Analyzing Warren Buffett's Strategy: Its Relevance To The Volatile Crypto Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Warren Buffett's Strategy: Its Relevance to the Volatile Crypto Market

The Oracle of Omaha, Warren Buffett, is known for his value investing approach, a strategy built on patience, thorough due diligence, and a focus on fundamentally sound companies. But how relevant is his time-tested strategy to the wildly volatile world of cryptocurrency? While seemingly disparate, a closer look reveals surprising parallels and crucial lessons that crypto investors can learn from Buffett's decades of success.

The Buffett Principles: A Foundation for Sound Investment

Buffett's investment philosophy centers around several key principles:

-

Understanding the Business: Before investing, Buffett meticulously researches a company's fundamentals, its management, and its competitive landscape. He famously looks for "moats," or sustainable competitive advantages, that protect a company's long-term profitability. This principle is directly applicable to crypto: thorough research into a project's whitepaper, technology, team, and market position is crucial before investing. Don't just chase the hype.

-

Value Investing: Buffett seeks to buy assets below their intrinsic value. This means identifying undervalued companies with strong potential for future growth. In the crypto market, this translates to identifying promising projects that are currently undervalued due to market sentiment or temporary setbacks. This requires patience and a long-term perspective.

-

Long-Term Perspective: Buffett famously holds investments for the long haul, weathering market fluctuations without panic selling. This contrasts sharply with the short-term, often speculative, nature of much crypto trading. Adopting a long-term view, focusing on the underlying technology and potential, is critical for navigating crypto's volatility.

-

Risk Management: Buffett emphasizes diversification and responsible risk management. He avoids excessive leverage and focuses on investments he understands. This is particularly important in the crypto market, where high leverage and speculative trading can lead to significant losses. Diversification across different cryptocurrencies and asset classes is crucial.

Applying Buffett's Wisdom to the Crypto World

While direct parallels aren't always obvious, Buffett's principles offer valuable guidance for crypto investors:

-

Due Diligence is Paramount: The crypto market is rife with scams and pump-and-dump schemes. Thorough research, including understanding the underlying technology, the team behind the project, and the project's long-term viability, is absolutely crucial.

-

Avoid Emotional Decision-Making: The volatility of the crypto market can trigger emotional responses. Buffett's focus on rational analysis and long-term perspective can help investors avoid impulsive decisions driven by fear or greed.

-

Focus on Fundamentals: Instead of chasing the next "moon shot," focus on projects with strong fundamentals, a clear use case, and a dedicated development team.

-

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your crypto holdings across different projects and asset classes can mitigate risk.

The Challenges of Applying Buffett's Strategy to Crypto

It's important to acknowledge the limitations of directly applying Buffett's value investing strategy to the crypto market. The decentralized and highly speculative nature of crypto presents unique challenges:

-

Lack of Traditional Financial Metrics: Traditional valuation metrics may not be directly applicable to many cryptocurrencies.

-

Regulatory Uncertainty: The regulatory landscape for crypto is still evolving, which introduces additional uncertainty.

-

Technological Risks: The underlying technology of many crypto projects is still under development, presenting technological risks.

Conclusion: A Measured Approach

While not a perfect fit, Warren Buffett's principles of thorough due diligence, long-term perspective, risk management, and a focus on understanding the underlying business offer invaluable lessons for navigating the volatile crypto market. By adapting these principles to the unique challenges of the crypto space, investors can increase their chances of success and build a more resilient portfolio. Remember, patience, research, and a long-term vision are key to navigating this dynamic and often unpredictable asset class.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Warren Buffett's Strategy: Its Relevance To The Volatile Crypto Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lewis Hamiltons Monaco Gamble Penalty Outcome Could Decide Fate

May 25, 2025

Lewis Hamiltons Monaco Gamble Penalty Outcome Could Decide Fate

May 25, 2025 -

Wordle May 24 2024 1435 Guide To Solving Todays Puzzle

May 25, 2025

Wordle May 24 2024 1435 Guide To Solving Todays Puzzle

May 25, 2025 -

Sabalenka Dominates One Hour Roland Garros Victory

May 25, 2025

Sabalenka Dominates One Hour Roland Garros Victory

May 25, 2025 -

Napoli Set For De Bruyne Signing Analyzing The Transfer Rumours

May 25, 2025

Napoli Set For De Bruyne Signing Analyzing The Transfer Rumours

May 25, 2025 -

Afl Walyalup Dockers Vs Yartapuulti Power Saturday Showdown

May 25, 2025

Afl Walyalup Dockers Vs Yartapuulti Power Saturday Showdown

May 25, 2025

Latest Posts

-

Sunderland Player Suffers Injury Requires Oxygen In Championship Play Off Final

May 26, 2025

Sunderland Player Suffers Injury Requires Oxygen In Championship Play Off Final

May 26, 2025 -

Racing Bulls Exceed Expectations In Thrilling Monaco Race

May 26, 2025

Racing Bulls Exceed Expectations In Thrilling Monaco Race

May 26, 2025 -

I O And Io Understanding The Key Differences In Google And Open Ais Approaches

May 26, 2025

I O And Io Understanding The Key Differences In Google And Open Ais Approaches

May 26, 2025 -

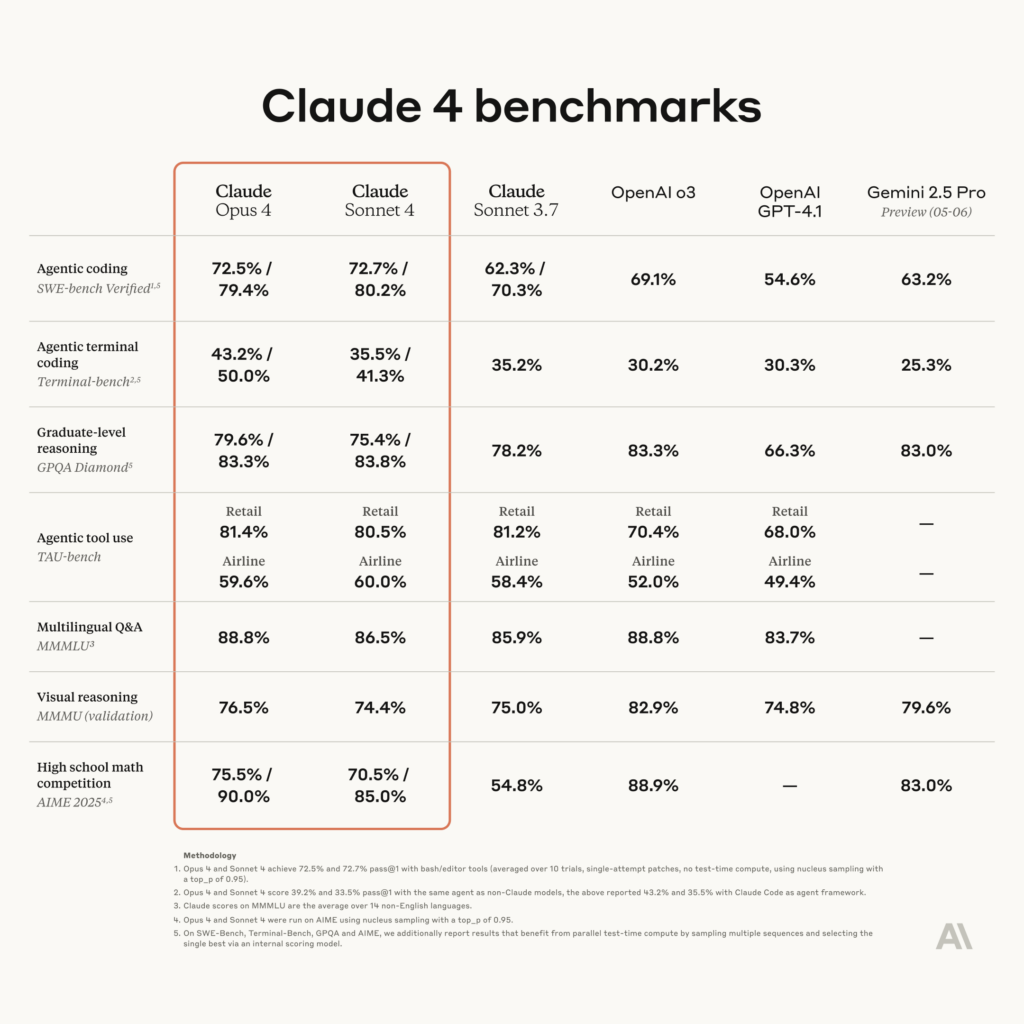

Claude 4 Sonnet Opus And The Future Of Agentic Coding From Anthropic

May 26, 2025

Claude 4 Sonnet Opus And The Future Of Agentic Coding From Anthropic

May 26, 2025 -

Xabi Alonsos Three Year Contract Confirmed As New Real Madrid Coach

May 26, 2025

Xabi Alonsos Three Year Contract Confirmed As New Real Madrid Coach

May 26, 2025