Analyzing The Recent Downturn: Understanding Singapore's Stock Market Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Recent Downturn: Understanding Singapore's Stock Market Performance

Singapore's vibrant stock market, the Straits Times Index (STI), has experienced a recent downturn, prompting concerns among investors. This article delves into the factors contributing to this decline, analyzes the current market sentiment, and offers insights into potential future trajectories. Understanding these dynamics is crucial for both seasoned investors and those new to the Singaporean market.

The Recent Dip: A Multifaceted Issue

The recent slump in the STI isn't attributable to a single cause but rather a confluence of global and local factors. Several key elements are at play:

-

Global Economic Uncertainty: The global economic slowdown, fueled by persistent inflation, rising interest rates, and geopolitical instability, has significantly impacted investor confidence worldwide. Singapore, being a highly interconnected global economy, is particularly susceptible to these external pressures. The war in Ukraine, ongoing supply chain disruptions, and energy price volatility all contribute to this uncertainty.

-

Tech Sector Weakness: The technology sector, a significant component of the STI, has experienced a considerable correction. Concerns around overvaluation, reduced growth projections, and tighter regulatory environments have led to a sell-off in technology stocks, impacting the overall index performance.

-

Interest Rate Hikes: The Monetary Authority of Singapore (MAS) has been actively managing inflation by raising interest rates. While necessary to curb inflation, these hikes increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings. This, in turn, affects investor sentiment and stock valuations.

-

China's Economic Slowdown: China's economic slowdown, hampered by its zero-COVID policy and real estate sector woes, also casts a shadow over Singapore's economy. Given Singapore's strong trade ties with China, any slowdown in the Chinese economy directly impacts Singaporean businesses and investor confidence.

Market Sentiment and Investor Behavior

The current market sentiment is characterized by caution and uncertainty. Investors are adopting a more risk-averse approach, favoring safer investments over higher-risk equities. This is evident in the increased demand for government bonds and other fixed-income securities. Volatility remains high, indicating ongoing uncertainty and the potential for further market fluctuations.

Potential Future Trajectories and Investment Strategies

Predicting the future trajectory of the STI is challenging, but several potential scenarios exist:

-

A Gradual Recovery: As global economic uncertainty subsides and inflation cools down, the STI may experience a gradual recovery. This scenario hinges on the effectiveness of central bank policies and the resolution of geopolitical tensions.

-

Prolonged Correction: If global economic challenges persist, the correction in the STI could be prolonged. Investors should brace for further volatility and potentially lower returns in the short to medium term.

-

Selective Opportunities: Even during a downturn, opportunities exist for discerning investors. Focusing on fundamentally strong companies with sustainable business models and attractive valuations can yield positive returns in the long run. Diversification across sectors and asset classes remains crucial.

Conclusion:

The recent downturn in Singapore's stock market reflects a complex interplay of global and local factors. While uncertainty persists, understanding these factors is critical for navigating the current market environment. Investors should adopt a well-informed and cautious approach, focusing on long-term investment strategies and diversification to mitigate risk. Regular monitoring of economic indicators and market trends is essential for making informed investment decisions in the dynamic Singaporean stock market. Staying informed about the latest news and analyses will be crucial for success in the coming months.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Recent Downturn: Understanding Singapore's Stock Market Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brunson Leads Knicks To Playoff Win Over Celtics A Series Turning Point

May 13, 2025

Brunson Leads Knicks To Playoff Win Over Celtics A Series Turning Point

May 13, 2025 -

Lorry Strikes Elephant Family Calf Dies On Malaysian Highway

May 13, 2025

Lorry Strikes Elephant Family Calf Dies On Malaysian Highway

May 13, 2025 -

Flower Micromoon 2025 Date Time And Viewing Tips

May 13, 2025

Flower Micromoon 2025 Date Time And Viewing Tips

May 13, 2025 -

The Strategic Interplay Of Teslas Dojo Chips And 4680 Battery Technology

May 13, 2025

The Strategic Interplay Of Teslas Dojo Chips And 4680 Battery Technology

May 13, 2025 -

115 Tariff Reduction Landmark Us China Trade Agreement Reached

May 13, 2025

115 Tariff Reduction Landmark Us China Trade Agreement Reached

May 13, 2025

Latest Posts

-

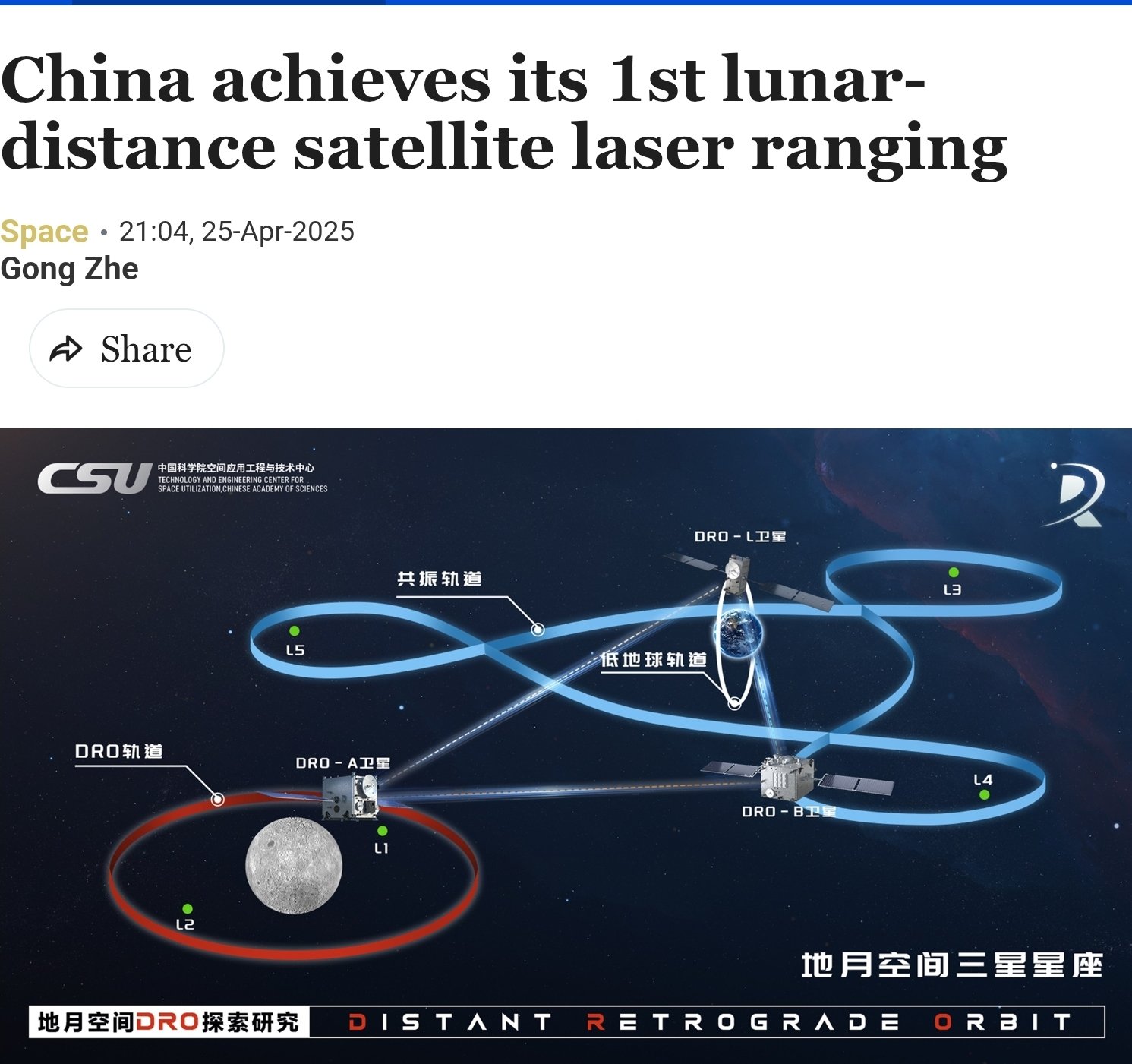

Lunar Laser Ranging A Chinese Satellites Technological Feat

May 13, 2025

Lunar Laser Ranging A Chinese Satellites Technological Feat

May 13, 2025 -

Follow The Action Draper Vs Moutet Italian Open Last 16 Live Score

May 13, 2025

Follow The Action Draper Vs Moutet Italian Open Last 16 Live Score

May 13, 2025 -

Uptick In Singapore Covid 19 Infections Authorities Expect Recurring Waves

May 13, 2025

Uptick In Singapore Covid 19 Infections Authorities Expect Recurring Waves

May 13, 2025 -

Hondas Financial Woes Deepen The Lasting Impact Of Trumps Trade Policies On Japan

May 13, 2025

Hondas Financial Woes Deepen The Lasting Impact Of Trumps Trade Policies On Japan

May 13, 2025 -

Beyond The Propaganda Unmasking Russias False Sense Of Victory

May 13, 2025

Beyond The Propaganda Unmasking Russias False Sense Of Victory

May 13, 2025