Analyzing QUBT Stock: Investment Outlook Before Earnings Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing QUBT Stock: Investment Outlook Before Earnings Announcement

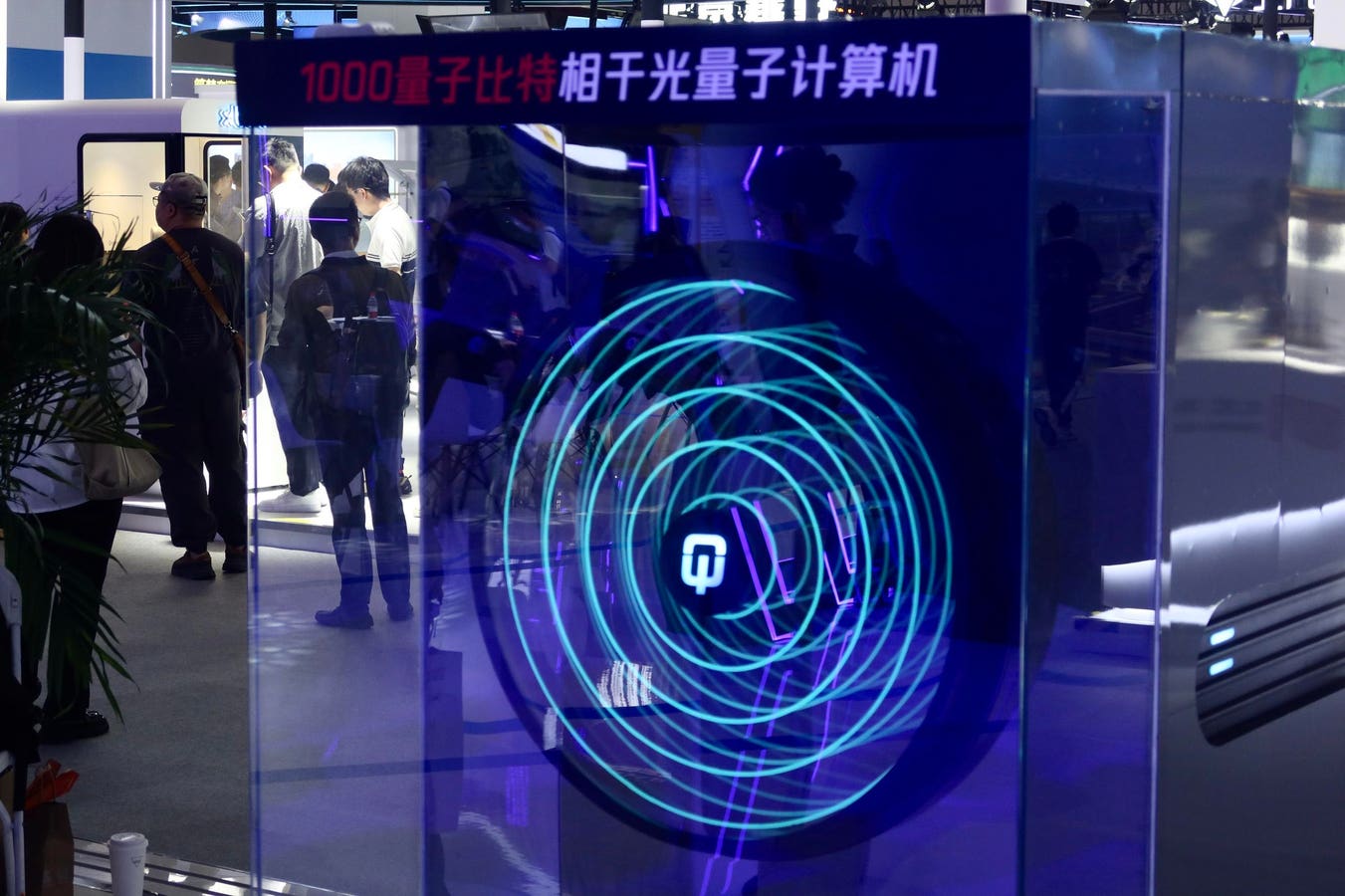

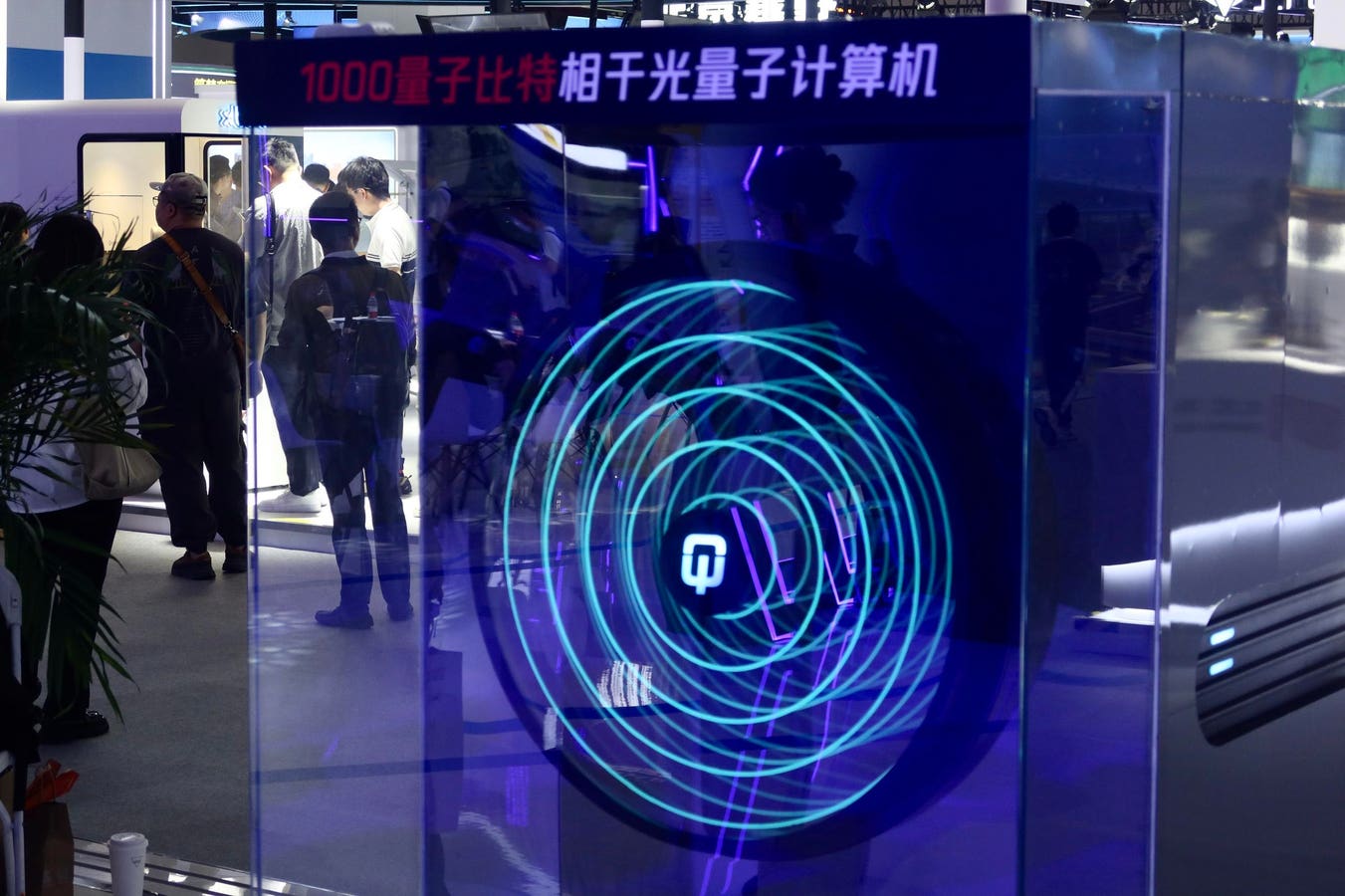

QUBT stock is generating significant buzz among investors as its upcoming earnings announcement approaches. Understanding the current market sentiment and the company's recent performance is crucial for making informed investment decisions. This in-depth analysis explores the key factors influencing QUBT's stock price and provides insights into the potential investment outlook before the earnings release.

Understanding QUBT's Business Model:

Before diving into the investment analysis, it's crucial to understand what QUBT does. [Insert a concise description of QUBT's business, including its products and services. Mention any recent partnerships or significant developments. Example: "QUBT is a leading provider of [industry] solutions, focusing on [specific niche]. Recently, they announced a partnership with [partner name], which is expected to significantly boost their market share."]. This understanding forms the bedrock of any effective investment strategy.

Recent Market Performance and Key Indicators:

QUBT's stock price has experienced [describe recent price movements – e.g., "significant volatility," "a steady climb," "a period of consolidation"]. This fluctuation can be attributed to several factors, including [mention specific factors like market trends, industry news, regulatory changes, or any other relevant information]. Analyzing key indicators like:

- Trading Volume: High trading volume often suggests increased investor interest and potential for significant price movements. Monitoring this indicator leading up to the earnings announcement is vital.

- Analyst Ratings: Consensus analyst ratings offer a snapshot of the collective expert opinion on the stock's future performance. A significant shift in these ratings warrants close attention.

- Technical Indicators: Technical analysis tools, such as moving averages and relative strength index (RSI), can provide insights into potential short-term price trends. However, these should be considered in conjunction with fundamental analysis.

Factors to Consider Before the Earnings Announcement:

Several factors will likely influence investor sentiment and QUBT's stock price following the earnings release:

- Revenue Growth: Investors will closely scrutinize QUBT's revenue figures, looking for evidence of continued growth or signs of slowing momentum. Any significant deviation from analysts' expectations could trigger a substantial market reaction.

- Earnings Per Share (EPS): EPS is a crucial metric indicating profitability. A positive surprise (beating expectations) usually leads to a price increase, while a negative surprise can result in a decline.

- Guidance: The company's forward-looking guidance, offering predictions for future performance, carries immense weight. Positive guidance can instill confidence among investors, while cautious or negative guidance can dampen enthusiasm.

- Market Conditions: The overall market environment significantly impacts individual stock performance. Broad market trends and prevailing economic conditions should be considered alongside company-specific factors.

Potential Investment Strategies:

Based on the current analysis, investors may consider several strategies:

- Buy the Dip: If the stock price dips before the earnings announcement due to market uncertainty, some investors may view this as a buying opportunity.

- Wait and See: A conservative approach involves waiting for the earnings announcement and subsequent market reaction before making any investment decisions.

- Hedging: Investors concerned about potential downside risk may consider hedging strategies, such as buying put options.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Keywords: QUBT stock, QUBT earnings, QUBT investment, stock analysis, stock market, earnings announcement, investment outlook, stock price prediction, financial analysis, market analysis, [add other relevant keywords related to QUBT's industry and business].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing QUBT Stock: Investment Outlook Before Earnings Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pga Championship 2025 Second Round Tee Times Tv Broadcast And Online Streaming

May 17, 2025

Pga Championship 2025 Second Round Tee Times Tv Broadcast And Online Streaming

May 17, 2025 -

How Micro Strategy Uses Strk Preferred Stock To Fuel Its Bitcoin Investments

May 17, 2025

How Micro Strategy Uses Strk Preferred Stock To Fuel Its Bitcoin Investments

May 17, 2025 -

Sc Braga Lidera Ao Intervalo Analise Do Jogo Contra O Benfica

May 17, 2025

Sc Braga Lidera Ao Intervalo Analise Do Jogo Contra O Benfica

May 17, 2025 -

Maserati Biopic The Brothers Casts Al Pacino Alongside Hopkins And Alba

May 17, 2025

Maserati Biopic The Brothers Casts Al Pacino Alongside Hopkins And Alba

May 17, 2025 -

Garmin Forerunner 970 Vs 570 Which Gps Running Watch Is Right For You

May 17, 2025

Garmin Forerunner 970 Vs 570 Which Gps Running Watch Is Right For You

May 17, 2025