Analysis: India Gold Price Drop - Global Factors And Market Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: India Gold Price Drop – Global Factors and Market Outlook

India's gold market, a significant player on the global stage, has witnessed a recent price drop. This fluctuation has sent ripples through the country's economy, impacting investors, jewelers, and consumers alike. Understanding the reasons behind this decline and predicting future trends is crucial for anyone involved in or affected by the Indian gold market. This analysis delves into the global factors driving the price drop and offers a perspective on the market outlook.

Global Factors Fueling the Dip:

Several interconnected global factors have contributed to the recent fall in gold prices in India. These include:

-

Strengthening US Dollar: The US dollar's strength against other major currencies, including the Indian Rupee, directly impacts gold pricing. A stronger dollar makes gold more expensive for buyers using other currencies, reducing demand and consequently pushing prices down. This is because gold is priced in US dollars globally.

-

Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes have made alternative investments, like bonds, more attractive. This shift in investor sentiment away from gold, considered a safe haven asset, has also contributed to the price decline. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold.

-

Easing Inflationary Pressures: While inflation remains a concern globally, recent data suggests some easing of inflationary pressures in key economies. This reduced fear of inflation, a traditional driver of gold demand, has lessened the appeal of gold as a hedge against inflation.

-

Increased Supply: Factors influencing global gold mine production and recycling rates can also influence the overall supply, impacting prices. Increased supply, in relation to demand, can lead to price corrections.

Impact on the Indian Market:

The global factors mentioned above have a direct and significant impact on India's gold market. India is one of the world's largest consumers of gold, with demand driven by both investment and consumption (jewelry). The price drop has led to:

-

Increased Affordability: The lower prices make gold more accessible to Indian consumers, potentially boosting demand in the short term. However, this effect is often tempered by other economic factors influencing consumer spending.

-

Investor Sentiment: Indian investors are closely watching global market trends. The price drop could lead to some investors taking a wait-and-see approach, while others might see it as a buying opportunity.

-

Impact on Jewelers: The price fluctuation creates uncertainty for jewelers, affecting their pricing strategies and profitability.

Market Outlook: A Cautious Optimism?

Predicting future gold prices is inherently challenging, but several factors suggest a cautiously optimistic outlook for the Indian gold market:

-

Festival Season Demand: The upcoming festival season in India traditionally witnesses a surge in gold demand, which could counterbalance the current price dip.

-

Safe Haven Appeal: Gold's inherent value as a safe haven asset remains intact. Geopolitical uncertainties and potential economic slowdowns could reignite demand in the future.

-

Long-Term Investment: Many Indians view gold as a long-term investment, and price fluctuations are often seen as temporary corrections within a broader upward trend.

Conclusion:

The recent gold price drop in India is primarily attributed to a confluence of global factors. While the current dip presents opportunities for some, it also introduces uncertainties for others within the market. The interplay between global economic trends and India's unique domestic demand will ultimately determine the future trajectory of gold prices in India. Continuous monitoring of global economic indicators and domestic market dynamics is essential for navigating this dynamic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: India Gold Price Drop - Global Factors And Market Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No Taxpayer Dollars For Illegal Immigrant Housing Says Hud Secretary

Apr 08, 2025

No Taxpayer Dollars For Illegal Immigrant Housing Says Hud Secretary

Apr 08, 2025 -

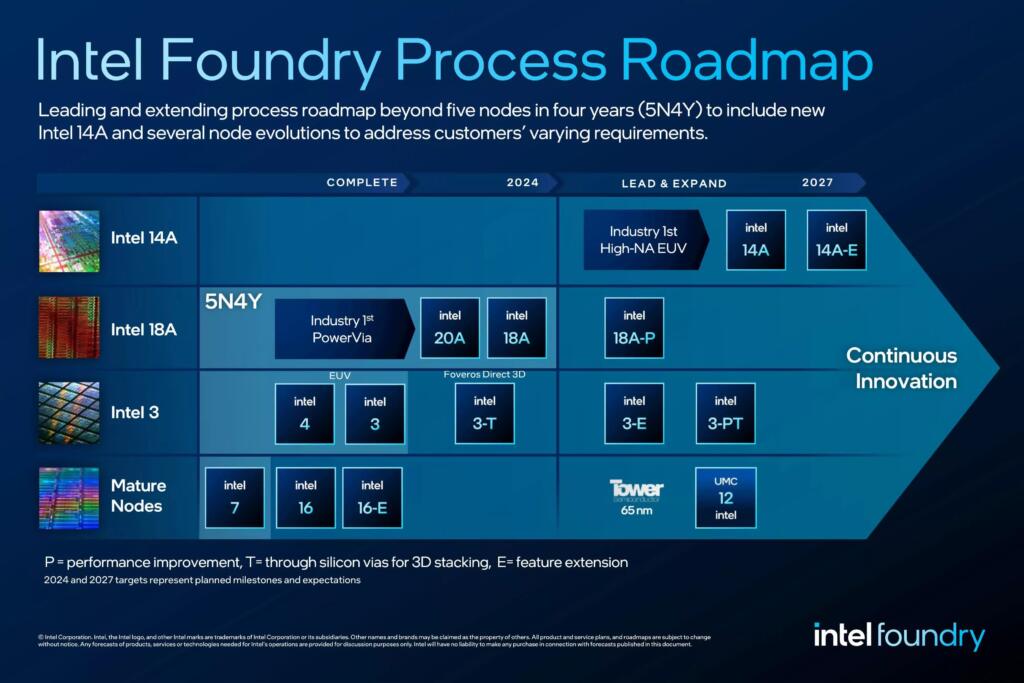

2025 Intel Targets Mass Production Of Its Advanced 18 Angstrom Chips

Apr 08, 2025

2025 Intel Targets Mass Production Of Its Advanced 18 Angstrom Chips

Apr 08, 2025 -

Augusta National Weather 2025 Masters Tournament Outlook

Apr 08, 2025

Augusta National Weather 2025 Masters Tournament Outlook

Apr 08, 2025 -

So Viel Verdient Der Fc Bayern In Der Champions League

Apr 08, 2025

So Viel Verdient Der Fc Bayern In Der Champions League

Apr 08, 2025 -

Negotiating A Way Out Resolving The Impact Of Trumps Penguin And Vaccine Tariffs

Apr 08, 2025

Negotiating A Way Out Resolving The Impact Of Trumps Penguin And Vaccine Tariffs

Apr 08, 2025