Analysis Of Deepseek AI's Remarkable 85% Profit Margins

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DeepSeek AI's Stunning 85% Profit Margins: A Deep Dive into the Numbers

DeepSeek AI, the innovative artificial intelligence company specializing in [mention DeepSeek AI's specialization, e.g., predictive analytics for the financial sector], has announced staggering profit margins of 85%. This remarkable figure has sent shockwaves through the tech industry, sparking intense curiosity about the company's strategies and raising questions about the future of AI profitability. This article delves into the potential factors behind DeepSeek AI's success, examining its business model, market position, and the implications for the broader AI landscape.

The 85% Margin: A Closer Look

DeepSeek AI's 85% profit margin is unprecedented in the typically capital-intensive AI sector. While many AI companies struggle with profitability, DeepSeek's success highlights the potential for significant returns when innovation meets efficient operations. This impressive margin suggests a potent combination of factors, including:

- High-value services: DeepSeek AI likely focuses on high-value services with substantial pricing power. Their sophisticated AI solutions probably command premium fees due to their unique capabilities and the significant return on investment they offer clients.

- Efficient scalability: The company’s technology may be highly scalable, allowing them to serve a growing clientele without a proportional increase in operational costs. This suggests a lean and optimized infrastructure.

- Intellectual property protection: Strong intellectual property (IP) protection likely plays a crucial role. A robust patent portfolio and trade secrets prevent competitors from easily replicating DeepSeek AI's unique technology, maintaining a competitive advantage.

- Strategic partnerships: Strategic partnerships with key players in their industry could provide access to larger markets and reduce acquisition costs, contributing to the high margin.

The Implications for the AI Industry

DeepSeek AI's achievement presents a compelling case study for the entire AI industry. It demonstrates that exceptionally high profit margins are attainable, even within a field known for its high development costs. This success story could:

- Attract further investment: The impressive margins are likely to attract significant investment in AI research and development, fueling further innovation in the sector.

- Inspire new business models: Other AI companies may seek to emulate DeepSeek AI's success by focusing on high-value, scalable solutions with strong intellectual property protection.

- Shift investor perceptions: The success of DeepSeek AI could shift investor perceptions of the AI market, moving away from a solely growth-focused narrative towards a more profitability-centric approach.

Challenges and Future Outlook

While DeepSeek AI's success is undeniable, maintaining these exceptional margins will require ongoing innovation and adaptation. The company faces several challenges, including:

- Maintaining a competitive edge: Continuous innovation is crucial to prevent competitors from catching up. DeepSeek AI must invest heavily in R&D to stay ahead of the curve.

- Managing scaling challenges: As the company grows, managing its expanding operations and ensuring continued efficiency will be crucial for maintaining its profitability.

- Responding to market changes: The AI landscape is constantly evolving. DeepSeek AI must be agile and adaptable to respond effectively to emerging trends and technologies.

DeepSeek AI's 85% profit margin is a remarkable achievement, offering a valuable lesson for the AI industry. Its success highlights the potential for significant profitability when innovation, efficiency, and strong IP protection are combined. While challenges remain, DeepSeek AI's story serves as a powerful testament to the transformative power of AI and the potential for exceptional returns in this rapidly evolving sector. Further analysis of their financial reports and public statements will be crucial in understanding the full extent of their success and the long-term sustainability of their business model.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis Of Deepseek AI's Remarkable 85% Profit Margins. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Donald Trumps Crypto Strategy A Winning Bet Experts Weigh In

Mar 04, 2025

Is Donald Trumps Crypto Strategy A Winning Bet Experts Weigh In

Mar 04, 2025 -

Lenovos Gaming Laptop Performance Beyond Expectations

Mar 04, 2025

Lenovos Gaming Laptop Performance Beyond Expectations

Mar 04, 2025 -

Conheca Opcoes Para Usar Casas Na Praia E Campo Sem A Compra Direta

Mar 04, 2025

Conheca Opcoes Para Usar Casas Na Praia E Campo Sem A Compra Direta

Mar 04, 2025 -

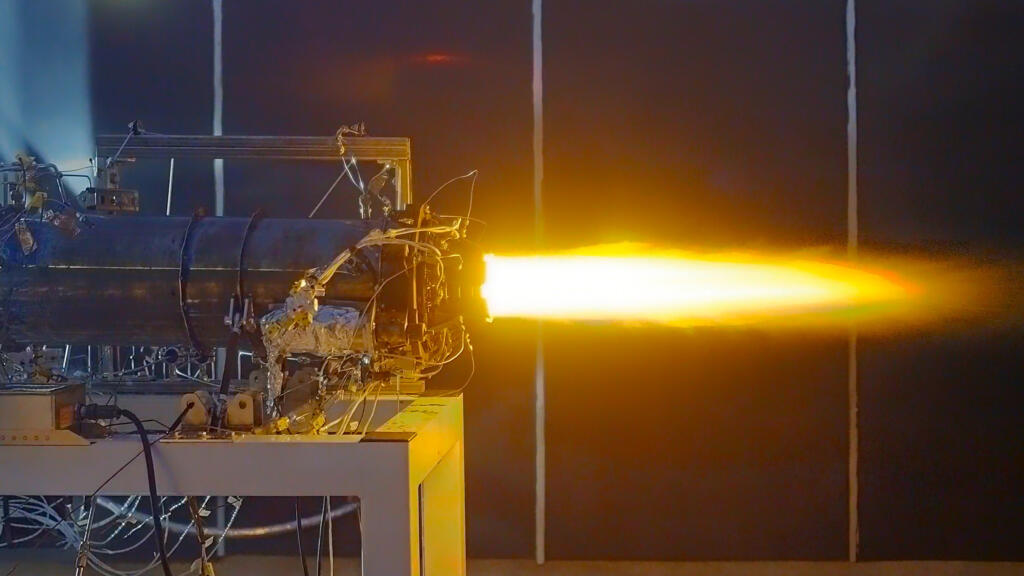

Vdr 2 Engine Ignition Venus Aerospace Marks A Major Milestone

Mar 04, 2025

Vdr 2 Engine Ignition Venus Aerospace Marks A Major Milestone

Mar 04, 2025 -

Melhores Acoes Para Dividendos Eletrobras Caixa Seguridade E Outras

Mar 04, 2025

Melhores Acoes Para Dividendos Eletrobras Caixa Seguridade E Outras

Mar 04, 2025