Analysis: THORChain Liquidity Crash And The Impact On RUNE Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: THORChain Liquidity Crash and the Impact on RUNE Price

The decentralized exchange (DEX) THORChain experienced a significant liquidity crisis in late 2022, sending shockwaves through the cryptocurrency market and drastically impacting the price of its native token, RUNE. This event highlighted the inherent risks associated with DeFi protocols and sparked intense debate about the future of cross-chain liquidity solutions. This analysis delves into the causes of the crash, its consequences for RUNE's price, and the broader implications for the DeFi landscape.

The Liquidity Crisis: A Perfect Storm?

THORChain's innovative cross-chain swapping mechanism, while ambitious, proved vulnerable to a confluence of factors. The primary issue stemmed from a significant imbalance in liquidity pools. Several factors contributed to this imbalance:

- Exploitation Attempts: While no successful exploits were confirmed, several attempts to manipulate liquidity pools were reported, increasing volatility and eroding trust.

- Concentrated Liquidity: A large portion of liquidity was concentrated in specific pools, making the entire system susceptible to large withdrawals or attacks targeting these high-value pools.

- Chain-Specific Issues: Technical difficulties on various blockchains integrated with THORChain also played a role, hindering the smooth flow of liquidity.

- Market Sentiment: The broader cryptocurrency market downturn in late 2022 exacerbated existing vulnerabilities within the THORChain ecosystem. A general lack of confidence amplified sell-offs.

The Impact on RUNE Price:

The liquidity crisis had a devastating effect on RUNE's price. The token experienced a sharp and sustained decline, losing a significant percentage of its value within a short period. This price drop can be attributed to:

- Loss of Confidence: Investors lost faith in THORChain's stability and the security of their assets, leading to a mass sell-off of RUNE.

- Liquidity Withdrawals: As users rushed to withdraw their funds, the price of RUNE plummeted due to increased sell pressure.

- Market Panic: The event triggered a broader panic in the cryptocurrency market, further impacting the price of RUNE.

THORChain's Response and Recovery Efforts:

Following the crisis, THORChain's development team implemented several measures aimed at stabilizing the protocol and restoring user confidence. These included:

- Enhanced Security Audits: Thorough security audits were conducted to identify and address vulnerabilities in the protocol.

- Improved Liquidity Management: Changes were made to the liquidity management system to mitigate the risk of future imbalances.

- Community Engagement: The team actively engaged with the community to address concerns and provide updates on the recovery process.

Long-Term Implications for DeFi:

The THORChain liquidity crash serves as a cautionary tale for the entire DeFi ecosystem. It highlighted the importance of:

- Robust Risk Management: DeFi protocols need to implement robust risk management strategies to protect against unexpected events.

- Decentralized Governance: Strong decentralized governance models are essential to ensure the long-term health and stability of DeFi projects.

- Transparency and Communication: Open and transparent communication between developers and the community is crucial for building trust and mitigating risks.

Conclusion:

The THORChain liquidity crash and its impact on RUNE's price were significant events that underscored the risks inherent in the rapidly evolving DeFi space. While THORChain has taken steps to address the issues, the incident highlights the need for increased scrutiny and better risk management practices across the entire decentralized finance sector. The future of cross-chain solutions remains promising, but lessons learned from this crisis are vital for building a more resilient and secure decentralized future. The recovery and long-term success of THORChain will depend on continued transparency, community support, and the successful implementation of its improvement strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: THORChain Liquidity Crash And The Impact On RUNE Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Outperforming The Competition A Look At The Google Pixel 9as Value

Apr 10, 2025

Outperforming The Competition A Look At The Google Pixel 9as Value

Apr 10, 2025 -

Goalmax Your Bet365 Bonus Code For 150 In Illinois Sports Bets

Apr 10, 2025

Goalmax Your Bet365 Bonus Code For 150 In Illinois Sports Bets

Apr 10, 2025 -

Nintendos Post Switch 2 Plans Continued Support For Original Model

Apr 10, 2025

Nintendos Post Switch 2 Plans Continued Support For Original Model

Apr 10, 2025 -

Legia Warsaw Vs Chelsea Conference League Match Updates And Result

Apr 10, 2025

Legia Warsaw Vs Chelsea Conference League Match Updates And Result

Apr 10, 2025 -

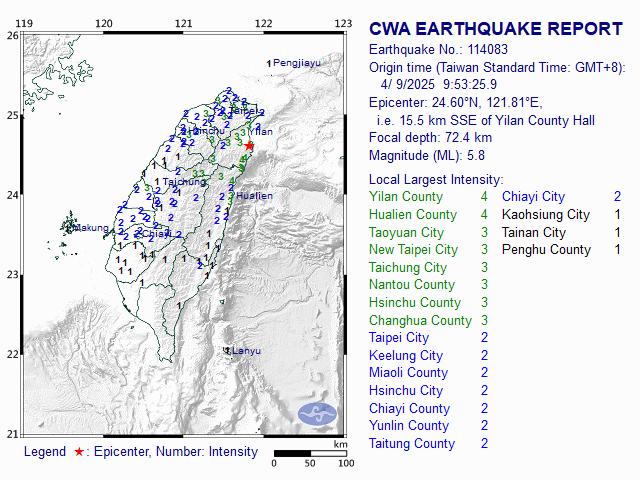

Northern Taiwan Rattled By Earthquake Minor Quake Causes No Damage

Apr 10, 2025

Northern Taiwan Rattled By Earthquake Minor Quake Causes No Damage

Apr 10, 2025