Analyzing Warren Buffett's Investment Philosophy: Implications For Cryptocurrency

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Warren Buffett's Investment Philosophy: Implications for Cryptocurrency

The Oracle of Omaha and the volatile world of digital assets: a fascinating clash of ideologies.

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, is renowned for his value investing approach. His philosophy, built on decades of success, emphasizes long-term investments in fundamentally sound companies with proven track records and understandable business models. But how does this time-tested strategy translate to the rapidly evolving and often turbulent world of cryptocurrency? This article delves into Buffett's core investment principles and explores their implications for the burgeoning crypto market.

Buffett's Core Principles: A Foundation of Value

Buffett's investment philosophy rests on several key pillars:

- Intrinsic Value: He focuses on identifying companies trading below their intrinsic value – what he believes the company is truly worth based on its assets, earnings, and future potential. He famously seeks a "margin of safety," buying assets significantly below this intrinsic value to cushion against potential losses.

- Long-Term Perspective: Buffett is a staunch believer in long-term investing, shunning short-term market fluctuations and focusing on the enduring value of a company. He often holds investments for decades.

- Understanding the Business: He prioritizes understanding the underlying business model of a company before investing. He wants to grasp how the company generates revenue, manages its finances, and operates within its industry.

- Risk Aversion: While not risk-averse in the sense of avoiding all risk, Buffett meticulously assesses risk before investing, preferring predictable and understandable businesses over high-risk, high-reward ventures.

Cryptocurrency: A Challenge to Buffett's Principles?

Cryptocurrencies like Bitcoin and Ethereum present a significant challenge to Buffett's established principles. Several key aspects clash directly with his investment philosophy:

- Volatility: The extreme price volatility of cryptocurrencies directly contradicts Buffett's preference for stable, predictable investments. The lack of consistent historical data makes accurately assessing intrinsic value extremely difficult.

- Lack of Understandable Business Model: Unlike established companies with clear business models, the value proposition of many cryptocurrencies is often complex and opaque to many investors. Understanding the underlying technology and its potential for long-term success requires specialized knowledge.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still largely undefined, creating significant uncertainty and risk. This lack of clarity makes it difficult to assess the long-term viability and legal compliance of cryptocurrency investments.

- Speculative Nature: A substantial portion of cryptocurrency trading is driven by speculation, rather than fundamental analysis. This speculative nature, a direct contrast to Buffett's focus on value, makes the market particularly susceptible to bubbles and crashes.

Implications for Investors:

While Buffett has publicly expressed skepticism about cryptocurrencies, his philosophy provides valuable lessons for investors navigating this complex market:

- Due Diligence is Paramount: Thorough research and a deep understanding of the underlying technology and market dynamics are crucial before investing in any cryptocurrency.

- Risk Management is Essential: Given the volatility and inherent risks, investors should carefully manage their exposure to cryptocurrencies, diversifying their portfolios and avoiding over-leveraging.

- Long-Term Vision is Key (but challenging): While Buffett advocates a long-term perspective, the nascent nature of the cryptocurrency market makes predicting long-term success particularly challenging.

Conclusion:

Warren Buffett's investment philosophy offers invaluable insights into successful investing, but its direct application to the cryptocurrency market presents significant challenges. The inherent volatility, regulatory uncertainty, and speculative nature of cryptocurrencies clash directly with Buffett's emphasis on value, predictability, and understanding the underlying business. Investors interested in this space must carefully consider these factors and apply rigorous due diligence before making any investment decisions. The future of cryptocurrency remains uncertain, requiring a different approach than the tried-and-true methods championed by the Oracle of Omaha.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Warren Buffett's Investment Philosophy: Implications For Cryptocurrency. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tehrans Pulse Assessing Public Sentiment As Iran Nuclear Talks Progress

May 25, 2025

Tehrans Pulse Assessing Public Sentiment As Iran Nuclear Talks Progress

May 25, 2025 -

Aoc Receives Death Threats Following Baseball Teams Offensive Video

May 25, 2025

Aoc Receives Death Threats Following Baseball Teams Offensive Video

May 25, 2025 -

Afl Premiership Coach Receives Public Apology After Live Insult

May 25, 2025

Afl Premiership Coach Receives Public Apology After Live Insult

May 25, 2025 -

Hudsons Bay Announces Major Lease Sale To British Columbia Mall Operator

May 25, 2025

Hudsons Bay Announces Major Lease Sale To British Columbia Mall Operator

May 25, 2025 -

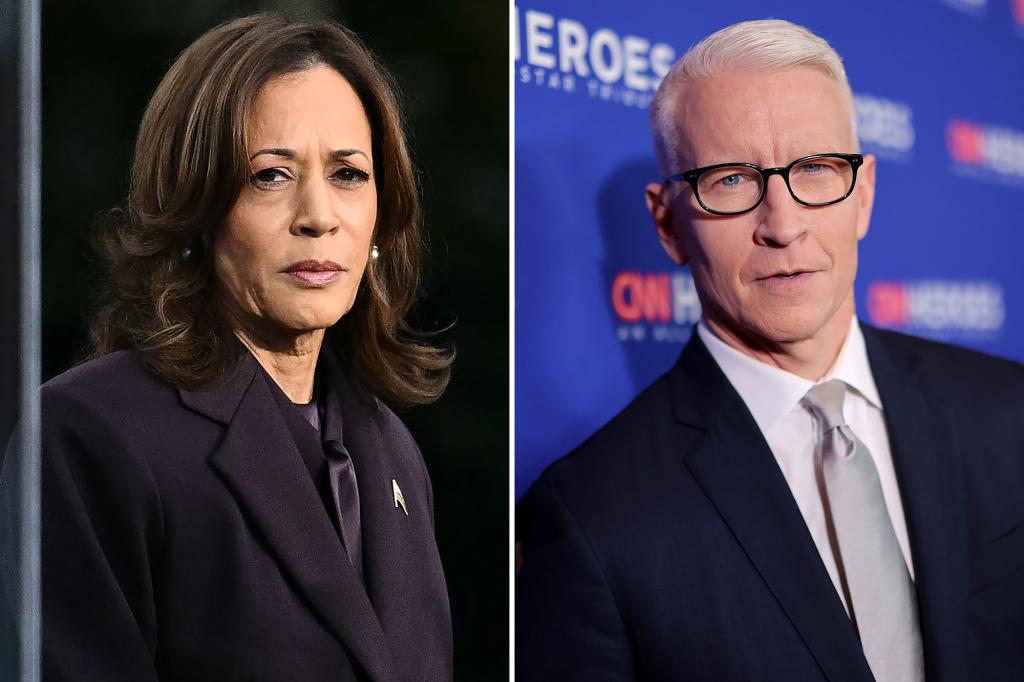

Kamala Harris And Anderson Cooper Clash Explosive Interview And Post Interview Remarks

May 25, 2025

Kamala Harris And Anderson Cooper Clash Explosive Interview And Post Interview Remarks

May 25, 2025

Latest Posts

-

Warren Buffetts Fear And Greed Indicator A Practical Guide For Crypto Investors

May 25, 2025

Warren Buffetts Fear And Greed Indicator A Practical Guide For Crypto Investors

May 25, 2025 -

Police Respond To Major Incident In South Melbourne Updates And Details

May 25, 2025

Police Respond To Major Incident In South Melbourne Updates And Details

May 25, 2025 -

Collingwood Reveals New Player For Round 11 Match

May 25, 2025

Collingwood Reveals New Player For Round 11 Match

May 25, 2025 -

Political Tensions Rise At Londons Popular Festivals

May 25, 2025

Political Tensions Rise At Londons Popular Festivals

May 25, 2025 -

Increased Colorectal Cancer Rates Among Young Adults Causes And Concerns

May 25, 2025

Increased Colorectal Cancer Rates Among Young Adults Causes And Concerns

May 25, 2025