Applying Warren Buffett's Principles To Cryptocurrency Investing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Applying Warren Buffett's Principles to Cryptocurrency Investing: A Contrarian Approach

The Oracle of Omaha, Warren Buffett, famously remains skeptical of cryptocurrencies. Yet, his core investing principles, while seemingly at odds with the volatile world of digital assets, can surprisingly offer valuable insights for navigating this turbulent market. This article explores how a contrarian application of Buffett's wisdom can help investors approach cryptocurrency with a more informed and potentially profitable strategy.

Understanding Buffett's Core Tenets:

Before applying them to crypto, let's briefly review Buffett's key investment philosophies:

- Value Investing: Identifying undervalued assets with intrinsic value that the market has overlooked.

- Long-Term Perspective: Holding investments for the long haul, weathering short-term market fluctuations.

- Understanding the Business: Thoroughly researching and understanding the underlying business model before investing.

- Risk Management: Diversification and careful risk assessment are paramount.

- Margin of Safety: Buying assets at a price significantly below their estimated intrinsic value.

The Contrarian Application to Crypto:

While Buffett's skepticism stems largely from the speculative nature and lack of inherent value he sees in cryptocurrencies, adapting his principles offers a unique approach:

1. Identifying Undervalued Projects: The cryptocurrency market is rife with speculative bubbles and pump-and-dump schemes. However, opportunities exist to identify projects with strong fundamentals, talented teams, and real-world utility. Focus on projects with established track records, strong community support, and clear use cases. This is where thorough due diligence, mirroring Buffett's research-heavy approach, becomes crucial. Look beyond the hype and dig deep into the whitepaper, team background, and technology.

2. Long-Term Holding Strategy (with a Twist): Buffett's buy-and-hold strategy can apply to crypto, but with a crucial modification. Instead of holding indefinitely, consider a strategic long-term holding approach with planned partial divestment at predetermined price targets. This helps mitigate risk and capitalize on potential gains.

3. Understanding the Underlying Technology: While Buffett might not grasp the intricacies of blockchain technology, understanding the underlying technology of a cryptocurrency project is paramount. Research the consensus mechanism, scalability solutions, and security features. This knowledge allows you to evaluate the long-term viability of the project.

4. Diversification and Risk Management: Never put all your eggs in one basket. Diversify your cryptocurrency portfolio across different projects and asset classes, balancing risk and potential rewards. This aligns perfectly with Buffett's risk-averse approach.

5. Defining Your "Margin of Safety": This is the most challenging aspect. Unlike traditional assets, defining the intrinsic value of a cryptocurrency is difficult. Instead, focus on identifying projects with strong potential for growth and buying at a price that accounts for potential downside risk. Consider factors such as market capitalization, adoption rate, and development progress.

Conclusion:

Applying Warren Buffett's principles to cryptocurrency investing requires a contrarian approach. It's about leveraging his wisdom on value, long-term perspective, and risk management, while acknowledging the unique characteristics of the crypto market. By focusing on fundamental analysis, diversification, and a strategic approach, investors can navigate the volatility and potentially reap the rewards, even if the Oracle of Omaha remains unconvinced. Remember, however, that cryptocurrency investment carries significant risk and should only be undertaken with capital you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Applying Warren Buffett's Principles To Cryptocurrency Investing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Garlick Returns To South Sydney Fueling The Nrls Aggressive Rebuild

May 23, 2025

Garlick Returns To South Sydney Fueling The Nrls Aggressive Rebuild

May 23, 2025 -

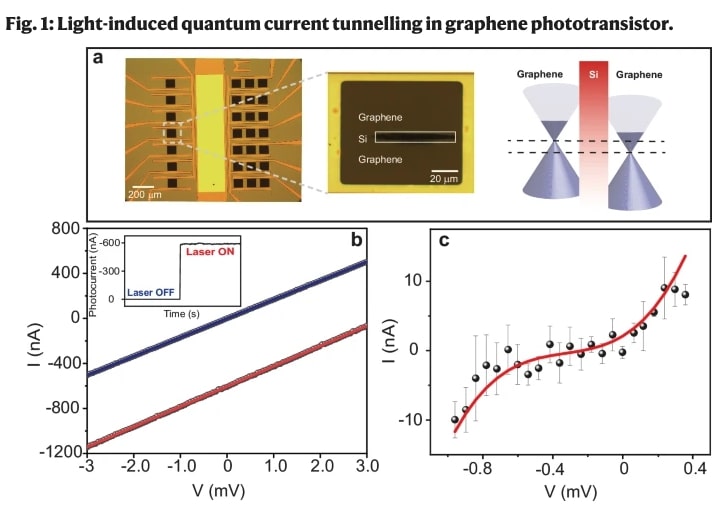

Worlds First Room Temperature Petahertz Phototransistor Created

May 23, 2025

Worlds First Room Temperature Petahertz Phototransistor Created

May 23, 2025 -

Laos Economic Crisis Debt Relief Needed To Avoid A Lost Decade

May 23, 2025

Laos Economic Crisis Debt Relief Needed To Avoid A Lost Decade

May 23, 2025 -

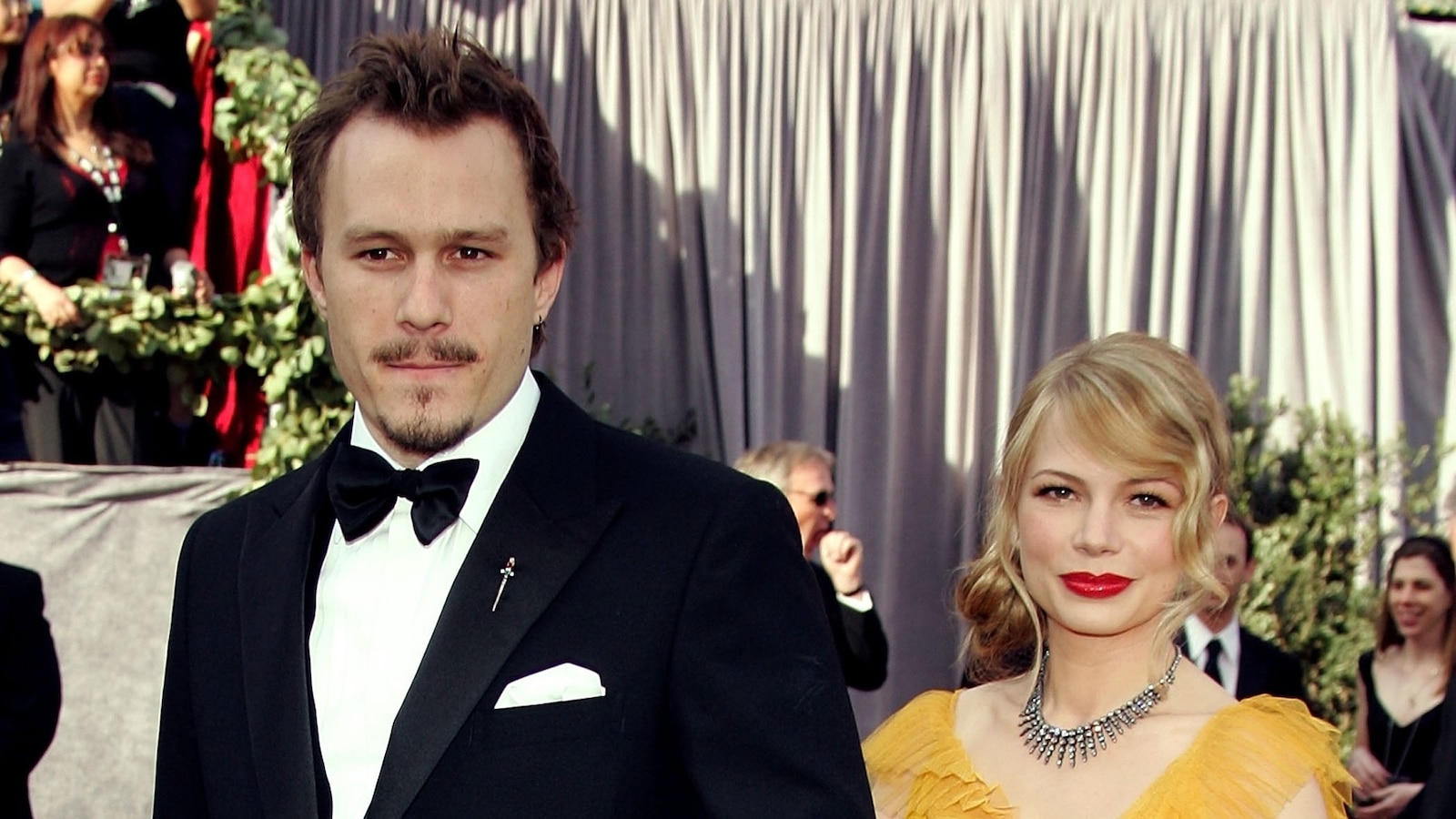

Michelle Williams Heartbreaking Tribute To Heath Ledger And Their Daughter

May 23, 2025

Michelle Williams Heartbreaking Tribute To Heath Ledger And Their Daughter

May 23, 2025 -

Say Goodbye To Lost Prescriptions Nhs Implements New Tracking System

May 23, 2025

Say Goodbye To Lost Prescriptions Nhs Implements New Tracking System

May 23, 2025

Latest Posts

-

Gillian Anderson A Transatlantic Life Her Connections To The Us And Uk

May 24, 2025

Gillian Anderson A Transatlantic Life Her Connections To The Us And Uk

May 24, 2025 -

Viral Linked In Post Featuring Piyush Gupta Deemed False Dbs Bank Confirms

May 24, 2025

Viral Linked In Post Featuring Piyush Gupta Deemed False Dbs Bank Confirms

May 24, 2025 -

Draisaitl Calls Out Oilers Struggling Penalty Kill A Necessary Confrontation

May 24, 2025

Draisaitl Calls Out Oilers Struggling Penalty Kill A Necessary Confrontation

May 24, 2025 -

Oilers Stars Game 2 Key Matchup Preview And Betting Odds

May 24, 2025

Oilers Stars Game 2 Key Matchup Preview And Betting Odds

May 24, 2025 -

Starlinks Australian Expansion Hit By Regulatory Warning From Accc

May 24, 2025

Starlinks Australian Expansion Hit By Regulatory Warning From Accc

May 24, 2025