Analyzing Nvidia's (NVDA) Potential: A $150 Price Prediction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia (NVDA) Stock Forecast: Could We See a $150 Price Target?

Nvidia (NVDA) has been on a tear, consistently exceeding expectations and becoming a Wall Street darling. But with the stock price already at impressive heights, the question on many investors' minds is: can NVDA reach a $150 price target? This article analyzes the factors that could propel Nvidia to this ambitious valuation and explores the potential risks involved.

The Bull Case for NVDA Reaching $150:

Several key factors contribute to the optimistic outlook for NVDA's future price:

-

Dominance in AI: Nvidia's GPUs are the gold standard for artificial intelligence processing. The explosive growth of AI across various sectors – from data centers to autonomous vehicles – fuels significant demand for NVDA's hardware. This market dominance is a crucial element in the $150 price prediction. Analysts point to the increasing adoption of AI by businesses of all sizes as a major catalyst.

-

Data Center Growth: The data center market is booming, and Nvidia is a key player. Their high-performance computing solutions are essential for powering cloud computing infrastructure and large-scale AI deployments. Continued expansion in this segment is vital for justifying a $150 price target.

-

Automotive Innovation: Nvidia's technology is integral to the development of autonomous vehicles. As the automotive industry accelerates its transition towards self-driving capabilities, Nvidia stands to benefit significantly from this growing market. The potential for substantial revenue growth from the automotive sector is a key component of the bullish forecast.

-

Strong Financial Performance: Nvidia's consistent financial performance, marked by robust revenue growth and increasing profitability, instills confidence in investors. Sustaining this momentum is paramount for achieving the ambitious $150 price prediction. Quarterly earnings reports will be crucial for monitoring progress.

Challenges and Risks to Consider:

While the outlook is positive, several factors could hinder Nvidia's ascent to $150:

-

Competition: Increased competition from AMD and other chip manufacturers could erode Nvidia's market share and impact its pricing power. Staying ahead of the curve in terms of innovation is vital to maintain its competitive edge.

-

Economic Slowdown: A broader economic downturn could reduce demand for Nvidia's products, particularly in the data center and automotive sectors. Economic uncertainty is a risk factor that could affect the stock's performance.

-

Overvaluation: Some analysts argue that Nvidia's current valuation is already stretched, making a further jump to $150 less likely. Careful consideration of valuation metrics is crucial for informed investment decisions.

-

Supply Chain Issues: Persistent supply chain disruptions could limit Nvidia's production capacity and hinder its ability to meet growing demand. Addressing supply chain challenges is essential for consistent growth.

Conclusion: A Realistic Outlook?

Reaching a $150 price target for NVDA is ambitious but not entirely improbable. The company's strong position in the rapidly expanding AI and data center markets provides a solid foundation for growth. However, investors should carefully weigh the potential risks, including competition, economic headwinds, and valuation concerns. Consistent monitoring of Nvidia's financial performance, technological advancements, and competitive landscape is crucial for making informed investment decisions. The $150 price prediction ultimately depends on the successful execution of Nvidia's strategic initiatives and the continued growth of the markets it serves. Further research and due diligence are recommended before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Nvidia's (NVDA) Potential: A $150 Price Prediction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bitcoins Return To 100 K Impact Of The 2023 Short Squeeze

May 12, 2025

Bitcoins Return To 100 K Impact Of The 2023 Short Squeeze

May 12, 2025 -

Godzilla X Kong The New Empire Production Begins Sequel Teaser And Title Confirmed

May 12, 2025

Godzilla X Kong The New Empire Production Begins Sequel Teaser And Title Confirmed

May 12, 2025 -

Unlock Screen Times Potential A Guide To I Phones Digital Health Features

May 12, 2025

Unlock Screen Times Potential A Guide To I Phones Digital Health Features

May 12, 2025 -

Asi Jugo Guido Ante Necaxa Desempeno Goles Y Estadisticas Clave

May 12, 2025

Asi Jugo Guido Ante Necaxa Desempeno Goles Y Estadisticas Clave

May 12, 2025 -

Bitcoin Soars Above 100 000 Fueling Metaplanets Massive 5 555 Btc Profit

May 12, 2025

Bitcoin Soars Above 100 000 Fueling Metaplanets Massive 5 555 Btc Profit

May 12, 2025

Latest Posts

-

Eva Longorias Bold Statement Does It Rule Out A Desperate Housewives Reunion

May 13, 2025

Eva Longorias Bold Statement Does It Rule Out A Desperate Housewives Reunion

May 13, 2025 -

Tesla Stock Price Decline Analyzing The Factors And Future Potential

May 13, 2025

Tesla Stock Price Decline Analyzing The Factors And Future Potential

May 13, 2025 -

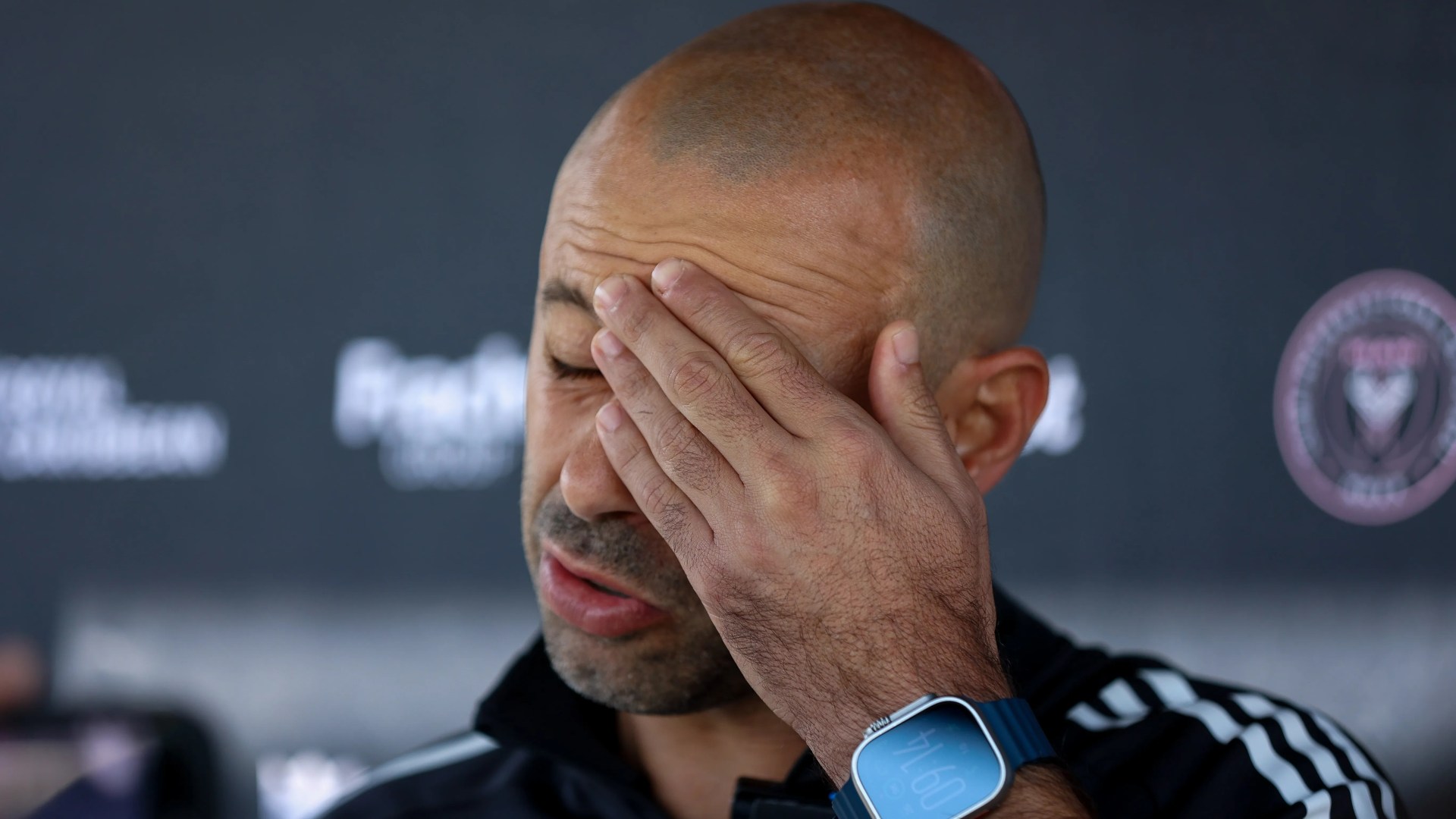

Inter Miamis Heavy Defeat Pressure Mounts On Beckham To Dismiss Mascherano

May 13, 2025

Inter Miamis Heavy Defeat Pressure Mounts On Beckham To Dismiss Mascherano

May 13, 2025 -

Apple And Google A Strategic Partnership And Its Implications

May 13, 2025

Apple And Google A Strategic Partnership And Its Implications

May 13, 2025 -

Ai Driven Job Cuts Ibm And Crowdstrike Lay Off Hundreds

May 13, 2025

Ai Driven Job Cuts Ibm And Crowdstrike Lay Off Hundreds

May 13, 2025