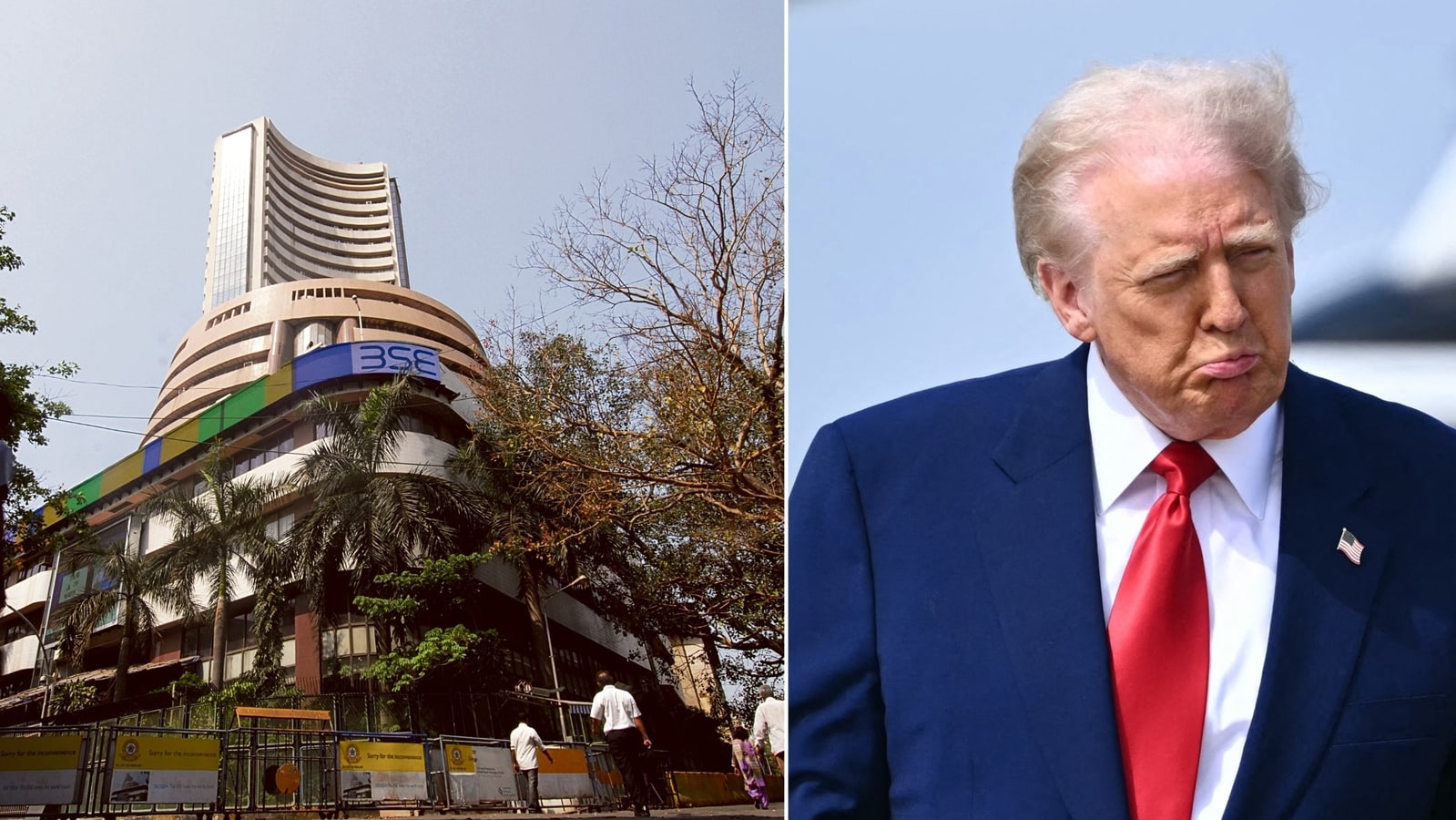

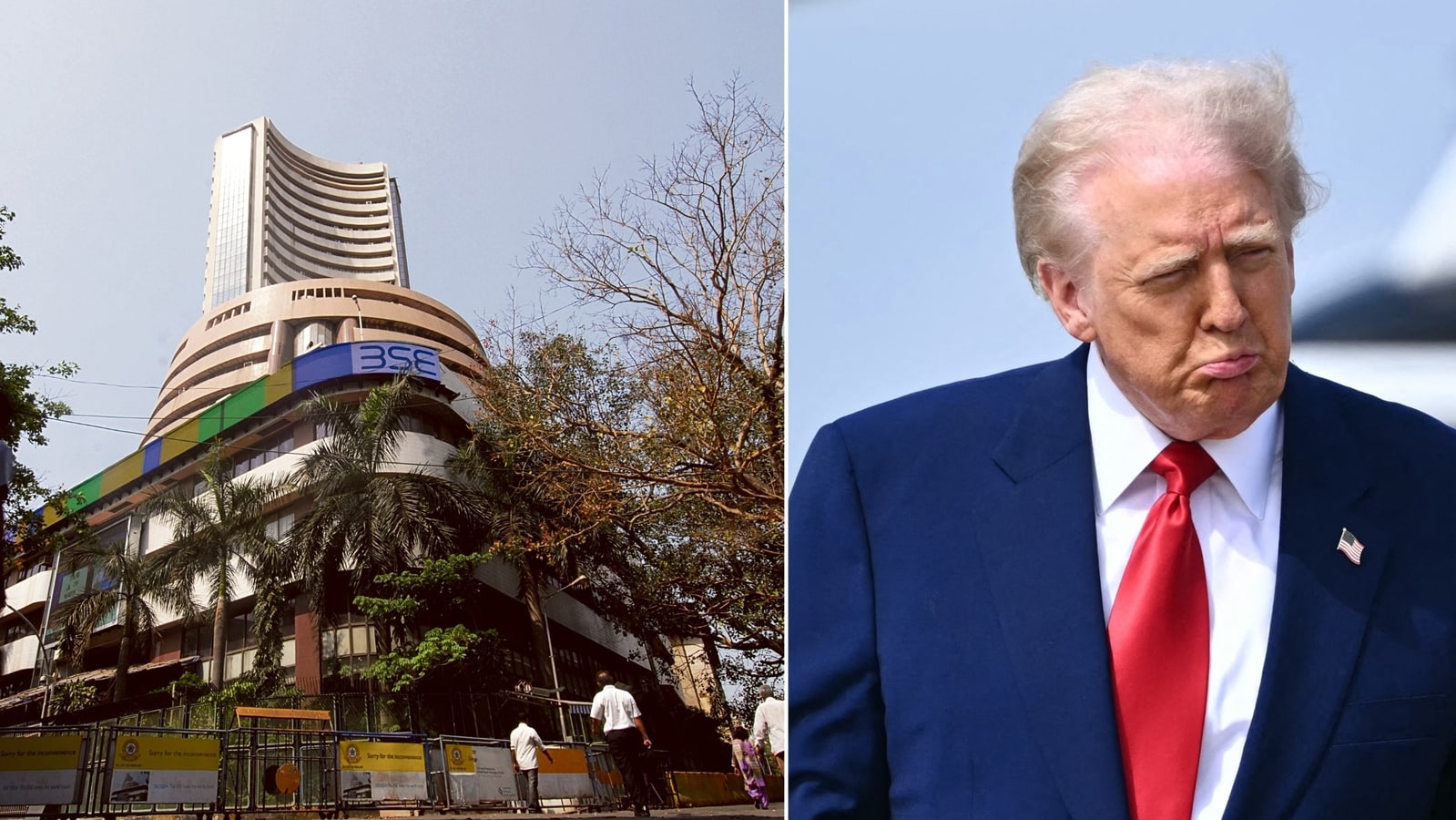

Analyzing The Indian Market Crash: Sensex And Nifty's Sharp Drop Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Indian Market Crash: Sensex and Nifty's Sharp Drop Explained

The Indian stock market experienced a significant downturn recently, with the Sensex and Nifty plunging sharply. This unexpected crash has left investors reeling and sparked widespread concern about the country's economic outlook. Understanding the reasons behind this sudden market volatility is crucial for both seasoned investors and newcomers alike. This in-depth analysis delves into the key factors contributing to the drop, offering insights into potential future trends.

What Caused the Sensex and Nifty's Dramatic Fall?

The recent market crash wasn't triggered by a single event, but rather a confluence of factors, each playing a significant role in the overall decline. These include:

-

Global Economic Uncertainty: The global economic landscape is currently fraught with challenges. High inflation in many developed nations, coupled with aggressive interest rate hikes by central banks like the Federal Reserve, creates a ripple effect impacting emerging markets like India. Concerns about a potential global recession are further fueling investor anxieties.

-

Foreign Institutional Investor (FII) Outflows: FIIs have been significant net sellers in the Indian market for several months. This outflow of foreign capital puts downward pressure on stock prices, as demand decreases. The reasons behind these outflows are multifaceted, ranging from global risk aversion to reassessments of India's growth prospects.

-

Rupee Depreciation: The weakening of the Indian Rupee against the US dollar adds another layer of complexity. This makes Indian assets less attractive to foreign investors and contributes to capital flight, exacerbating the market downturn. The depreciation is often linked to global currency fluctuations and India's current account deficit.

-

Domestic Factors: Beyond global influences, certain domestic factors also contributed to the market's instability. Rising inflation, concerns about corporate earnings, and potential policy changes can all impact investor sentiment and lead to selling pressure. Specific sector-specific headwinds also play a role.

Understanding the Impact on Investors:

The sharp drop in the Sensex and Nifty has significant implications for investors. Many are experiencing substantial portfolio losses, leading to increased market volatility and uncertainty. This situation underlines the importance of a well-diversified investment strategy and risk management.

What Lies Ahead for the Indian Stock Market?

Predicting the future of the market is inherently challenging, but several factors will likely influence its trajectory in the coming months. These include:

-

Global Economic Recovery: A faster-than-expected global economic recovery could bolster investor confidence and lead to a market rebound. Conversely, a prolonged period of global uncertainty could prolong the downturn.

-

Government Policies: Government intervention and policy decisions will play a crucial role in stabilizing the market. Measures to boost investor confidence and address domestic concerns could help mitigate the negative impact.

-

Corporate Earnings: Strong corporate earnings reports can help alleviate investor anxieties and attract investment. Conversely, weak earnings could further depress the market.

Strategies for Navigating Market Volatility:

Investors should adopt a cautious approach during periods of market instability. This includes:

-

Diversification: Maintain a well-diversified portfolio across asset classes to mitigate risk.

-

Risk Assessment: Regularly reassess your risk tolerance and adjust your investment strategy accordingly.

-

Long-Term Perspective: Avoid panic selling and maintain a long-term investment horizon. Short-term market fluctuations are a normal part of investing.

-

Professional Advice: Seek guidance from a qualified financial advisor to navigate the complexities of the market.

The recent crash in the Indian stock market serves as a reminder of the inherent risks associated with investing. Understanding the underlying factors and adopting a prudent approach are crucial for navigating market volatility and achieving long-term investment success. While the immediate future remains uncertain, a thorough analysis of the contributing factors provides valuable insights for investors to make informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Indian Market Crash: Sensex And Nifty's Sharp Drop Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can Canucks Hot Streak Survive Clash With Dominant Rocket Team

Apr 08, 2025

Can Canucks Hot Streak Survive Clash With Dominant Rocket Team

Apr 08, 2025 -

Singapore Tycoon Robert Ng Familys China Ties Lead To Politically Significant Person Designation

Apr 08, 2025

Singapore Tycoon Robert Ng Familys China Ties Lead To Politically Significant Person Designation

Apr 08, 2025 -

Hamster Kombats First Year A Web3 Gaming Retrospective

Apr 08, 2025

Hamster Kombats First Year A Web3 Gaming Retrospective

Apr 08, 2025 -

Legendary Malian Musician Amadou Bagayoko Dead At 70

Apr 08, 2025

Legendary Malian Musician Amadou Bagayoko Dead At 70

Apr 08, 2025 -

3 Ton Stonehenge Components A Possible Connection To Earlier Megalithic Structures

Apr 08, 2025

3 Ton Stonehenge Components A Possible Connection To Earlier Megalithic Structures

Apr 08, 2025