Analyzing Warren Buffett's Strategy: Its Relevance To Cryptocurrency Investing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Warren Buffett's Strategy: Its Relevance to Cryptocurrency Investing

The Oracle of Omaha and the Wild West of Crypto: A Surprising Connection?

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, is famously skeptical of cryptocurrencies. His aversion to Bitcoin and other digital assets is well-documented. However, while his investment philosophy might seem worlds apart from the volatile world of crypto, a closer examination reveals surprising parallels and valuable lessons for cryptocurrency investors. Understanding Buffett's core tenets can actually enhance your approach to navigating the often-turbulent crypto market.

Buffett's Core Principles: A Foundation for Prudent Investing

Buffett's investing strategy centers around several key principles:

-

Value Investing: He focuses on identifying undervalued companies with strong fundamentals and long-term growth potential. This emphasis on intrinsic value is a crucial concept that can be adapted to the crypto space, albeit with necessary modifications. Instead of focusing on a company's balance sheet, you might look at a cryptocurrency's network effects, adoption rate, and underlying technology.

-

Long-Term Perspective: Buffett is a staunch believer in long-term investing, eschewing short-term market fluctuations. This is particularly relevant in the volatile crypto market, where short-term price swings are common. Holding onto promising cryptocurrencies for the long haul, weathering market downturns, is a strategy mirroring Buffett's patience.

-

Understanding the Business: Buffett meticulously researches the businesses he invests in, understanding their competitive advantages and management teams. Similarly, successful crypto investors need to thoroughly understand the technology behind different cryptocurrencies, their use cases, and the teams developing them. This due diligence is paramount to avoiding scams and making informed decisions.

-

Risk Management: Buffett is known for his disciplined approach to risk management. He avoids speculative investments and concentrates on businesses he understands well. This cautionary approach should be mirrored in cryptocurrency investing, where the risk of scams and significant price drops is substantial. Diversification across different cryptocurrencies and careful risk assessment are crucial.

Applying Buffett's Wisdom to Cryptocurrency Investing

While Buffett might not invest in Bitcoin, his principles offer valuable insights for crypto investors:

-

Focus on Fundamentals: Instead of chasing hype, focus on cryptocurrencies with strong underlying technology, active development communities, and clear use cases. Look beyond the price and analyze the project's long-term potential.

-

Long-Term Hold Strategy: Resist the urge to panic sell during market corrections. If you've done your research and believe in a project's long-term potential, holding through volatility can be highly rewarding.

-

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your cryptocurrency holdings across different projects reduces your overall risk.

-

Due Diligence is Key: Thoroughly research any cryptocurrency before investing. Understand the technology, the team, and the potential risks involved.

Conclusion: Learning from the Master

While Warren Buffett might not be a cryptocurrency enthusiast, his time-tested investment principles offer valuable lessons for anyone navigating the complex world of digital assets. By focusing on fundamentals, adopting a long-term perspective, and practicing rigorous risk management, cryptocurrency investors can learn from the Oracle of Omaha and improve their chances of success in this exciting but unpredictable market. Remember, thorough research and a disciplined approach are key to navigating the crypto landscape effectively, regardless of your investment philosophy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Warren Buffett's Strategy: Its Relevance To Cryptocurrency Investing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Anwar Ibrahim Familys Role In Pkr Is Justified Nepotism Allegations False

May 24, 2025

Anwar Ibrahim Familys Role In Pkr Is Justified Nepotism Allegations False

May 24, 2025 -

Budget Friendly Echo Show Amazons Latest Move Against Googles Smart Home Dominance

May 24, 2025

Budget Friendly Echo Show Amazons Latest Move Against Googles Smart Home Dominance

May 24, 2025 -

Analyzing The Dockers Horses For Courses Ruck Strategy

May 24, 2025

Analyzing The Dockers Horses For Courses Ruck Strategy

May 24, 2025 -

The Problem With Googles Ai Product Names A Users Perspective

May 24, 2025

The Problem With Googles Ai Product Names A Users Perspective

May 24, 2025 -

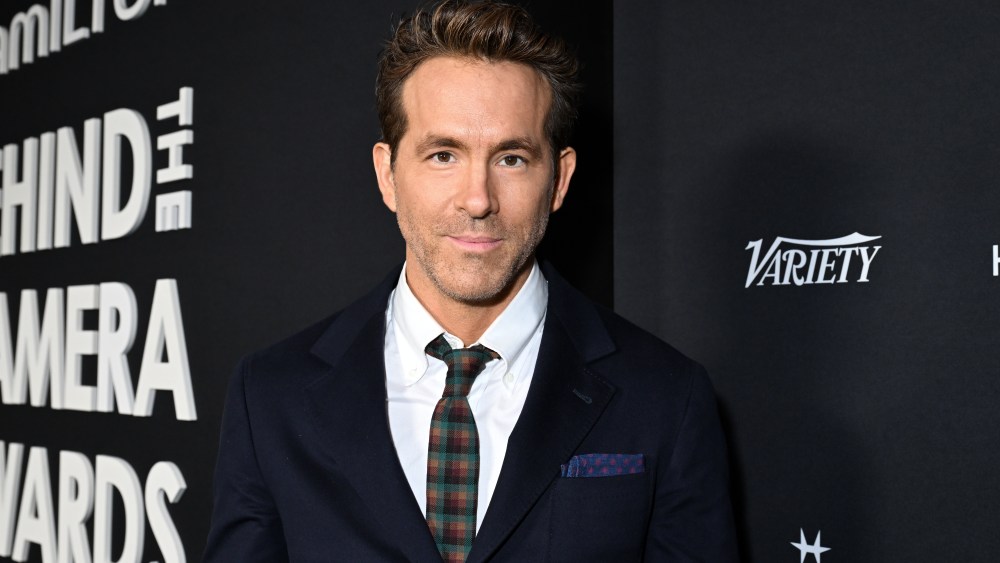

Ryan Reynolds Proposed R Rated Star Wars Film To Disney

May 24, 2025

Ryan Reynolds Proposed R Rated Star Wars Film To Disney

May 24, 2025