Analysis: AMD Beats Earnings, But China Chip Sales Ban Creates Significant Headwind

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMD Beats Earnings, But China Chip Sales Ban Casts a Long Shadow

AMD (Advanced Micro Devices) delivered a strong earnings beat in its latest quarterly report, exceeding analyst expectations on both revenue and earnings per share. However, the celebratory mood is tempered by a significant headwind: the looming impact of new US restrictions on the sale of advanced chips to China. This presents a complex challenge for AMD, forcing the company to navigate a delicate geopolitical landscape while maintaining its growth trajectory.

The company reported a Q3 revenue of $5.6 billion, surpassing the anticipated $5.5 billion and demonstrating consistent growth in key market segments. This success can largely be attributed to strong demand for its Ryzen processors in the PC market and its EPYC server CPUs, which continue to gain market share against Intel. The impressive performance across these segments underscores AMD's continued technological innovation and its ability to effectively compete in a highly competitive market.

Strong Performance Across Key Segments: A Closer Look

- PC Market: Ryzen processors continue to dominate, driven by both the consumer and professional markets. AMD's success in this sector highlights the growing appeal of its high-performance, energy-efficient chips.

- Data Center Market: The growth of the EPYC server CPU business is particularly encouraging, indicating AMD’s increasing penetration into the lucrative data center market. This sector is crucial for long-term growth and represents a significant challenge to Intel's dominance.

- Gaming Market: While specific figures weren't broken down extensively, the overall strong revenue suggests continued success in the gaming market, a crucial segment for AMD's graphic cards, particularly the Radeon series.

The China Chip Sales Ban: A Major Hurdle

The US government's new restrictions on the export of advanced chips to China represent a significant challenge. While AMD hasn't yet fully quantified the financial impact, analysts predict a considerable negative effect on future revenue. This ban targets high-performance computing chips, impacting both the data center and potentially the high-end gaming markets. The uncertainty surrounding the long-term implications of these restrictions adds a layer of complexity to AMD's future outlook.

This presents a multi-faceted challenge:

- Lost Revenue: The immediate impact is a loss of potential revenue from the Chinese market, a considerable segment for semiconductor companies.

- Supply Chain Disruption: The ban could also lead to disruptions in the global supply chain, affecting production and potentially impacting timelines for product launches.

- Geopolitical Risks: Navigating the complex geopolitical landscape adds further uncertainty, requiring AMD to carefully manage its relationships with both the US and Chinese governments.

Navigating the Future: AMD's Strategic Response

AMD is likely to adapt its strategies to mitigate the impact of the China chip sales ban. This could include:

- Diversification: Focusing on other key markets to lessen dependence on China.

- Innovation: Investing in technological advancements to maintain a competitive edge and offer products that circumvent the restrictions.

- Lobbying Efforts: Engaging in policy discussions to influence future regulations and potentially ease the restrictions.

Conclusion: A Balancing Act

While AMD's latest earnings report is undoubtedly positive, showcasing the company’s strength and innovative capabilities, the China chip sales ban introduces significant uncertainty. The company’s ability to successfully navigate this complex geopolitical landscape and adapt its strategies will be crucial in determining its long-term success. The coming quarters will be critical in assessing AMD’s response and its ultimate impact on the company's financial performance. Investors will be closely monitoring AMD's future announcements for further clarification on the impact of these restrictions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: AMD Beats Earnings, But China Chip Sales Ban Creates Significant Headwind. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Canadian Basketballs Rising Stars Gilgeous Alexander And Murray Lead The Way

May 08, 2025

Canadian Basketballs Rising Stars Gilgeous Alexander And Murray Lead The Way

May 08, 2025 -

Mark Daigneault Discusses Strategic Fouling And 3 Point Shooting Probabilities

May 08, 2025

Mark Daigneault Discusses Strategic Fouling And 3 Point Shooting Probabilities

May 08, 2025 -

High Cost Low Connectivity A Disappointing Modular Mini Pc

May 08, 2025

High Cost Low Connectivity A Disappointing Modular Mini Pc

May 08, 2025 -

Ai Agents Connecting To All Saa S Applications Today

May 08, 2025

Ai Agents Connecting To All Saa S Applications Today

May 08, 2025 -

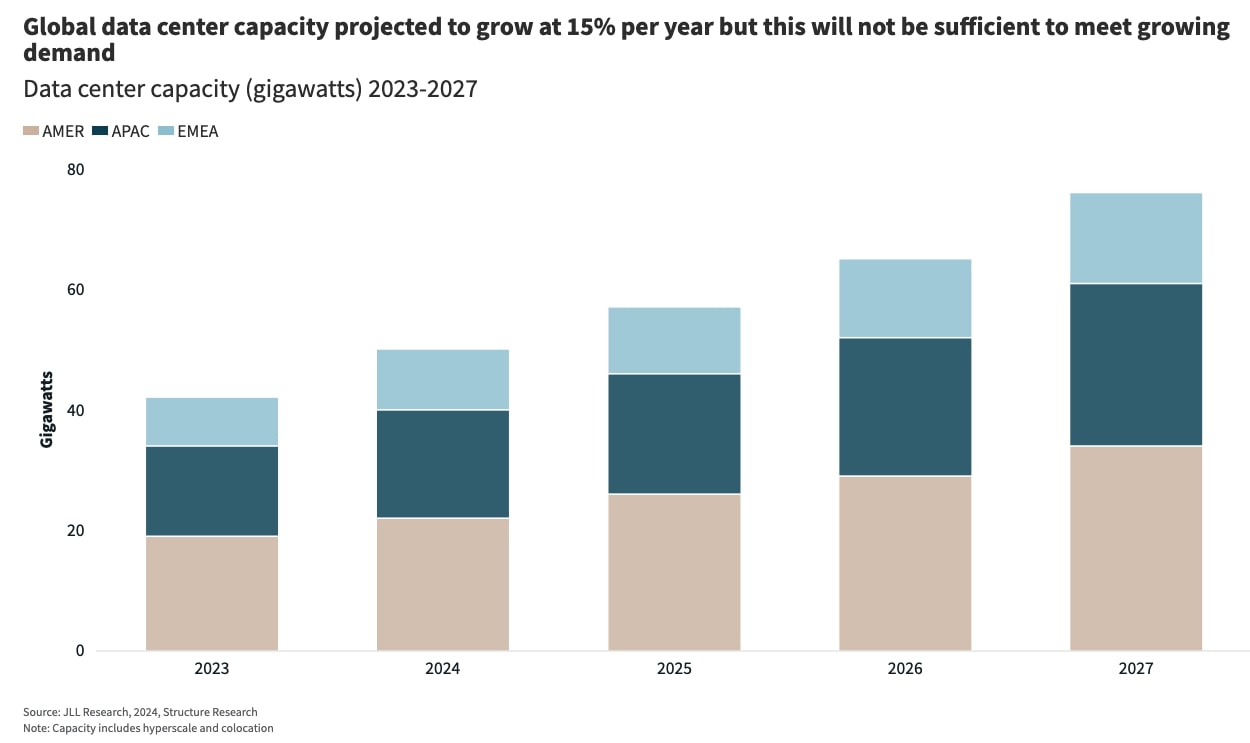

Global Ai Data Center Growth Continues Despite Tech Giants Adjustments

May 08, 2025

Global Ai Data Center Growth Continues Despite Tech Giants Adjustments

May 08, 2025

Latest Posts

-

Denver Nuggets Defeat Oklahoma City Thunder May 5 2025 Game Recap

May 08, 2025

Denver Nuggets Defeat Oklahoma City Thunder May 5 2025 Game Recap

May 08, 2025 -

2025 Nba Season Denver Nuggets Vs Oklahoma City Thunder May 7th Game Report

May 08, 2025

2025 Nba Season Denver Nuggets Vs Oklahoma City Thunder May 7th Game Report

May 08, 2025 -

Denver Nuggets At Oklahoma City Thunder Game 1 Analysis And Betting Odds

May 08, 2025

Denver Nuggets At Oklahoma City Thunder Game 1 Analysis And Betting Odds

May 08, 2025 -

Fact Check Pakistan Ministers Claim Of No Terror Camps Faces Scrutiny

May 08, 2025

Fact Check Pakistan Ministers Claim Of No Terror Camps Faces Scrutiny

May 08, 2025 -

35 Unit 42 U Racks A Us Vendors Choice Of Amd Epyc 4005 Mini Pcs For High Density Computing

May 08, 2025

35 Unit 42 U Racks A Us Vendors Choice Of Amd Epyc 4005 Mini Pcs For High Density Computing

May 08, 2025