Analyzing Warren Buffett's Approach: Its Relevance To Cryptocurrency Investing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Warren Buffett's Approach: Its Relevance to Cryptocurrency Investing

Warren Buffett, the Oracle of Omaha, is renowned for his value investing philosophy. His decades-long success has made him a legendary figure in the financial world. But how relevant is his approach to the volatile and often perplexing world of cryptocurrency investing? This article delves into Buffett's strategies and examines their applicability—or lack thereof—in the crypto space.

Buffett's Core Principles: A Foundation of Value

Buffett's investing philosophy centers on several key principles:

- Intrinsic Value: He focuses on identifying companies with intrinsic value significantly exceeding their market price. This means understanding the underlying business, its profitability, and its future potential.

- Long-Term Perspective: Buffett is a long-term investor, eschewing short-term market fluctuations in favor of sustained growth. He famously holds investments for years, even decades.

- Understanding the Business: He emphasizes thorough due diligence, gaining a deep understanding of the companies he invests in before committing capital. This involves analyzing financial statements, understanding the competitive landscape, and assessing management quality.

- Risk Aversion: While not risk-free, Buffett's approach prioritizes minimizing risk through careful selection and diversification within a portfolio of fundamentally sound businesses.

The Crypto Conundrum: Where Buffett's Approach Falls Short

Applying these principles directly to cryptocurrency investing presents significant challenges:

- Intangible Assets: Unlike traditional stocks representing ownership in established businesses, cryptocurrencies largely lack the tangible assets and predictable cash flows that Buffett typically analyzes. Their value is often driven by speculation and market sentiment, making intrinsic value assessment incredibly difficult.

- Volatility: Crypto markets are notoriously volatile. The significant price swings contradict Buffett's long-term, value-driven approach. The potential for rapid losses clashes with his risk-averse strategy.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains uncertain globally. This uncertainty introduces a significant layer of risk that Buffett's traditional analysis doesn't fully account for. Regulations could dramatically impact the value of crypto assets, undermining any long-term investment strategy.

- Lack of Transparency: The lack of transparency in some areas of the cryptocurrency market, including the origins of some projects and the identities of their developers, presents a major challenge to Buffett's emphasis on understanding the underlying business.

Finding Parallels: Adapting Buffett's Wisdom

While a direct application of Buffett's strategies might be problematic, certain aspects remain relevant:

- Due Diligence: Even in the crypto world, thorough research and understanding of a project's whitepaper, technology, and team are crucial. Investors should not blindly follow hype.

- Diversification: Diversifying across different cryptocurrencies can help mitigate risk, mirroring Buffett's approach to traditional stock portfolios.

- Long-Term Vision (with Caution): While short-term gains are tempting, a long-term perspective is crucial, although the "long-term" in crypto might be significantly shorter than in traditional markets due to inherent volatility.

Conclusion: A Cautious Approach

Warren Buffett's value investing principles provide a solid foundation for traditional investing. However, the unique characteristics of the cryptocurrency market necessitate a cautious and adapted approach. While some elements of his philosophy, such as thorough due diligence and diversification, remain relevant, directly applying his core strategies to cryptocurrency investing without significant modification would likely be unwise. The cryptocurrency market demands a separate set of analytical tools and a higher tolerance for risk than Buffett's traditional value investing approach.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Warren Buffett's Approach: Its Relevance To Cryptocurrency Investing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fa Cup Final Why Alan Pardew Will Be Missing From Crystal Palace

May 17, 2025

Fa Cup Final Why Alan Pardew Will Be Missing From Crystal Palace

May 17, 2025 -

Sony Wh 1000 Xm 6 Top 3 Features And New Portable Design

May 17, 2025

Sony Wh 1000 Xm 6 Top 3 Features And New Portable Design

May 17, 2025 -

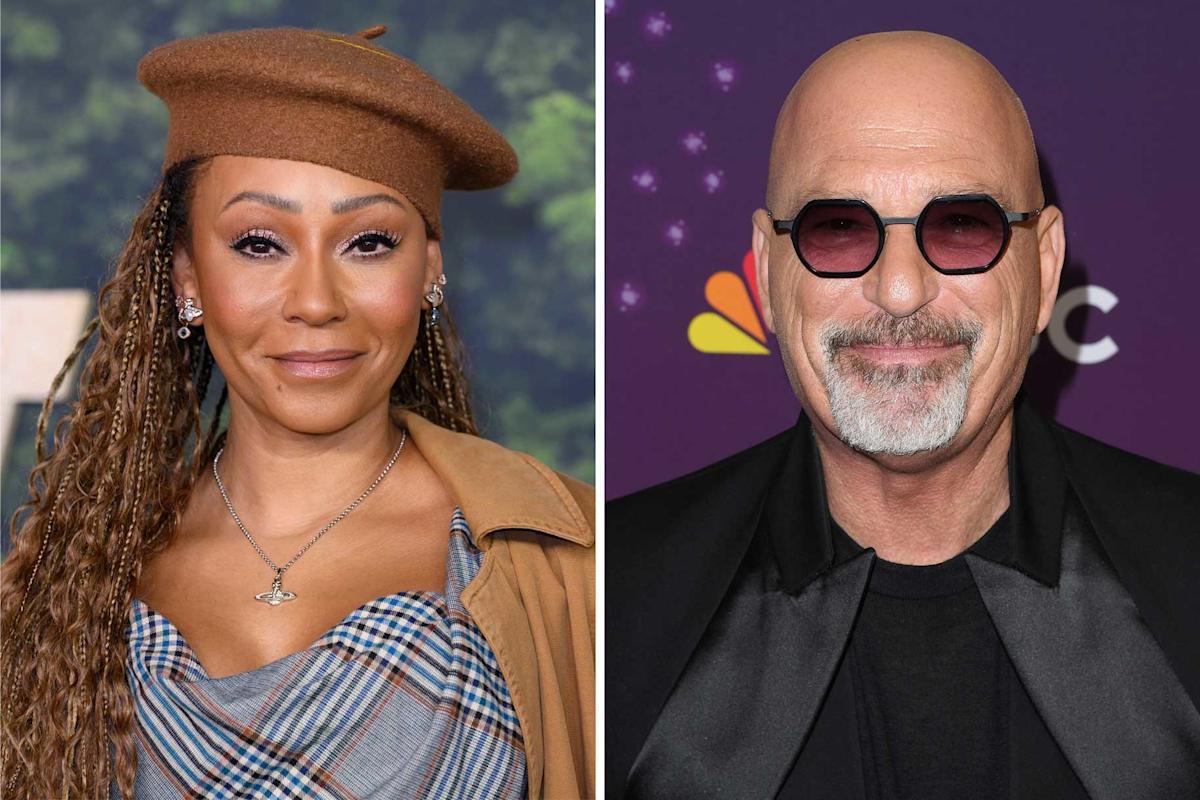

Mel Bs Wedding Guest List Why Howie Mandel Wont Be Attending

May 17, 2025

Mel Bs Wedding Guest List Why Howie Mandel Wont Be Attending

May 17, 2025 -

Destruicao No Rio Grande Do Sul Chuvas Causam 75 Mortes E Crise De Agua E Energia

May 17, 2025

Destruicao No Rio Grande Do Sul Chuvas Causam 75 Mortes E Crise De Agua E Energia

May 17, 2025 -

Transfer News Max Power Joins Bradford City After Wigan Exit

May 17, 2025

Transfer News Max Power Joins Bradford City After Wigan Exit

May 17, 2025