Apple Stock Plunges: Warren Buffett's 13% Share Reduction And Its Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Apple Stock Plunges: Warren Buffett's 13% Share Reduction and its Implications

Apple Inc. (AAPL) experienced a significant stock price drop following the revelation that Berkshire Hathaway, Warren Buffett's investment conglomerate, reduced its Apple holdings by 13%. This move sent shockwaves through the market, prompting investors to question the future trajectory of the tech giant. The news, announced [Insert Date of Announcement], immediately impacted trading, with Apple shares plummeting [Insert Percentage] in [Insert Timeframe]. This article delves into the reasons behind Buffett's decision, its implications for Apple, and what it means for investors.

Buffett's Strategic Shift: A Diversification Play?

Warren Buffett, often considered one of the most successful investors of all time, is known for his long-term investment strategy. His significant reduction in Apple stock, however, represents a departure from his previous unwavering support for the company. While Berkshire Hathaway still holds a substantial stake in Apple, the 13% decrease is noteworthy. Several theories attempt to explain this move:

-

Market Diversification: One prominent theory suggests that Buffett is diversifying Berkshire Hathaway's portfolio. With the current economic uncertainty and potential for a recession, spreading investments across different sectors might be a prudent strategy. This would mitigate risk associated with over-reliance on any single stock, no matter how strong.

-

Valuation Concerns: Another explanation points towards concerns about Apple's current valuation. While Apple remains a highly profitable company, its stock price has seen significant growth in recent years. Buffett might believe that the current valuation is inflated and that selling some shares presents a good opportunity to lock in profits.

-

Strategic Rebalancing: Buffett may be rebalancing his portfolio to capitalize on opportunities in other sectors showing promising growth. This strategic reallocation of capital could reflect a shift in his outlook on the tech sector as a whole or a focus on undervalued companies elsewhere.

Implications for Apple and Investors:

The implications of this move are multifaceted:

-

Investor Sentiment: The reduction in Berkshire Hathaway's stake has negatively impacted investor confidence. This is largely due to Buffett's reputation and the significant weight his investment decisions hold in the market. A major investor's move can trigger a domino effect, leading to further selling by other investors.

-

Apple's Future Performance: While Apple's fundamentals remain strong, the stock price plunge highlights the market's sensitivity to perceived shifts in investor confidence. The long-term performance of Apple stock will depend on various factors, including product innovation, competition, and the overall economic climate.

-

Opportunities for Bargain Hunters?: Some investors may see the stock price drop as a buying opportunity. For those with a long-term perspective, the reduced price could present an attractive entry point, especially if they believe in Apple's future growth prospects.

What's Next for Apple and Berkshire Hathaway?

The market is closely watching Apple's response to this significant shift. Any announcements regarding future product launches, strategic partnerships, or financial performance will greatly influence the stock price. Similarly, the market will scrutinize Berkshire Hathaway's future investment moves to gain insights into their investment strategy.

Conclusion:

Warren Buffett's decision to reduce Berkshire Hathaway's Apple stake is a significant event with far-reaching consequences. While the exact reasons behind the move remain speculative, it underscores the dynamic nature of the investment world and the importance of diversification. The stock market's reaction highlights the influence of major investors and their impact on investor sentiment. Whether this marks the beginning of a broader trend in tech sector investment remains to be seen, but it certainly warrants close observation. This situation serves as a stark reminder that even the most seemingly stable investments carry inherent risks, and diversification should always be a key part of any investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Apple Stock Plunges: Warren Buffett's 13% Share Reduction And Its Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sanjay Manjrekar On Rohit Sharma Test Retirement And Fitness Debate

May 11, 2025

Sanjay Manjrekar On Rohit Sharma Test Retirement And Fitness Debate

May 11, 2025 -

Minnesota 4 1 Victory Over Miami Key Moments And Player Performances May 11 2025

May 11, 2025

Minnesota 4 1 Victory Over Miami Key Moments And Player Performances May 11 2025

May 11, 2025 -

Washington Capitals Playoff Chip On Shoulder Carbery Speaks Out

May 11, 2025

Washington Capitals Playoff Chip On Shoulder Carbery Speaks Out

May 11, 2025 -

Beckham Family Fallout Analyzing The Final Smiling Portrait

May 11, 2025

Beckham Family Fallout Analyzing The Final Smiling Portrait

May 11, 2025 -

Bombers Game Day One Player Swap Shakes Up The Team

May 11, 2025

Bombers Game Day One Player Swap Shakes Up The Team

May 11, 2025

Latest Posts

-

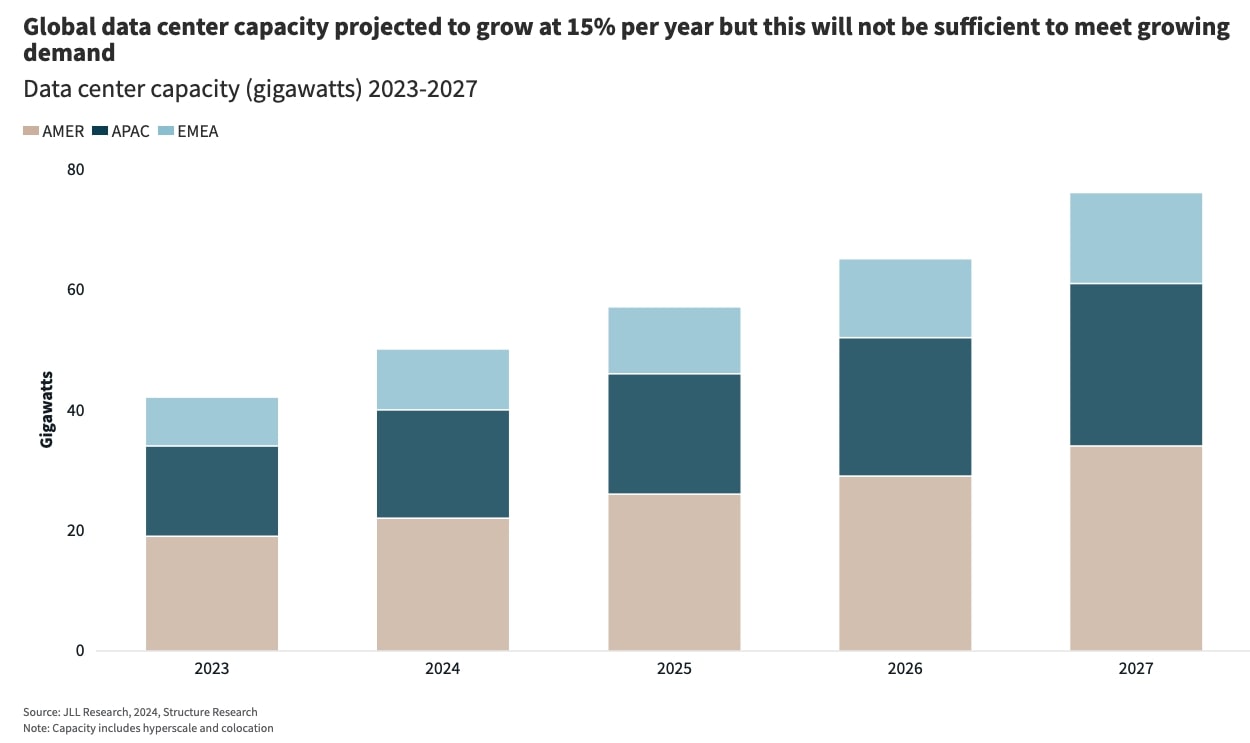

Ai Data Center Market Navigating The Shifting Landscape Of Cloud Computing

May 12, 2025

Ai Data Center Market Navigating The Shifting Landscape Of Cloud Computing

May 12, 2025 -

Expert Predicts Significant Gains For This Ai Semiconductor Stock After May 28

May 12, 2025

Expert Predicts Significant Gains For This Ai Semiconductor Stock After May 28

May 12, 2025 -

Ginny And Georgia Season 3 Official Release Date Announced By Netflix

May 12, 2025

Ginny And Georgia Season 3 Official Release Date Announced By Netflix

May 12, 2025 -

Post Draw Analysis Napolis Lead Shrinks In Serie A Battle

May 12, 2025

Post Draw Analysis Napolis Lead Shrinks In Serie A Battle

May 12, 2025 -

St Kilda Concert Turns Violent Womans Intoxication Leads To Brawl During Tina Arena Performance

May 12, 2025

St Kilda Concert Turns Violent Womans Intoxication Leads To Brawl During Tina Arena Performance

May 12, 2025