Analysts Warn: Obstacles Ahead For Trump's Strategic Crypto Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysts Warn: Obstacles Ahead for Trump's Strategic Crypto Holdings

Former President Donald Trump's foray into the cryptocurrency market has sparked significant debate, and now, analysts are raising concerns about potential hurdles ahead. While the exact nature and extent of his crypto holdings remain undisclosed, the sheer fact of his involvement has injected a potent dose of unpredictability into an already volatile market. This article delves into the challenges Trump's crypto investments may face, exploring the legal, regulatory, and market-driven obstacles that could impact his portfolio.

The Murky Waters of Disclosure and Transparency

One of the most immediate challenges surrounds the lack of transparency regarding Trump's crypto holdings. Unlike traditional financial assets, the decentralized and often anonymous nature of the cryptocurrency market makes it difficult to track ownership and verify holdings. This opacity raises concerns about potential conflicts of interest, particularly given Trump's ongoing political influence and business ventures. Regulators are likely to scrutinize any perceived lack of transparency, potentially leading to investigations and increased regulatory scrutiny of his activities.

Navigating the Regulatory Maze

The cryptocurrency landscape is constantly evolving, with regulations varying significantly across jurisdictions. Navigating this complex regulatory environment presents a considerable challenge. Different countries have implemented diverse rules concerning taxation, security token offerings (STOs), and the overall classification of cryptocurrencies as securities or commodities. Trump's holdings could face legal challenges depending on the jurisdictions in which they are held and the specific regulations governing those assets. This uncertainty could lead to unforeseen legal battles and potential financial penalties.

Market Volatility and Price Fluctuations

Perhaps the most significant obstacle for Trump's crypto investments is the inherent volatility of the cryptocurrency market. Bitcoin and other major cryptocurrencies have experienced dramatic price swings, often influenced by market sentiment, regulatory announcements, and technological developments. This volatility poses a considerable risk to any investor, particularly those with significant holdings. A sudden market downturn could result in substantial losses, impacting not only Trump's personal finances but potentially also his public image.

Geopolitical Risks and International Sanctions

Trump's crypto holdings are also vulnerable to geopolitical risks and the potential for international sanctions. The use of cryptocurrencies in illicit activities and their potential to circumvent traditional financial systems raises concerns among governments worldwide. This could lead to increased regulatory pressure and even potential sanctions targeting individuals or entities involved in the handling of cryptocurrencies, potentially impacting Trump's assets.

The Long-Term Outlook: Challenges and Opportunities

While the obstacles are significant, Trump's crypto investment strategy might also present long-term opportunities. The continued growth of blockchain technology and the increasing adoption of cryptocurrencies could potentially lead to substantial returns. However, this hinges on successful navigation of the regulatory landscape and the ability to mitigate the inherent risks associated with the volatile nature of the market.

In Conclusion:

The analysts' warnings regarding Trump's strategic crypto holdings highlight the considerable challenges that lie ahead. Navigating the regulatory maze, mitigating market volatility, and addressing concerns about transparency will be crucial for managing these assets effectively. The future of Trump's crypto investment remains uncertain, presenting a fascinating case study in the intersection of politics, finance, and emerging technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysts Warn: Obstacles Ahead For Trump's Strategic Crypto Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Black Families Redefine Travel Trends And Motivations

Mar 04, 2025

Black Families Redefine Travel Trends And Motivations

Mar 04, 2025 -

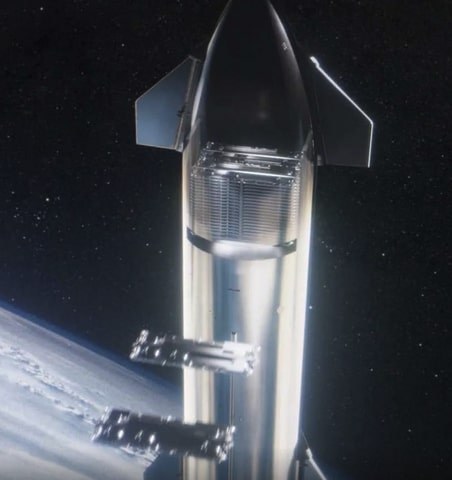

5 Million Starlink Customers And Beyond Space Xs Ambitious Plans For V3 Satellites And Starship

Mar 04, 2025

5 Million Starlink Customers And Beyond Space Xs Ambitious Plans For V3 Satellites And Starship

Mar 04, 2025 -

Xiaomi 15 Ultra Review Image Quality Vs Aesthetic Appeal

Mar 04, 2025

Xiaomi 15 Ultra Review Image Quality Vs Aesthetic Appeal

Mar 04, 2025 -

High Quality Audio Our Recommendations For Speakers Headphones And Accessories

Mar 04, 2025

High Quality Audio Our Recommendations For Speakers Headphones And Accessories

Mar 04, 2025 -

Fim De Era Buffett Delega Decisoes De Investimento A Greg Abel

Mar 04, 2025

Fim De Era Buffett Delega Decisoes De Investimento A Greg Abel

Mar 04, 2025