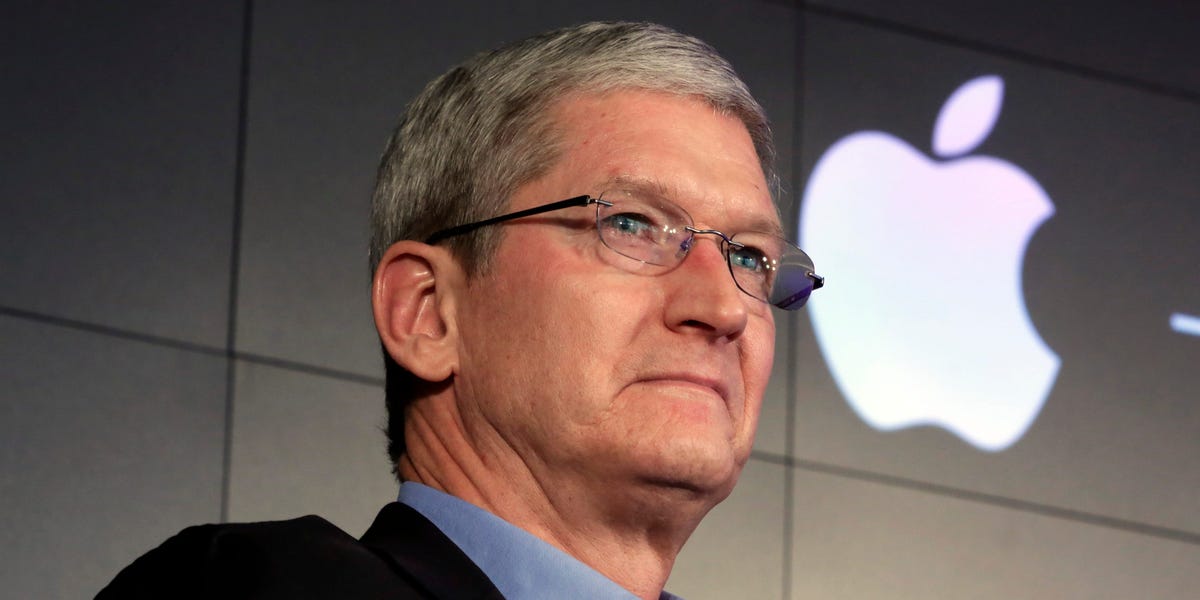

Apple Earnings: Stock Dips Despite Profit Beat, Service Revenue Disappoints

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Apple Earnings: Stock Dips Despite Profit Beat, Service Revenue Slowdown Casts Shadow

Apple's latest earnings report delivered a mixed bag, leaving investors with a sense of cautious optimism. While the tech giant exceeded profit expectations, a slowdown in its crucial Services revenue sent ripples through the market, causing a dip in Apple stock despite the positive earnings per share (EPS) announcement. The results highlight a complex picture for the Cupertino-based company, navigating a challenging global economic climate.

Profit Beats Expectations, But Growth Slows

Apple reported earnings per share (EPS) of $1.29, surpassing analysts' consensus estimates of $1.26. This positive news, however, was overshadowed by concerns regarding the future trajectory of the company's growth. Revenue for the quarter came in slightly below expectations, primarily driven by a weaker-than-anticipated performance in the iPhone segment and, more critically, the Services sector.

Services Revenue: The Key Disappointment

The Services segment, a key driver of Apple's recurring revenue and a significant component of its overall valuation, showed a noticeable slowdown in growth. This underperformance is a major concern for investors, signaling potential challenges in maintaining the robust growth seen in previous quarters. Analysts point to several factors contributing to this slowdown, including increased competition in the streaming market and a potential softening of consumer spending. The slower-than-expected growth in this critical area raises questions about Apple's ability to maintain its premium pricing strategy in a potentially weakening market.

iPhone Sales: A Mixed Bag

While iPhone sales remained strong, they also fell short of analysts’ predictions. This further contributes to the overall sense of cautiousness surrounding Apple's performance. The company cited macroeconomic headwinds and currency fluctuations as contributing factors to the slightly disappointing iPhone sales figures.

What's Next for Apple?

The market reaction to Apple's earnings report underscores the importance of the Services segment to the company's overall valuation and future growth prospects. The company's ability to reignite growth in this area, and to navigate the broader economic uncertainties, will be crucial in determining its future performance. Investors will be closely watching for signs of renewed momentum in the coming quarters. Further analysis will need to delve into the specifics of regional sales performance and assess the impact of new product launches, such as the latest iPhone models, on future revenue.

Key Takeaways:

- EPS Beat: Apple exceeded EPS expectations, reporting $1.29 compared to the projected $1.26.

- Services Slowdown: A significant slowdown in Services revenue growth was the primary driver of market concern.

- iPhone Sales Underperformed: iPhone sales, while still strong, missed analyst predictions.

- Market Reaction: Apple stock dipped despite the EPS beat, reflecting concerns about future growth.

- Future Outlook: Apple's ability to revitalize growth in its Services segment and navigate macroeconomic challenges will be crucial for its future success.

This earnings report highlights the complexities facing even the most successful tech giants. Apple's ability to adapt and innovate in a challenging market will ultimately determine whether this dip represents a temporary setback or a more significant shift in its growth trajectory. The coming months will provide crucial insights into the company's ability to address these challenges and maintain its market leadership.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Apple Earnings: Stock Dips Despite Profit Beat, Service Revenue Disappoints. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Follow Spurs Vs Bodo Glimt Live 2nd May 2025 Match Updates And Results

May 02, 2025

Follow Spurs Vs Bodo Glimt Live 2nd May 2025 Match Updates And Results

May 02, 2025 -

Satellite Phone Showdown Starlink Vs Traditional Systems

May 02, 2025

Satellite Phone Showdown Starlink Vs Traditional Systems

May 02, 2025 -

National Security Shuffle Waltzs Move From Trumps Nsc To The United Nations

May 02, 2025

National Security Shuffle Waltzs Move From Trumps Nsc To The United Nations

May 02, 2025 -

Andor Season 2 Episode 6 Bix Caleens Cathartic Revenge

May 02, 2025

Andor Season 2 Episode 6 Bix Caleens Cathartic Revenge

May 02, 2025 -

Real Betis Vs Fiorentina Expert Betting Tips And Predictions

May 02, 2025

Real Betis Vs Fiorentina Expert Betting Tips And Predictions

May 02, 2025