Analyzing 21 Capital's Bitcoin Approach: Cantor, Tether, And SoftBank's Adaptations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing 21 Capital's Bitcoin Approach: Cantor, Tether, and SoftBank's Adaptations

The cryptocurrency landscape is constantly evolving, and institutional investors are increasingly seeking strategic ways to navigate its complexities. 21 Capital, a prominent venture capital firm, has carved a unique path in its approach to Bitcoin, influencing the strategies of other major players like Cantor Fitzgerald, Tether, and SoftBank. This analysis delves into 21 Capital's innovative strategies and how these giants are adapting their own Bitcoin strategies in response.

21 Capital's success hinges on its forward-thinking approach to Bitcoin, going beyond simple investment and encompassing broader technological integration. Instead of merely holding Bitcoin, they actively seek opportunities to leverage its underlying blockchain technology and its potential to disrupt various sectors. This proactive stance is shaping the way other major players are viewing Bitcoin's role in their portfolios.

Cantor Fitzgerald's Strategic Shift

Cantor Fitzgerald, a global financial services firm, has historically been cautious about cryptocurrencies. However, 21 Capital's success and the growing institutional acceptance of Bitcoin have prompted Cantor to adopt a more nuanced approach. They are now exploring avenues to offer Bitcoin-related financial services, mirroring 21 Capital's strategy of integrating Bitcoin into existing financial infrastructure. This includes exploring options for Bitcoin trading, custody solutions, and potentially even Bitcoin-backed lending products. This move showcases the ripple effect of 21 Capital's influence on the traditional finance sector.

Tether's Enhanced Transparency (and Potential Concerns)

Tether, the controversial stablecoin issuer, faces unique challenges in the wake of increased regulatory scrutiny. 21 Capital's focus on transparency and regulatory compliance has indirectly influenced Tether's need to demonstrate greater accountability. While Tether's reserves remain a subject of ongoing debate, the pressure to meet higher standards of transparency, partially fueled by the broader shift toward institutional acceptance championed by firms like 21 Capital, is undeniable. This pressure is forcing Tether to consider more rigorous auditing processes and greater disclosure of its reserves. However, skepticism persists, particularly regarding the actual backing of USDT.

SoftBank's Cautious Optimism

SoftBank, a prominent Japanese conglomerate with substantial investments in technology, has displayed a more cautious yet increasingly optimistic stance towards Bitcoin and cryptocurrencies in general. While their direct involvement in Bitcoin remains relatively limited compared to their investments in other tech sectors, 21 Capital's successes have likely influenced their long-term strategic planning. They are likely monitoring the market closely, evaluating opportunities to participate in Bitcoin-related ventures and technologies in the future. This wait-and-see approach demonstrates a calculated risk assessment shaped partly by the observed success of more aggressive players like 21 Capital.

Key Takeaways and Future Implications

- The Institutionalization of Bitcoin: 21 Capital's strategic approach highlights the ongoing institutionalization of Bitcoin, moving it beyond the realm of speculative investment.

- Technological Integration: The focus is shifting towards leveraging Bitcoin's underlying blockchain technology rather than simply holding the asset.

- Regulatory Compliance: The increasing pressure for transparency and regulatory compliance is a crucial factor shaping the strategies of major players.

- Strategic Partnerships: Collaboration and strategic partnerships are becoming essential for navigating the complexities of the cryptocurrency market.

The strategies adopted by Cantor, Tether, and SoftBank demonstrate the significant influence of 21 Capital’s pioneering approach to Bitcoin. As the cryptocurrency market continues to mature, the innovative strategies of firms like 21 Capital will continue to shape the future of institutional involvement in this evolving asset class. The ongoing evolution of regulatory frameworks and technological advancements will only further solidify the significance of these adaptations and the continued importance of integrating Bitcoin into a broader financial ecosystem.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing 21 Capital's Bitcoin Approach: Cantor, Tether, And SoftBank's Adaptations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Early Reviews In Will Thunderbolts Deliver A Box Office Knockout For The Mcu

Apr 24, 2025

Early Reviews In Will Thunderbolts Deliver A Box Office Knockout For The Mcu

Apr 24, 2025 -

Pasir Ris Changi Grc Sda To Contest Ge 2025 Despite Potential Three Cornered Fight

Apr 24, 2025

Pasir Ris Changi Grc Sda To Contest Ge 2025 Despite Potential Three Cornered Fight

Apr 24, 2025 -

Meta Challenges Eus Digital Markets Act Key Points From Their Response

Apr 24, 2025

Meta Challenges Eus Digital Markets Act Key Points From Their Response

Apr 24, 2025 -

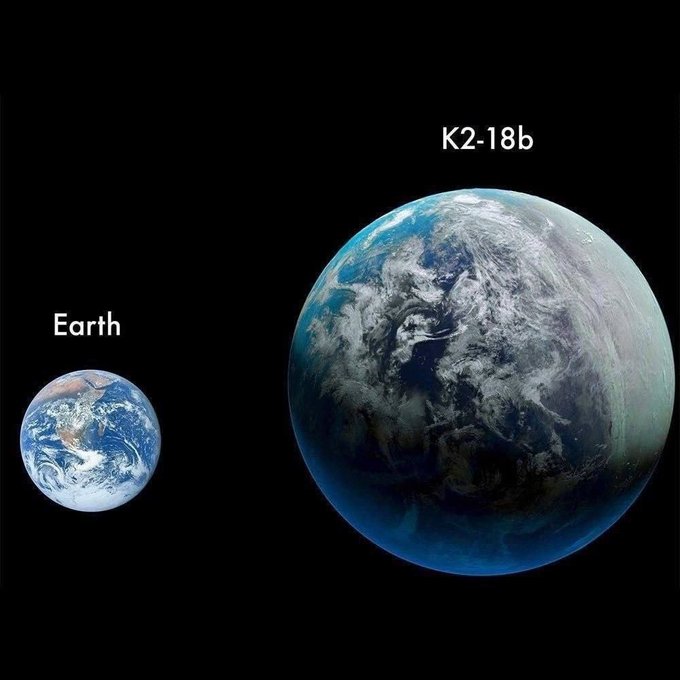

K2 18b The Promising Signs Of Life On A Potential Ocean Planet

Apr 24, 2025

K2 18b The Promising Signs Of Life On A Potential Ocean Planet

Apr 24, 2025 -

Suncorp Stadium Hosts Dolphins Rabbitohs Nrl Clash Round 17 Preview

Apr 24, 2025

Suncorp Stadium Hosts Dolphins Rabbitohs Nrl Clash Round 17 Preview

Apr 24, 2025