Analyzing The Polkadot (DOT) Price Decline: A Technical Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Polkadot (DOT) Price Decline: A Technical Perspective

The cryptocurrency market is known for its volatility, and Polkadot (DOT), a prominent blockchain project, has recently experienced a notable price decline. This article delves into a technical analysis of DOT's price action, exploring potential reasons behind the downturn and offering insights for investors navigating this dynamic market. Understanding these technical factors is crucial for informed decision-making in the ever-evolving crypto landscape.

The DOT Price Dip: A Closer Look

Polkadot's price has seen a significant drop in recent weeks, prompting concerns among investors. While the overall cryptocurrency market has experienced some bearish sentiment, DOT's decline warrants specific analysis. Several key technical indicators point towards potential factors contributing to this downturn.

1. Breakdown of Key Support Levels:

One of the most significant factors contributing to the DOT price decline is the breakdown of crucial support levels. Historically, DOT found support at certain price points, acting as barriers against further declines. However, the recent price action has decisively broken below these levels, suggesting a weakening trend. This breakdown often triggers further selling pressure as traders adjust their positions based on these technical signals. Analyzing these support levels on charts, using tools such as moving averages and Fibonacci retracements, offers crucial insight into potential future price movement.

2. Negative RSI and MACD Readings:

Technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) provide signals about the momentum and potential trend reversals. Currently, negative readings on both RSI and MACD for DOT suggest bearish momentum. These indicators, while not foolproof, contribute significantly to the overall bearish sentiment surrounding the coin. Understanding these indicators and their implications requires careful study and practice.

3. Volume Analysis: Confirmation of the Downtrend?

Analyzing trading volume alongside price action is essential. A significant price drop accompanied by high trading volume confirms the strength of the bearish trend. Conversely, a price drop with low volume might indicate a temporary pullback rather than a sustained downtrend. Analyzing the volume data alongside the price charts can provide a more nuanced perspective on the DOT price decline.

4. Impact of the Broader Cryptocurrency Market:

It's impossible to ignore the influence of the overall cryptocurrency market on individual assets like DOT. A general market downturn often exacerbates existing bearish trends, creating a cascading effect. The current bearish sentiment in the broader crypto market undoubtedly contributes to the pressure on DOT's price.

Potential Scenarios and Future Outlook for DOT

While the current technical analysis points towards a bearish trend, it is crucial to remember that the cryptocurrency market is unpredictable. Several scenarios could unfold:

-

Continued Decline: If the bearish momentum persists, further price drops are possible. Key support levels to watch will be crucial in determining the extent of any further decline.

-

Consolidation Phase: A period of consolidation, where the price moves sideways within a specific range, might follow the recent decline. This could be a period of accumulation before a potential rebound.

-

Reversal: A bullish reversal, while less likely given the current indicators, remains a possibility. Close observation of technical indicators and price action is critical in identifying any signs of a potential trend reversal.

Conclusion: Navigating Uncertainty in the Crypto Market

Analyzing the Polkadot (DOT) price decline requires a comprehensive approach, considering various technical indicators and the broader market context. While the current signals suggest a bearish trend, the cryptocurrency market remains highly volatile and unpredictable. Investors should remain cautious, carefully monitor the market, and base their decisions on thorough technical analysis and risk management strategies. This analysis provides a technical perspective and should not be considered financial advice. Always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Polkadot (DOT) Price Decline: A Technical Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

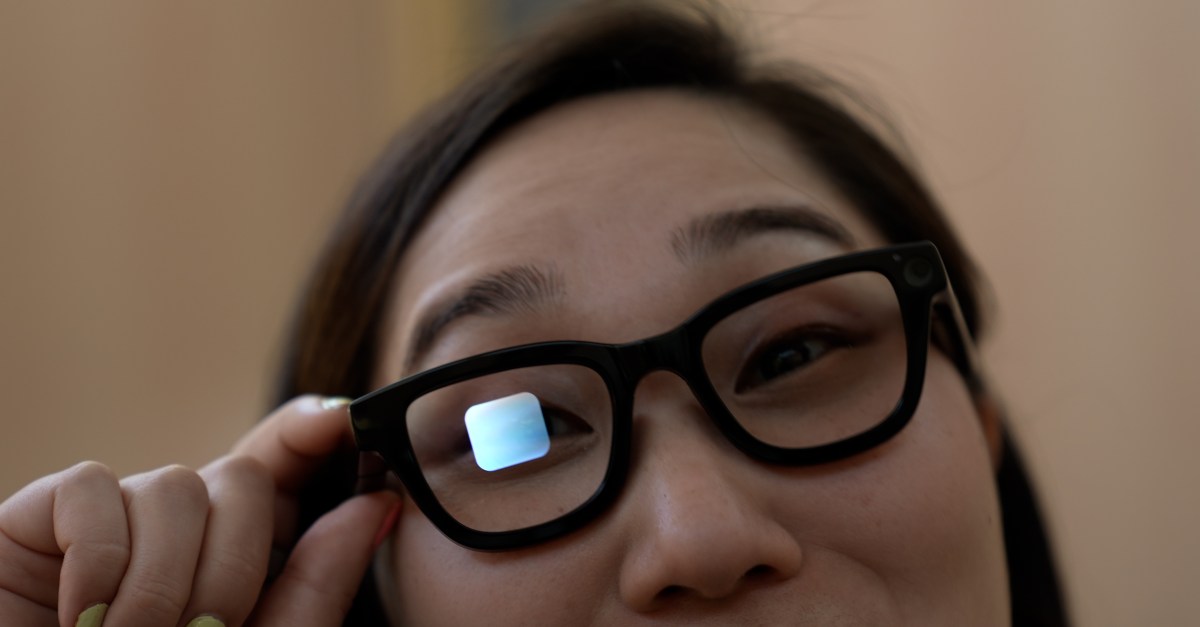

First Impressions Testing Googles Prototype Smart Glasses

May 23, 2025

First Impressions Testing Googles Prototype Smart Glasses

May 23, 2025 -

Bitcoin Price Soars To New Peak Key Factors Driving The Increase

May 23, 2025

Bitcoin Price Soars To New Peak Key Factors Driving The Increase

May 23, 2025 -

Volvo Cars And Google Strengthen Collaboration On Next Gen Vehicle Software

May 23, 2025

Volvo Cars And Google Strengthen Collaboration On Next Gen Vehicle Software

May 23, 2025 -

Could Dalton Knecht Fuel A Lakers Pacers Trade For A 16 1 Ppg Wing

May 23, 2025

Could Dalton Knecht Fuel A Lakers Pacers Trade For A 16 1 Ppg Wing

May 23, 2025 -

South Sydneys Rebuild Garlick Returns From Melbourne Storm

May 23, 2025

South Sydneys Rebuild Garlick Returns From Melbourne Storm

May 23, 2025

Latest Posts

-

Sunrise Host Welcomes Baby Girl A Healthy Arrival For Channel Seven Star

May 23, 2025

Sunrise Host Welcomes Baby Girl A Healthy Arrival For Channel Seven Star

May 23, 2025 -

Titan Implosion Shocking Footage Captures The Moment Of Collapse

May 23, 2025

Titan Implosion Shocking Footage Captures The Moment Of Collapse

May 23, 2025 -

Integrated Maritime Surveillance A Cornerstone Of The Coast Guards Modernized Force

May 23, 2025

Integrated Maritime Surveillance A Cornerstone Of The Coast Guards Modernized Force

May 23, 2025 -

Nvidias Huang On Ai A Critical Window Of Opportunity Is Closing

May 23, 2025

Nvidias Huang On Ai A Critical Window Of Opportunity Is Closing

May 23, 2025 -

Tournee De P A L Annonce Officielle Et Les Dates A Retenir

May 23, 2025

Tournee De P A L Annonce Officielle Et Les Dates A Retenir

May 23, 2025