Apple Stock: Warren Buffett's 13% Reduction And Its Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Apple Stock: Warren Buffett's 13% Reduction and its Implications

Warren Buffett's Berkshire Hathaway slashes its Apple stock holdings, sending ripples through the market. The Oracle of Omaha's recent move has left investors questioning the future trajectory of Apple's stock and the broader tech sector. This significant reduction, representing a 13% decrease in Berkshire's Apple stake, is a development that demands close scrutiny.

The news broke on [Insert Date Here], sending shockwaves through Wall Street. Berkshire Hathaway, a long-time major investor in Apple, reduced its holdings by [Insert Exact Number] shares, leaving them with approximately [Insert remaining number] shares. This represents a significant shift in Buffett's investment strategy, particularly considering Apple's historical position as a cornerstone of Berkshire's portfolio.

Why the Reduction? Unraveling the Mystery

While official statements from Berkshire Hathaway have been scarce, analysts have offered several potential explanations for this dramatic shift:

-

Profit-Taking: After years of significant gains, the decision could simply be a strategic move to secure substantial profits. Apple's stock price has seen remarkable growth in recent years, making a partial divestment a financially sound strategy.

-

Diversification: Buffett is renowned for his diversified portfolio approach. This reduction might signal a reallocation of capital into other promising sectors, reflecting a shift in market outlook or a search for higher returns elsewhere.

-

Market Concerns: While Apple remains a dominant player, concerns about slowing iPhone sales, increasing competition, and the broader economic climate might have influenced Buffett's decision. He's known for his cautious approach, adjusting his investments based on perceived risks.

-

Internal Portfolio Management: Berkshire Hathaway's investment strategies are complex. The reduction could be part of a larger internal portfolio rebalancing, unrelated to specific concerns about Apple's prospects.

Implications for Apple Stock and the Tech Sector

Buffett's move has undeniably impacted Apple's stock price, causing [Insert Percentage Change and Direction] fluctuations in the short term. However, the long-term implications remain uncertain. While the reduction is significant, Berkshire Hathaway still holds a substantial stake in Apple, underscoring their continued confidence in the company's long-term potential.

The tech sector, already facing headwinds, could experience further volatility in response to this development. Other tech giants might face increased scrutiny from investors, leading to potential adjustments in portfolio allocations across the board.

What to Expect Next

The market will be closely watching Apple's upcoming earnings reports and any further announcements from Berkshire Hathaway. Analyst opinions are divided, with some predicting a continued downward trend for Apple stock, while others maintain a bullish outlook.

Investors should exercise caution and consider their own risk tolerance before making any significant investment decisions based on this single development. Thorough research and diversification remain key to managing investment risk effectively. The situation warrants ongoing monitoring, and any new information should be carefully assessed before taking any action.

Keywords: Apple stock, Warren Buffett, Berkshire Hathaway, Apple stock price, investment strategy, tech sector, stock market, portfolio diversification, iPhone sales, economic climate, investment risk, stock market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Apple Stock: Warren Buffett's 13% Reduction And Its Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reframing Black History And Culture A Special Podcast Conversation

Apr 25, 2025

Reframing Black History And Culture A Special Podcast Conversation

Apr 25, 2025 -

Cicc Upgrades Pop Mart Price Target 29 Increase To 220

Apr 25, 2025

Cicc Upgrades Pop Mart Price Target 29 Increase To 220

Apr 25, 2025 -

Singapores Pm Warns Against Exploiting Sensitive Issues

Apr 25, 2025

Singapores Pm Warns Against Exploiting Sensitive Issues

Apr 25, 2025 -

Could Mace Windu Return In A Future Star Wars Project Director Comments Spark Debate

Apr 25, 2025

Could Mace Windu Return In A Future Star Wars Project Director Comments Spark Debate

Apr 25, 2025 -

Atalantas Retegui Newcastle United Transfer Interest Intensifies

Apr 25, 2025

Atalantas Retegui Newcastle United Transfer Interest Intensifies

Apr 25, 2025

Latest Posts

-

Ligue Des Champions Arsenal Vs Psg Composition Des Equipes Avec Doue Et Dembele

Apr 29, 2025

Ligue Des Champions Arsenal Vs Psg Composition Des Equipes Avec Doue Et Dembele

Apr 29, 2025 -

Brampton Centre Votes Key Takeaways From The 2025 Canadian Election

Apr 29, 2025

Brampton Centre Votes Key Takeaways From The 2025 Canadian Election

Apr 29, 2025 -

National Theatre Broadens Casting To Reach International Audiences

Apr 29, 2025

National Theatre Broadens Casting To Reach International Audiences

Apr 29, 2025 -

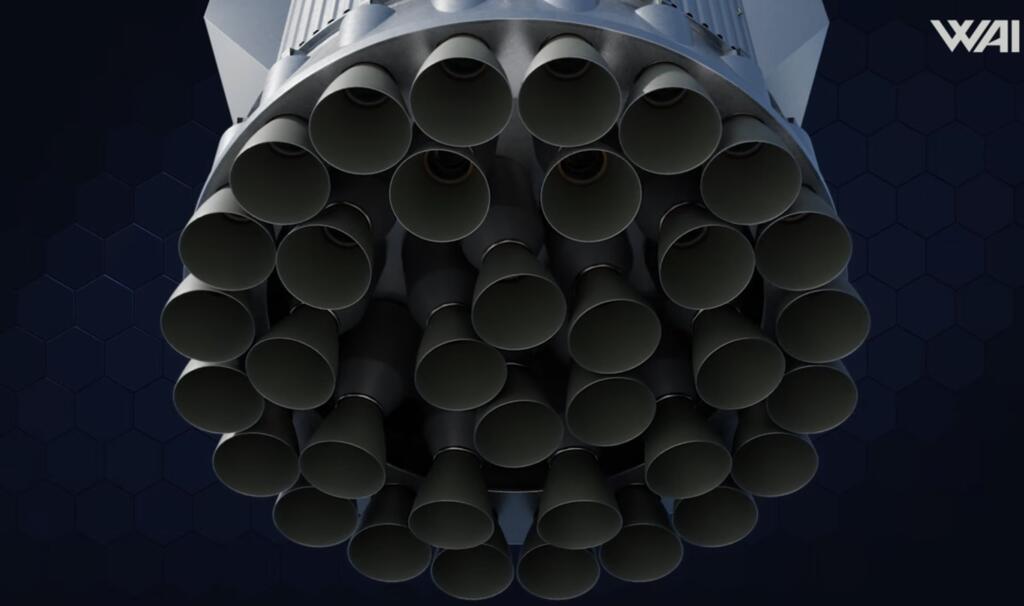

Enhanced Power Space X Starship Booster Equipped With 35 Raptor 3 Engines

Apr 29, 2025

Enhanced Power Space X Starship Booster Equipped With 35 Raptor 3 Engines

Apr 29, 2025 -

Pritam Singh On Ge 2025 Workers Party Rejects Negative Campaigning Tactics

Apr 29, 2025

Pritam Singh On Ge 2025 Workers Party Rejects Negative Campaigning Tactics

Apr 29, 2025