Apple Stock Reaction: Live Updates On Earnings Report, Service Revenue Shortfall

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

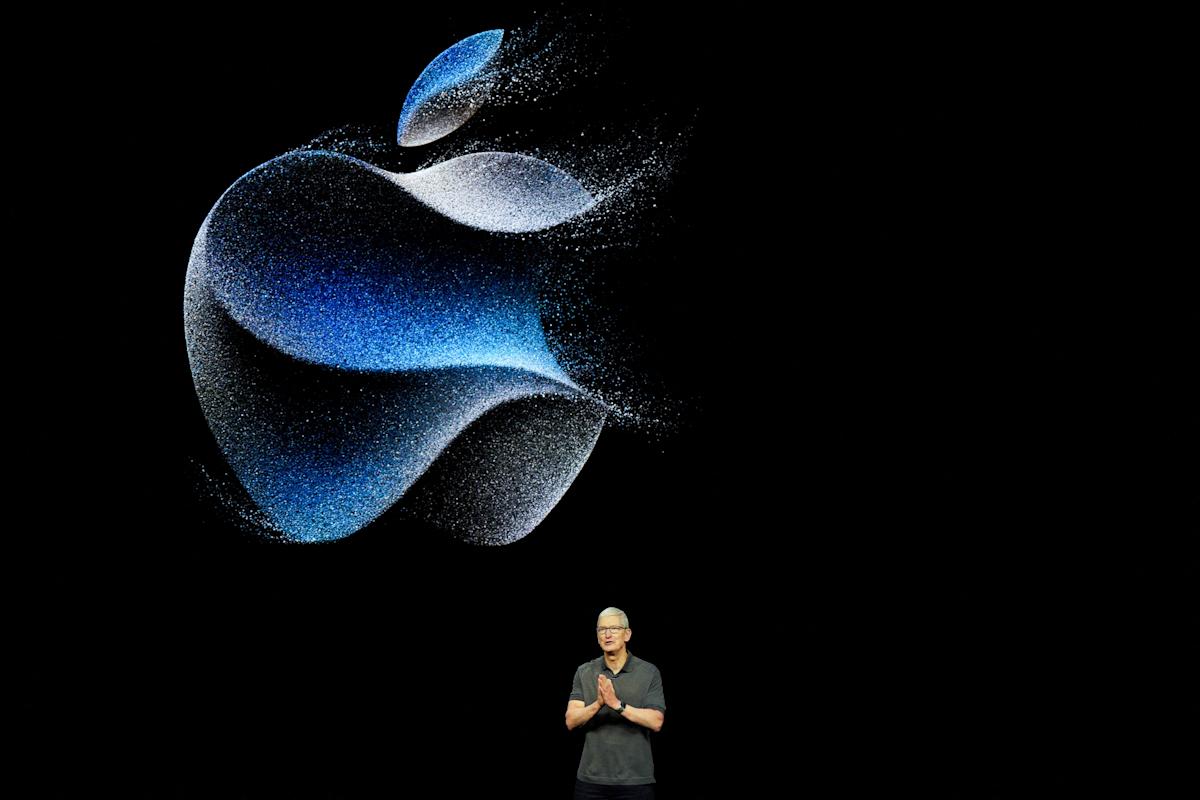

Apple Stock Reaction: Live Updates on Earnings Report, Service Revenue Shortfall

Apple's latest earnings report sent shockwaves through the tech world, triggering a mixed reaction from investors. While the company exceeded expectations in some areas, a shortfall in service revenue growth has left analysts scrambling to understand the implications. This article provides live updates and analysis of the Apple stock reaction, focusing on the unexpected dip in services performance.

Q4 2023 Earnings: A Mixed Bag

Apple reported its Q4 2023 earnings on [Insert Date of Report Release], revealing a complex picture of the company's financial health. While overall revenue beat analyst predictions, largely driven by strong iPhone sales, the performance of its services sector fell short of expectations. This unexpected shortfall overshadowed the positive aspects of the report, leading to immediate volatility in Apple's stock price.

Service Revenue Slowdown: The Key Concern

The most significant concern stemming from the report is the slower-than-anticipated growth in Apple's services revenue. This segment, which includes subscriptions like Apple Music, iCloud, and Apple TV+, has been a major driver of Apple's growth in recent years. The deceleration suggests potential headwinds, prompting questions about:

- Increased Competition: The growing competition in the streaming and cloud storage markets could be impacting Apple's ability to attract and retain subscribers.

- Economic Slowdown: A weakening global economy might be leading consumers to cut back on discretionary spending, impacting subscription services.

- Pricing Strategies: Concerns are mounting about the effectiveness of Apple's current pricing strategies for its services offerings.

Market Reaction: Immediate Volatility and Analyst Opinions

Following the release of the earnings report, Apple's stock price experienced a [Insert Percentage Change] [Increase/Decrease]. This initial reaction reflects the market's uncertainty surrounding the service revenue slowdown. Analysts are divided on the long-term implications. Some view the dip as a temporary setback, emphasizing the strength of the iPhone sales and the overall resilience of the Apple ecosystem. Others are more cautious, highlighting the importance of the services segment to Apple's future growth trajectory.

What to Watch For:

- Investor Confidence: The coming days will be crucial in gauging investor sentiment and whether the initial negative reaction persists.

- Apple's Response: Investors will be keen to see how Apple addresses the concerns raised about its service revenue growth, potentially through revised strategies or future product announcements.

- Long-Term Growth Projections: Analysts will be revising their long-term growth projections for Apple, considering the implications of the service revenue slowdown.

Conclusion: Uncertainty Remains

While Apple's Q4 2023 earnings showed a mixed performance, the shortfall in service revenue growth has cast a shadow over the company's otherwise positive results. The market's reaction has been volatile, and the coming days and weeks will be critical in determining the long-term impact of this development on Apple's stock price and overall market standing. This situation underscores the importance of diversifying revenue streams and the challenges faced by even the most dominant tech companies in a rapidly evolving market. Stay tuned for further updates as the situation unfolds.

Keywords: Apple Stock, Apple Earnings, Apple Service Revenue, Apple Q4 2023, Apple Stock Price, Apple Investor Reaction, Tech Stock, Market Analysis, Earnings Report, Stock Market, Apple Services, Apple Music, iCloud, Apple TV+

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Apple Stock Reaction: Live Updates On Earnings Report, Service Revenue Shortfall. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

End Of An Era Joe Michelettis Retirement From Rangers Commentary

May 02, 2025

End Of An Era Joe Michelettis Retirement From Rangers Commentary

May 02, 2025 -

I Phone Sales Fuel Apples Q2 Earnings Beat A Detailed Analysis

May 02, 2025

I Phone Sales Fuel Apples Q2 Earnings Beat A Detailed Analysis

May 02, 2025 -

Birmingham Premier League Darts Follow Littler Vs Bunting Live Scores And Results

May 02, 2025

Birmingham Premier League Darts Follow Littler Vs Bunting Live Scores And Results

May 02, 2025 -

Thunderbolts Void Exploring The Artistic Choices Behind The Villains Appearance

May 02, 2025

Thunderbolts Void Exploring The Artistic Choices Behind The Villains Appearance

May 02, 2025 -

Real Betis Predicted Lineup Three Key Changes For Fiorentina Clash

May 02, 2025

Real Betis Predicted Lineup Three Key Changes For Fiorentina Clash

May 02, 2025