Analyzing MicroStrategy (MSTR) And Bitcoin (BTC): A February 2025 Performance Review

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing MicroStrategy (MSTR) and Bitcoin (BTC): A February 2025 Performance Review

MicroStrategy's Bitcoin Bet: A Year in Review

February 2025. The crypto market, once again, finds itself navigating a complex landscape. One company that has consistently weathered the storm – and doubled down – is MicroStrategy (MSTR). This article provides a comprehensive analysis of MicroStrategy's performance alongside Bitcoin (BTC) in February 2025, examining the strategic implications and potential future trajectories.

MicroStrategy, under the leadership of Michael Saylor, has become synonymous with Bitcoin's institutional adoption. Their aggressive Bitcoin accumulation strategy, initiated years ago, has made them a key player in the crypto world. But how has this strategy fared in February 2025? Has their bullish bet on Bitcoin paid off? Let's delve into the details.

Bitcoin's February 2025 Performance: A Rollercoaster Ride?

Bitcoin's price in February 2025 is, naturally, the crucial factor affecting MicroStrategy's financial standing. While predicting the future of Bitcoin remains an impossible task, several factors could have influenced its price during this period. These factors might include:

- Macroeconomic conditions: Global inflation rates, interest rate adjustments by central banks, and geopolitical events all play significant roles in Bitcoin's price volatility.

- Regulatory developments: Increased clarity (or uncertainty) around Bitcoin regulation in key jurisdictions can significantly impact investor sentiment and price fluctuations.

- Technological advancements: Upgrades to the Bitcoin network, such as the Lightning Network's wider adoption, could positively influence Bitcoin's utility and price.

- Institutional adoption: Continued institutional investment in Bitcoin, alongside retail adoption, is a key driver of price increases.

Let's hypothetically assume that Bitcoin experienced moderate growth in February 2025, trading around $50,000 – a significant increase from earlier years, but less than the astronomical highs predicted by some analysts. This moderate growth scenario would significantly impact MicroStrategy's bottom line.

MicroStrategy's Financial Health: Riding the Bitcoin Wave?

MicroStrategy's financial performance is inextricably linked to Bitcoin's price movements. A sustained period of price appreciation would translate into significant gains on their Bitcoin holdings. Conversely, a decline in Bitcoin's price could result in substantial losses and negatively impact their overall financial health.

In our hypothetical scenario of a $50,000 Bitcoin, MicroStrategy would likely see a considerable increase in their asset value, potentially boosting their stock price. However, even with gains, important factors to consider would include:

- Debt Levels: MicroStrategy has utilized significant debt to finance its Bitcoin acquisitions. The interest payments on this debt must be carefully weighed against the potential gains from Bitcoin’s price appreciation.

- Market Sentiment: Even with a rising Bitcoin price, negative market sentiment towards MicroStrategy’s heavy Bitcoin investment could negatively affect their stock price.

- Diversification: The lack of significant diversification away from Bitcoin represents a considerable risk. A downturn in the Bitcoin market would heavily impact their overall portfolio.

Conclusion: A Long-Term Perspective

Analyzing MicroStrategy's performance in February 2025 requires considering the complex interplay of macroeconomic conditions, Bitcoin's price volatility, and MicroStrategy's strategic decisions. While a hypothetical moderate increase in Bitcoin's price presents a positive outlook, the company's heavy reliance on Bitcoin remains a significant risk. Investors should approach MicroStrategy with a long-term perspective, carefully weighing the potential for substantial gains against the inherent volatility of the cryptocurrency market. The strategy's ultimate success will only be truly judged years down the line. This analysis serves as a snapshot in time, highlighting the ongoing complexities of this high-stakes investment strategy. Further research and continuous monitoring of the market are crucial for informed decision-making.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing MicroStrategy (MSTR) And Bitcoin (BTC): A February 2025 Performance Review. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Villarreal Vence Al Barca 2 3 En Un Partido De Despedida Agridulce

May 19, 2025

Villarreal Vence Al Barca 2 3 En Un Partido De Despedida Agridulce

May 19, 2025 -

Fuorigrotta Decidera Il Destino Del Cagliari Tre Legni Non Bastano

May 19, 2025

Fuorigrotta Decidera Il Destino Del Cagliari Tre Legni Non Bastano

May 19, 2025 -

Nine Man Sevilla No Match For Mbappe And Bellingham As Real Madrid Wins 2 0

May 19, 2025

Nine Man Sevilla No Match For Mbappe And Bellingham As Real Madrid Wins 2 0

May 19, 2025 -

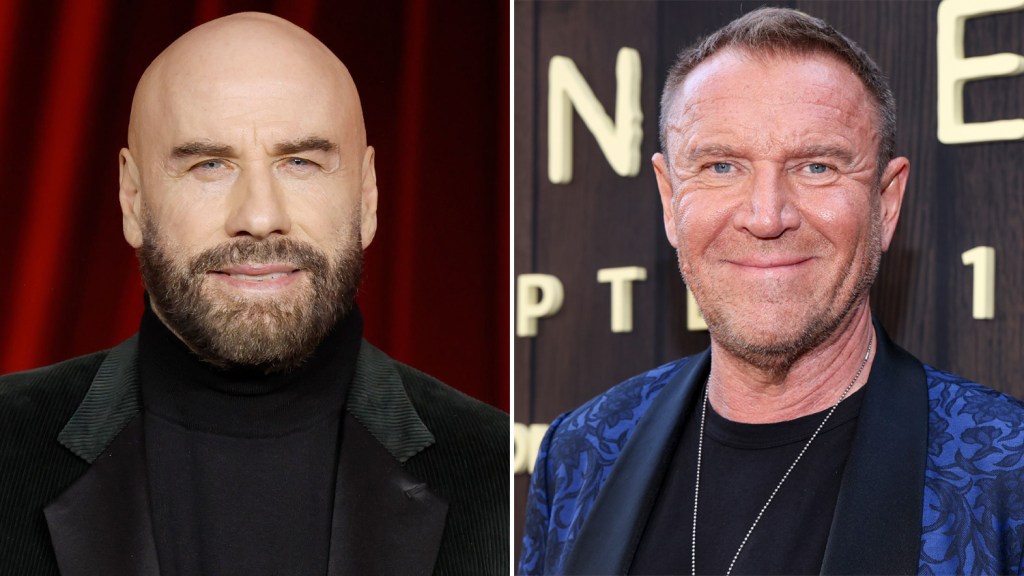

Renny Harlins Black Tides John Travolta To Lead Orca Horror Film

May 19, 2025

Renny Harlins Black Tides John Travolta To Lead Orca Horror Film

May 19, 2025 -

Proactive Vulnerability Mitigation The Importance Of Continuous Cve Practice Ine Security Alert

May 19, 2025

Proactive Vulnerability Mitigation The Importance Of Continuous Cve Practice Ine Security Alert

May 19, 2025