Analyzing 21 Capital's Bitcoin Approach: Cantor, Tether, And SoftBank's Replication

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing 21 Capital's Bitcoin Approach: Cantor, Tether, and SoftBank's Replication

21 Capital's audacious foray into Bitcoin has sent ripples through the crypto and finance worlds, prompting comparisons to the strategies of giants like Cantor Fitzgerald, Tether, and SoftBank. This article delves into 21 Capital's unique approach, examining its similarities and differences with these established players and analyzing the potential implications for the future of Bitcoin adoption.

21 Capital: A Novel Approach to Bitcoin Investment

21 Capital, a relatively new firm, stands apart with its focused, high-conviction strategy in Bitcoin. Unlike diversified investment firms, 21 Capital's bet is heavily weighted on Bitcoin's long-term potential, exhibiting a level of conviction rarely seen in traditional finance. This laser focus allows them to dedicate significant resources to research, development, and strategic partnerships within the Bitcoin ecosystem. Their approach is characterized by a deep understanding of the underlying technology and a long-term vision for Bitcoin’s role in the global financial system.

The Cantor Fitzgerald Parallel: Leveraging Existing Infrastructure

Cantor Fitzgerald, a well-known player in the financial markets, demonstrates a strategic approach mirroring aspects of 21 Capital's strategy. Cantor's success lies in its ability to leverage existing financial infrastructure to offer innovative solutions. Similarly, 21 Capital is effectively utilizing existing technology and networks to expand Bitcoin's reach and accessibility. Both firms understand the importance of bridging the gap between traditional finance and the burgeoning cryptocurrency market. However, unlike Cantor’s diverse portfolio, 21 Capital's concentration on Bitcoin represents a significantly higher-risk, higher-reward proposition.

Tether's Stablecoin Strategy: A Point of Divergence

While both 21 Capital and Tether operate within the cryptocurrency space, their approaches differ significantly. Tether, with its USDT stablecoin, aims to provide price stability within the volatile crypto market. 21 Capital, on the other hand, embraces Bitcoin's volatility, viewing it as an inherent characteristic of a disruptive technology. This fundamental difference in risk appetite highlights contrasting investment philosophies – one focused on stability, the other on high-growth potential. The success of each strategy depends entirely on different market conditions and investor preferences.

SoftBank's Vision: Long-Term Investments and Strategic Partnerships

SoftBank's investment strategy, with its focus on long-term ventures and strategic partnerships, shares some similarities with 21 Capital’s approach. Both entities are willing to make significant investments in promising, albeit sometimes risky, ventures. SoftBank's history of backing disruptive technologies provides a compelling parallel to 21 Capital's commitment to Bitcoin. However, SoftBank’s vast portfolio diversifies risk across multiple sectors, unlike 21 Capital’s concentrated Bitcoin strategy.

Risks and Rewards: A High-Stakes Game

21 Capital’s strategy presents substantial risks. The volatility of Bitcoin is undeniable, and a significant downturn could severely impact the firm’s performance. However, the potential rewards are equally substantial. If Bitcoin achieves mainstream adoption, 21 Capital's early and aggressive investment could yield enormous returns. This high-risk, high-reward profile is a defining characteristic of the firm and a key factor in understanding its strategic choices.

The Future of 21 Capital and Bitcoin Adoption

The success of 21 Capital's approach will be directly tied to the future trajectory of Bitcoin. The firm’s focused strategy and its perceived parallels to successful strategies employed by Cantor Fitzgerald and SoftBank generate significant interest and anticipation. However, the differences with Tether's approach highlight the diverse paths within the crypto ecosystem. The coming years will be crucial in determining whether 21 Capital’s bold bet on Bitcoin pays off. The firm’s success or failure will undoubtedly offer valuable lessons for future investors navigating the complexities of the cryptocurrency market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing 21 Capital's Bitcoin Approach: Cantor, Tether, And SoftBank's Replication. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Trumps Bitcoin Strategy Fueling Cryptos Ascent

Apr 25, 2025

Is Trumps Bitcoin Strategy Fueling Cryptos Ascent

Apr 25, 2025 -

Monday Evening Weather Strong Winds Diminishing

Apr 25, 2025

Monday Evening Weather Strong Winds Diminishing

Apr 25, 2025 -

Environmental Regulations And Elon Musk The Tesla Space X And Doge Impact

Apr 25, 2025

Environmental Regulations And Elon Musk The Tesla Space X And Doge Impact

Apr 25, 2025 -

Remote Workers Face Job Cuts As Google Enforces Office Return

Apr 25, 2025

Remote Workers Face Job Cuts As Google Enforces Office Return

Apr 25, 2025 -

Bradley Coopers Philly Cheesesteak A Restaurant Review

Apr 25, 2025

Bradley Coopers Philly Cheesesteak A Restaurant Review

Apr 25, 2025

Latest Posts

-

Saka Vs Psg A Crucial One On One Showdown After Salahs Failure

Apr 29, 2025

Saka Vs Psg A Crucial One On One Showdown After Salahs Failure

Apr 29, 2025 -

Unveiling Khvicha Kvaratskhelia The Path To Psg And Beyond

Apr 29, 2025

Unveiling Khvicha Kvaratskhelia The Path To Psg And Beyond

Apr 29, 2025 -

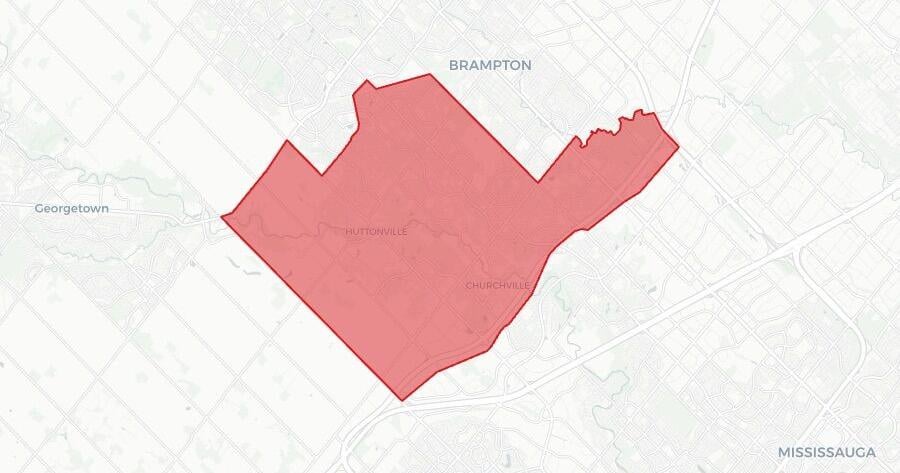

Federal Election 2023 Brampton South Constituency Results And Key Highlights

Apr 29, 2025

Federal Election 2023 Brampton South Constituency Results And Key Highlights

Apr 29, 2025 -

Cybercriminals Target Woo Commerce Stores With Fake Patch Phishing Campaign

Apr 29, 2025

Cybercriminals Target Woo Commerce Stores With Fake Patch Phishing Campaign

Apr 29, 2025 -

Revealed Trumps Furious Reaction To Amazons Tariff Plan

Apr 29, 2025

Revealed Trumps Furious Reaction To Amazons Tariff Plan

Apr 29, 2025