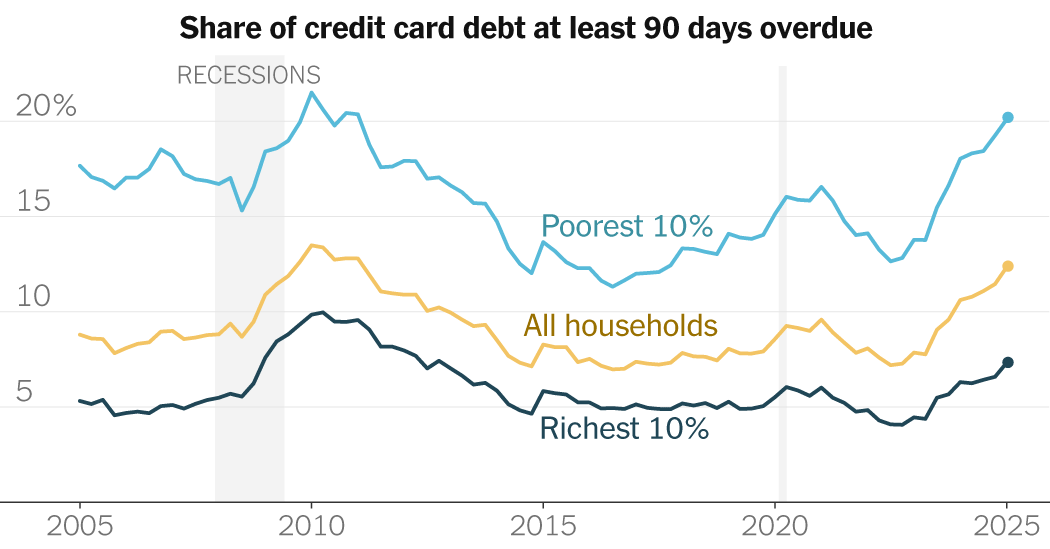

- Global Market Volatility: Continued uncertainty could lead to increased market volatility and investment hesitancy.

- Supply Chain Disruptions: Businesses may need to adjust their supply chains to mitigate the impact of tariffs.

- Inflationary Pressures: Increased tariffs could lead to higher consumer prices globally.

However, this situation also presents opportunities:

- Diversification of Trade Partners: Companies may seek to diversify their supply chains, reducing reliance on either the US or China.

- Innovation and Technological Advancement: The pressure to compete could spur innovation and technological development.

- Renegotiation of Trade Agreements: This could be a catalyst for renegotiating trade agreements to create a more balanced and equitable global trade system.

In conclusion, while the 30% US tariff and 10% China tariff might appear as a temporary de-escalation, they are unlikely to signal a lasting trade truce. The underlying issues remain unresolved, leaving the global economy vulnerable to further fluctuations. Careful observation and strategic adaptation are crucial for navigating this complex and evolving landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: 30% US Tariff, 10% China Tariff – A Trade Truce?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Economic Strain Mounts How Tariffs Are Affecting American Consumers

May 17, 2025

Economic Strain Mounts How Tariffs Are Affecting American Consumers

May 17, 2025 -

Quail Hollow Club Hosts Pga Championship 2025 Live Scores Streaming Info And News

May 17, 2025

Quail Hollow Club Hosts Pga Championship 2025 Live Scores Streaming Info And News

May 17, 2025 -

Sigue El Partido Alcaraz Musetti En Vivo Y Online

May 17, 2025

Sigue El Partido Alcaraz Musetti En Vivo Y Online

May 17, 2025 -

Ge 2025 How Overseas Voting Patterns Align With National Results

May 17, 2025

Ge 2025 How Overseas Voting Patterns Align With National Results

May 17, 2025 -

Analysis Dean Hendersons Dogso Challenge And Potential Red Card

May 17, 2025

Analysis Dean Hendersons Dogso Challenge And Potential Red Card

May 17, 2025