Analyzing Tesla's Share: Price Comparison With Similar Electric Vehicles

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tesla's Stock: A Deep Dive into Share Price and EV Market Comparisons

Tesla's meteoric rise has cemented its position as a leading electric vehicle (EV) manufacturer. But how does its share price stack up against competitors in the burgeoning EV market? This in-depth analysis compares Tesla's stock performance to similar electric vehicle companies, examining factors influencing price fluctuations and offering insights for investors.

The Tesla Stock Story: A Rollercoaster Ride

Tesla's stock (TSLA) has experienced dramatic swings, reflecting both the company's innovative achievements and the inherent volatility of the technology sector. While delivering consistent revenue growth and expanding its global presence, the stock price remains susceptible to market sentiment, regulatory changes, and CEO Elon Musk's often unpredictable pronouncements. Understanding these dynamics is crucial for anyone considering investing in TSLA.

Key Competitors and Share Price Comparisons:

Several companies are vying for market share in the electric vehicle sector. A direct comparison of Tesla's share price with its main competitors provides valuable context:

-

Rivian Automotive (RIVN): Rivian, focusing on trucks and SUVs, has seen its stock price fluctuate significantly since its IPO. While promising, its market capitalization remains considerably smaller than Tesla's, reflecting a difference in production scale and brand recognition. A direct share price comparison reveals a considerable gap, highlighting Tesla's dominance in the market.

-

Lucid Group (LCID): Lucid, known for its luxury EVs, presents a compelling alternative to Tesla in the high-end market. However, similar to Rivian, its share price and market capitalization lag behind Tesla, largely due to lower production volumes and a smaller established market presence.

-

Ford Motor Company (F) and General Motors (GM): Traditional automakers are aggressively expanding their EV offerings. While both Ford and GM have seen increased interest in their electric vehicle lines, their overall stock performance reflects a more diversified portfolio, including internal combustion engine vehicles. Comparing their EV-specific performance with Tesla's dedicated focus presents a nuanced picture.

Factors Influencing Share Price:

Several key factors impact the share prices of all EV companies, including Tesla:

-

Production Capacity and Delivery Numbers: Consistent and increasing vehicle production is crucial for revenue growth and investor confidence. Tesla's impressive production numbers contribute significantly to its higher market valuation.

-

Technological Innovation: The ongoing development of battery technology, autonomous driving capabilities, and charging infrastructure is vital for long-term competitiveness. Tesla's pioneering role in these areas often positively impacts its stock price.

-

Market Sentiment and Investor Confidence: Overall market trends and investor sentiment toward the EV sector significantly influence stock prices. Geopolitical events, economic forecasts, and evolving consumer preferences all play a role.

-

Regulatory Landscape and Government Incentives: Government policies regarding EV adoption, tax credits, and environmental regulations directly influence the profitability and attractiveness of EV manufacturers.

Conclusion: A Complex Equation

Comparing Tesla's share price to its competitors requires a multi-faceted approach. While Tesla currently enjoys a substantial lead in market capitalization and production scale, the EV market is dynamic and competitive. The future trajectory of Tesla's share price, and those of its rivals, depends on a complex interplay of technological advancements, market demand, regulatory environments, and investor perception. Thorough due diligence and careful consideration of these factors are essential for informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Tesla's Share: Price Comparison With Similar Electric Vehicles. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Atletico Madrids Lineup For The Girona Clash Seasons End Strategy

May 25, 2025

Atletico Madrids Lineup For The Girona Clash Seasons End Strategy

May 25, 2025 -

Analyzing The Implications Of The New 28 Years Later Scene Featuring Aaron Taylor Johnson

May 25, 2025

Analyzing The Implications Of The New 28 Years Later Scene Featuring Aaron Taylor Johnson

May 25, 2025 -

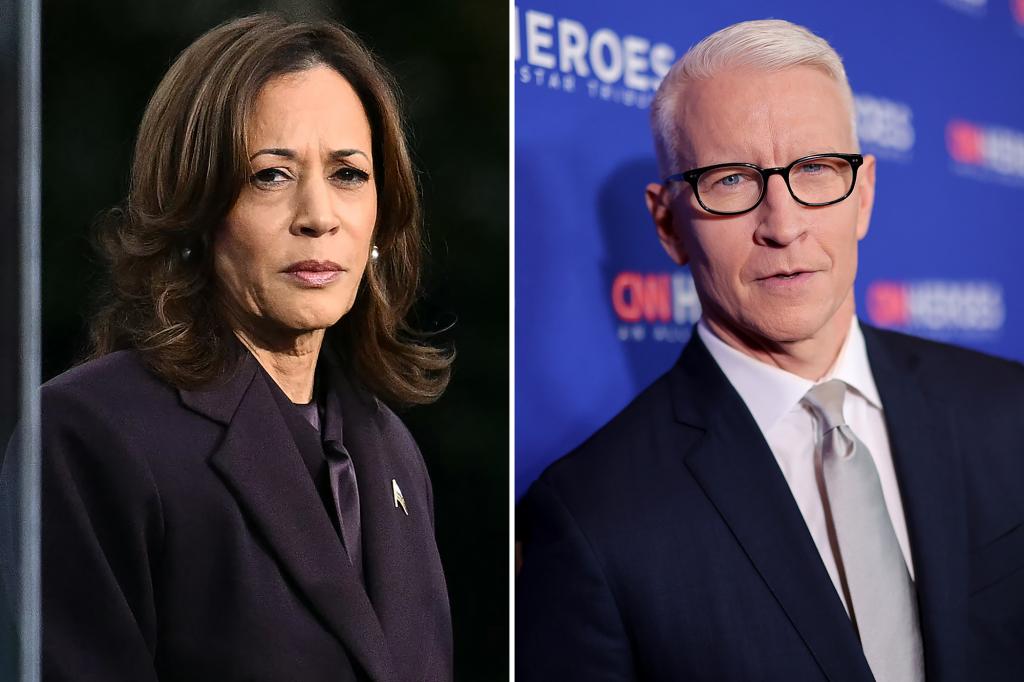

Kamala Harriss Profane Outburst Details Emerge From Post Debate Interview With Anderson Cooper

May 25, 2025

Kamala Harriss Profane Outburst Details Emerge From Post Debate Interview With Anderson Cooper

May 25, 2025 -

Aussie Farmers Uncover Significant Findings On Remote Island Research Trip

May 25, 2025

Aussie Farmers Uncover Significant Findings On Remote Island Research Trip

May 25, 2025 -

Napoli Transfer Target The Kevin De Bruyne Situation

May 25, 2025

Napoli Transfer Target The Kevin De Bruyne Situation

May 25, 2025

Latest Posts

-

Retour Sur Terre Battue Pour Nadal Decryptage Du Debut De Roland Garros

May 25, 2025

Retour Sur Terre Battue Pour Nadal Decryptage Du Debut De Roland Garros

May 25, 2025 -

Roland Garros Update Sabalenkas Dominant First Round Performance

May 25, 2025

Roland Garros Update Sabalenkas Dominant First Round Performance

May 25, 2025 -

Ireland Vs West Indies 2nd Odi Pitch Report And Weather Forecast

May 25, 2025

Ireland Vs West Indies 2nd Odi Pitch Report And Weather Forecast

May 25, 2025 -

Justice Department Deal Boeing Avoids Criminal Charges In 737 Max Crash Investigation

May 25, 2025

Justice Department Deal Boeing Avoids Criminal Charges In 737 Max Crash Investigation

May 25, 2025 -

Louise Redknapps Honest Account Of Navigating An Age Gap Romance

May 25, 2025

Louise Redknapps Honest Account Of Navigating An Age Gap Romance

May 25, 2025