Analyzing GameStop's Financial Health: Profits, $6B Balance Sheet, And Bitcoin Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing GameStop's Financial Health: Profits, $6 Billion Balance Sheet, and Bitcoin Strategy

GameStop, the video game retailer that became a Wall Street darling and meme stock sensation, is charting a new course. While the rollercoaster ride of its stock price continues to fascinate investors, a closer look at its financial health reveals a complex picture beyond the meme-fueled hype. This analysis delves into GameStop's recent profits, its substantial balance sheet, and its increasingly prominent Bitcoin strategy.

Profits and the Path to Profitability:

GameStop's recent financial reports show a mixed bag. While the company has yet to consistently return to sustained profitability, recent quarters have shown signs of improvement. This improvement isn't solely attributable to meme stock frenzy; rather, it's linked to a strategic shift towards e-commerce and a focus on expanding its product offerings beyond physical games. Key factors contributing to this improved performance include:

- E-commerce growth: GameStop's online sales have shown significant growth, highlighting the success of its digital transformation efforts. This online presence is crucial for reaching a broader customer base and mitigating reliance on brick-and-mortar stores.

- New product categories: Diversification beyond video games, including collectibles, electronics, and apparel, is broadening revenue streams and reducing dependence on a single market sector. This strategy is vital for long-term stability and growth.

- Cost-cutting measures: Efficient inventory management and streamlined operations have helped improve profit margins, though further optimization is likely needed for consistent profitability.

A $6 Billion Balance Sheet: Strength and Opportunity:

One of the most striking aspects of GameStop's financial position is its substantial balance sheet, exceeding $6 billion in assets. This considerable financial cushion provides a significant buffer against economic downturns and allows for strategic investments in areas like technology and expansion. This strong balance sheet offers several key advantages:

- Debt reduction: The substantial cash reserves allow GameStop to aggressively pay down debt, improving its credit rating and reducing financial risk.

- Strategic acquisitions: The company can leverage its financial strength to acquire smaller companies that complement its existing offerings or expand into new markets.

- Technological advancements: Investment in cutting-edge technology, such as improved e-commerce platforms and supply chain management systems, is crucial for maintaining competitiveness.

Bitcoin and the Crypto Gamble:

GameStop's foray into the cryptocurrency market, particularly its embrace of Bitcoin, is a bold and potentially high-risk, high-reward strategy. While the long-term implications remain uncertain, several factors drive this decision:

- Attracting a new customer base: The cryptocurrency community represents a significant and growing market segment that aligns with GameStop's younger demographic.

- Diversification beyond traditional retail: Investing in Bitcoin diversifies GameStop's asset portfolio beyond traditional retail investments, mitigating risk associated with market fluctuations in the video game industry.

- Keeping pace with technological trends: Adopting cryptocurrency showcases GameStop's commitment to embracing technological innovation, attracting investors and customers alike.

Conclusion: A Company in Transition

GameStop's financial health is a story of transformation. While profitability remains a key challenge, the company's significant balance sheet, strategic diversification, and bold foray into cryptocurrency present both opportunities and risks. The future success of GameStop hinges on its ability to effectively execute its strategic initiatives, navigate the volatile cryptocurrency market, and adapt to the ever-evolving landscape of the video game and retail industries. Only time will tell if this ambitious strategy will ultimately pay off.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing GameStop's Financial Health: Profits, $6B Balance Sheet, And Bitcoin Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Government Announces Half Price Energy For Millions Over Spring Bank Holiday

May 24, 2025

Government Announces Half Price Energy For Millions Over Spring Bank Holiday

May 24, 2025 -

Nrl Panthers Players High Tackle Sparks Debate After Knights Fullback Incident

May 24, 2025

Nrl Panthers Players High Tackle Sparks Debate After Knights Fullback Incident

May 24, 2025 -

Evaluating Game Of Thrones Kingsroad A Progress Report Review

May 24, 2025

Evaluating Game Of Thrones Kingsroad A Progress Report Review

May 24, 2025 -

Suis Cetus De Fi Platform Targeted 260 M Hack Successful Recovery Efforts Detailed

May 24, 2025

Suis Cetus De Fi Platform Targeted 260 M Hack Successful Recovery Efforts Detailed

May 24, 2025 -

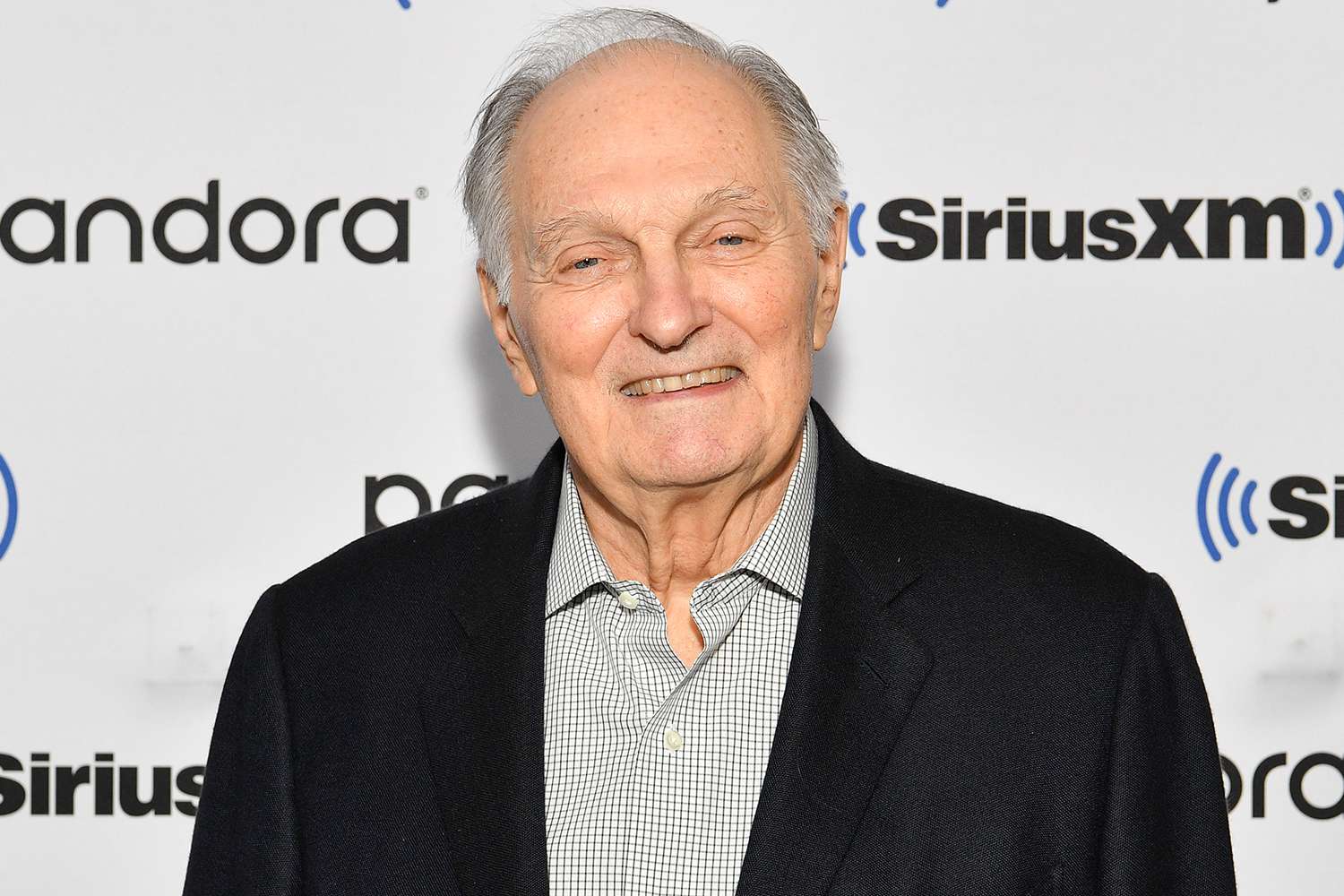

Alan Alda 89 On Parkinson S A Full Time Battle A Lifetime Of Laughter

May 24, 2025

Alan Alda 89 On Parkinson S A Full Time Battle A Lifetime Of Laughter

May 24, 2025