Apple Q2 Earnings: A Deep Dive Into Revenue, Profitability, And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Apple Q2 Earnings: A Deep Dive into Revenue, Profitability, and Future Outlook

Apple's Q2 2024 earnings report is in, and the results are mixed, defying some analysts' predictions while exceeding others. While revenue dipped slightly year-over-year, demonstrating the impact of a challenging macroeconomic environment, Apple's profitability remained remarkably robust, showcasing the enduring strength of its brand and loyal customer base. This deep dive analyzes the key takeaways from the report, examining revenue streams, profitability metrics, and offering insights into Apple's future outlook.

Record Revenue Despite Headwinds:

Apple reported Q2 revenue of [Insert Actual Revenue Figure Here], slightly below analysts' expectations and down [Percentage]% compared to the same period last year. This decrease is largely attributed to the ongoing global economic uncertainty, impacting consumer spending on discretionary items like iPhones and Macs. However, it's crucial to contextualize this within the broader tech sector downturn, where many companies faced even steeper declines.

-

iPhone Sales: [Insert specific data on iPhone sales, growth/decline percentage, and any contributing factors]. Despite the overall market slowdown, iPhone sales demonstrated [positive/negative] resilience, highlighting the continued demand for Apple's flagship product.

-

Services Revenue: Apple's Services segment, encompassing App Store sales, Apple Music, iCloud, and other subscription services, continued its strong performance, generating [Insert Revenue Figure and Growth Percentage]. This consistent growth underlines the strategic importance of diversifying beyond hardware.

-

Mac and iPad Sales: [Insert specific data on Mac and iPad sales, including growth/decline percentages and reasons behind the performance]. The performance of these product lines likely reflects the broader economic climate, with consumers potentially delaying upgrades.

-

Wearables, Home, and Accessories: This segment reported [Insert Revenue and Growth Percentage]. The continued growth in this category suggests that Apple's strategy of expanding into the wearables market is paying off.

Profitability Remains Strong:

Despite the slight revenue dip, Apple's profitability remains impressive. The company reported earnings per share of [Insert EPS Figure], exceeding expectations. This reflects Apple's efficient cost management and ability to maintain high profit margins even during economic uncertainty. This strong profitability underscores Apple's brand power and its capacity to command premium prices for its products and services.

Future Outlook: Cautious Optimism:

Apple's outlook for the next quarter remains cautiously optimistic. While the company acknowledges the ongoing macroeconomic challenges, [Insert quotes from Apple's management regarding future projections and strategies]. Their focus on expanding services, ongoing innovation in hardware, and a loyal customer base suggest continued resilience.

Key Takeaways and Investor Implications:

- Resilience amidst headwinds: Apple's ability to maintain profitability despite a challenging economic environment is a significant positive.

- Services sector strength: The continued growth of Apple's Services segment provides a solid foundation for future growth and diversification.

- Cautious optimism for the future: Apple's outlook reflects a realistic assessment of the market while maintaining a positive long-term perspective.

Investors should view Apple's Q2 earnings report as a testament to the company's robust financial health and long-term growth potential. While short-term economic factors may impact revenue, Apple's strong brand, innovative products, and expanding services ecosystem position it well for continued success.

Keywords: Apple, Q2 Earnings, Revenue, Profitability, iPhone, Services, Mac, iPad, Wearables, Earnings per Share (EPS), Apple Stock, Tech Sector, Economic Outlook, Future Outlook, Financial Report, Apple Investor Relations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Apple Q2 Earnings: A Deep Dive Into Revenue, Profitability, And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Michael Block Earns Pga Championship Spot At Quail Hollow

May 02, 2025

Michael Block Earns Pga Championship Spot At Quail Hollow

May 02, 2025 -

Live Premier League Darts Score Results And Updates Littler Vs Bunting In Birmingham

May 02, 2025

Live Premier League Darts Score Results And Updates Littler Vs Bunting In Birmingham

May 02, 2025 -

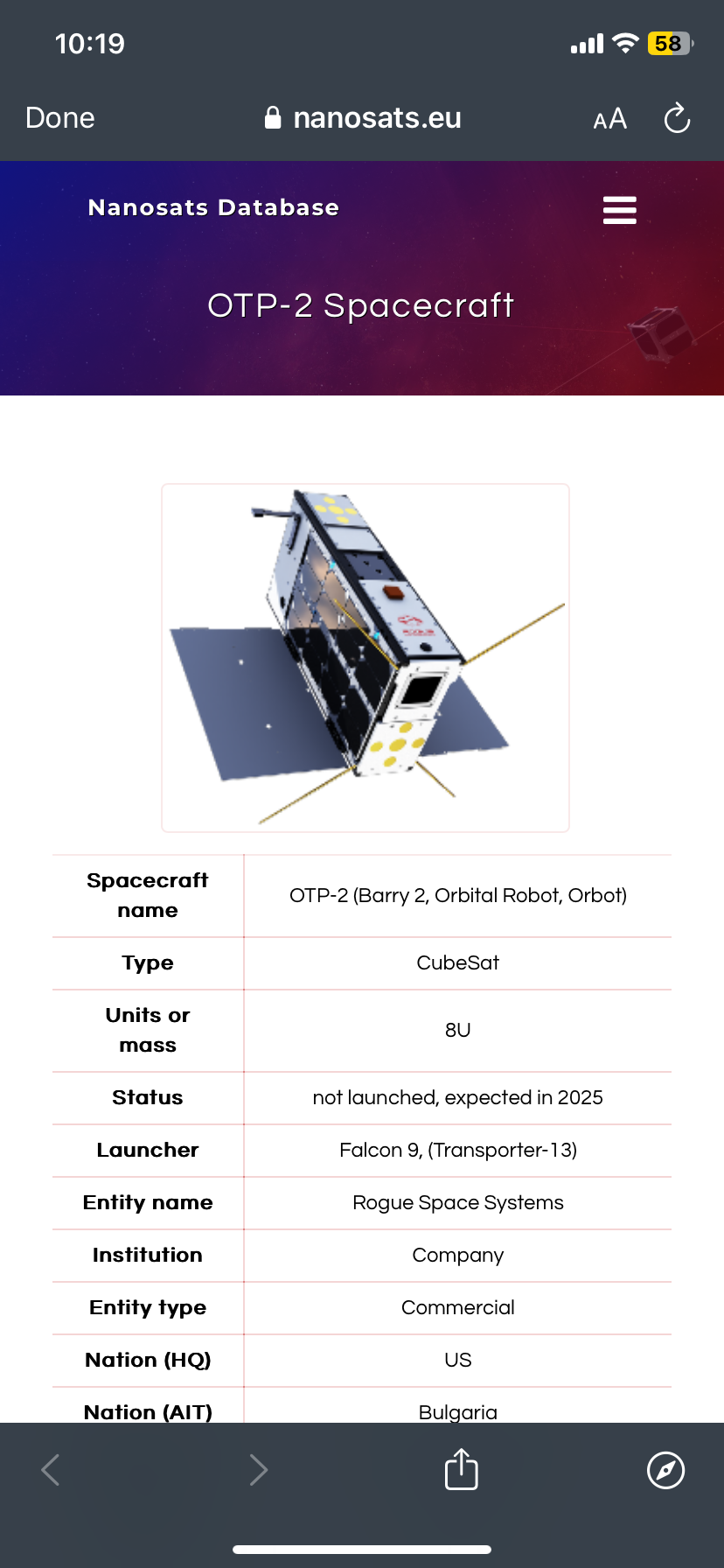

Otp 2 Propulsion Technology Insights From Two Experiments Detailed On Next Big Future Com

May 02, 2025

Otp 2 Propulsion Technology Insights From Two Experiments Detailed On Next Big Future Com

May 02, 2025 -

Wsl Man Utds Top Three Hopes Fade After Chelsea Defeat Player Ratings Revealed

May 02, 2025

Wsl Man Utds Top Three Hopes Fade After Chelsea Defeat Player Ratings Revealed

May 02, 2025 -

Quail Hollow Michael Block Secures Pga Championship Berth

May 02, 2025

Quail Hollow Michael Block Secures Pga Championship Berth

May 02, 2025