Analyzing Canada's Economic Trajectory: A CIBC Perspective On BoC Inflation Policy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Canada's Economic Trajectory: A CIBC Perspective on BoC Inflation Policy

Canada's economy is navigating a complex landscape, grappling with persistent inflation and the Bank of Canada's (BoC) efforts to tame it. The Canadian Imperial Bank of Commerce (CIBC), a major player in the Canadian financial sector, offers a unique perspective on the current trajectory and the effectiveness of the BoC's monetary policy. This analysis delves into CIBC's insights, examining the key factors influencing the Canadian economy and the potential future scenarios.

CIBC's Economic Outlook: A Balancing Act

CIBC's recent reports paint a picture of a Canadian economy walking a tightrope. While acknowledging the resilience of the Canadian consumer and strong employment numbers, the bank also highlights the persistent challenges posed by high inflation. The BoC's aggressive interest rate hikes, aimed at cooling the economy and reducing inflationary pressures, are a central element of CIBC's analysis.

Interest Rate Hikes: A Double-Edged Sword

The BoC's interest rate policy is a key factor impacting CIBC's economic forecast. While rate hikes are designed to curb inflation by reducing borrowing and spending, they also carry the risk of slowing economic growth too sharply, potentially leading to a recession. CIBC analysts carefully weigh the potential benefits of further rate increases against the risks of triggering a significant economic downturn. They are closely monitoring key economic indicators such as:

- Inflation Rates: The persistence and stickiness of inflation remain a primary concern. CIBC analysts are scrutinizing the core inflation rate, which excludes volatile food and energy prices, to gauge the underlying inflationary pressures.

- Employment Data: Robust employment figures are a positive sign, but sustained high employment could fuel further wage increases, potentially exacerbating inflation. CIBC is closely observing wage growth trends for signs of inflationary pressures.

- Housing Market: The housing market, a significant driver of the Canadian economy, is experiencing a slowdown due to higher interest rates. CIBC assesses the impact of this slowdown on overall economic activity and consumer confidence.

- Global Economic Conditions: Canada's economy is intertwined with the global economy. Global economic headwinds, such as geopolitical instability and supply chain disruptions, could further complicate the BoC's inflation-fighting efforts. CIBC incorporates global economic forecasts into its Canadian economic projections.

CIBC's Forecast and Potential Scenarios

CIBC's economic forecasts usually involve several potential scenarios, ranging from a soft landing to a more severe recession. Their analyses incorporate various factors and attempt to assign probabilities to each potential outcome. While specific numerical projections vary over time, CIBC consistently emphasizes the importance of careful monitoring of the aforementioned key indicators.

The Role of Fiscal Policy

CIBC's analysis also considers the role of fiscal policy in influencing the Canadian economy. Government spending and taxation policies can interact with the BoC's monetary policy, either amplifying or mitigating its effects. CIBC examines the potential interplay between these two policy levers and their combined impact on inflation and economic growth.

Conclusion: Navigating Uncertainty

Canada's economic future remains uncertain, with the BoC's inflation-fighting strategy playing a crucial role. CIBC's ongoing analysis provides valuable insights into the potential trajectories and the complexities involved. By closely monitoring key economic indicators and carefully weighing the potential impacts of both monetary and fiscal policies, CIBC contributes to a more informed understanding of the Canadian economic landscape. Their reports provide crucial context for businesses, investors, and policymakers alike, helping to navigate the challenging economic terrain ahead. Stay tuned for updates as CIBC continues to refine its analysis and adapt to evolving economic conditions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Canada's Economic Trajectory: A CIBC Perspective On BoC Inflation Policy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

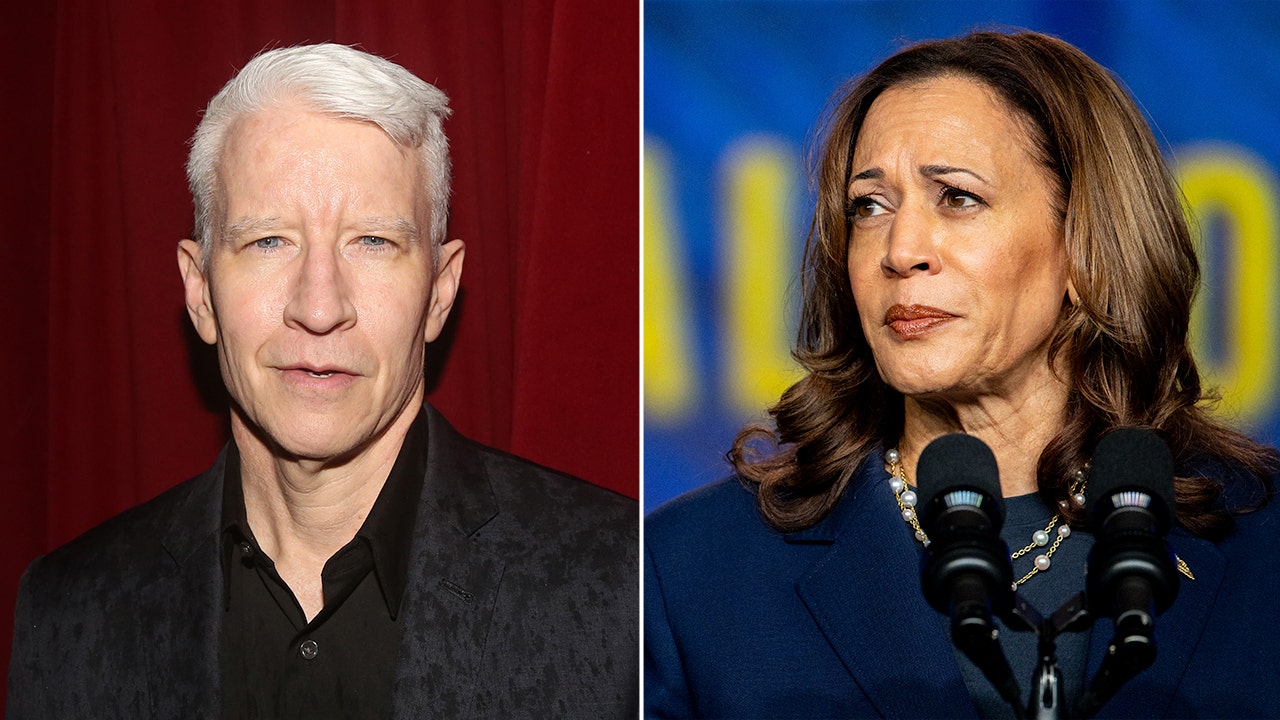

Book Exposes Kamala Harriss Angry Reaction To Anderson Cooper Interview After Biden Debate

May 24, 2025

Book Exposes Kamala Harriss Angry Reaction To Anderson Cooper Interview After Biden Debate

May 24, 2025 -

Nhl Forward Tom Eisenhuth Ends Career After Concussion Battle

May 24, 2025

Nhl Forward Tom Eisenhuth Ends Career After Concussion Battle

May 24, 2025 -

Urgent Energy Bill Alert From Martin Lewis Avoid Costly Mistakes

May 24, 2025

Urgent Energy Bill Alert From Martin Lewis Avoid Costly Mistakes

May 24, 2025 -

Microsofts Ai Agent Factory A Race To Revolutionize Ai Development

May 24, 2025

Microsofts Ai Agent Factory A Race To Revolutionize Ai Development

May 24, 2025 -

Billy Joels Tour Cancelled Rare Brain Condition Diagnosis Announced

May 24, 2025

Billy Joels Tour Cancelled Rare Brain Condition Diagnosis Announced

May 24, 2025