Applying Warren Buffett's Principles To Cryptocurrency Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Applying Warren Buffett's Principles to Cryptocurrency Markets: A Contrarian Approach

The Oracle of Omaha, Warren Buffett, is famously skeptical of cryptocurrencies. His aversion, however, doesn't negate the possibility of applying his core investment principles to navigate the volatile crypto landscape. While Buffett himself might not be buying Bitcoin, savvy investors can adapt his strategies for potentially lucrative – albeit risky – opportunities. This article explores how to apply Buffett's wisdom to the cryptocurrency market, highlighting both the challenges and potential rewards.

Understanding Buffett's Core Principles:

Before applying these principles to crypto, let's understand the fundamentals of Buffett's investment philosophy:

- Value Investing: Buffett focuses on identifying undervalued assets with strong fundamentals and long-term growth potential. He seeks companies with durable competitive advantages (moats) and consistent earnings.

- Long-Term Perspective: Buffett is a long-term investor, famously holding stocks for decades. He's unfazed by short-term market fluctuations.

- Risk Management: He emphasizes understanding the risks before investing and avoids speculation. Diversification is key to his strategy.

- Understanding the Business: Buffett insists on thoroughly understanding the business model of any company before investing. He famously says, "Never invest in a business you cannot understand."

Applying Buffett's Principles to Cryptocurrencies:

Applying these principles to the crypto market presents unique challenges. The inherent volatility, lack of regulation in many jurisdictions, and speculative nature of many crypto projects make direct application difficult. However, a contrarian approach can yield results:

- Identify Undervalued Projects: This requires rigorous due diligence. Focus on projects with strong underlying technology, active development teams, and a clear use case. Analyze the tokenomics carefully and look for projects with a potentially sustainable long-term value proposition. Avoid get-rich-quick schemes and meme coins.

- Long-Term Holding: The volatile nature of crypto necessitates a strong stomach. Only invest what you can afford to lose and hold for the long term, weathering market corrections.

- Risk Management and Diversification: Diversify your crypto portfolio across different projects, just as Buffett diversifies his stock portfolio. Avoid overexposure to any single cryptocurrency. Consider hedging strategies to mitigate risk.

- Understanding the Technology: Unlike traditional businesses, understanding the underlying blockchain technology is crucial. Familiarize yourself with concepts like consensus mechanisms, smart contracts, and decentralization.

Challenges and Considerations:

- Volatility: Crypto markets are notoriously volatile. Be prepared for significant price swings and potential losses.

- Regulation: The regulatory landscape for cryptocurrencies is constantly evolving. Stay informed about changes in regulations that could impact your investments.

- Security: Cryptocurrency investments are vulnerable to hacking and scams. Use secure wallets and exchanges and be wary of phishing attempts.

- Lack of Transparency: Some crypto projects lack transparency in their operations and financials. Thorough due diligence is essential.

Conclusion:

Applying Warren Buffett's investment principles to the cryptocurrency market is a contrarian approach that requires significant research, patience, and risk tolerance. While it's unlikely Buffett himself will ever embrace Bitcoin, his core tenets of value investing, long-term perspective, risk management, and understanding the underlying business (or in this case, technology) can provide a framework for navigating this complex and potentially rewarding asset class. Remember, however, that crypto investing involves significant risk, and losses are possible. Always conduct thorough research and only invest what you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Applying Warren Buffett's Principles To Cryptocurrency Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Semiconductor Export Rules Change White House Alters Bidens China Policy

May 16, 2025

Semiconductor Export Rules Change White House Alters Bidens China Policy

May 16, 2025 -

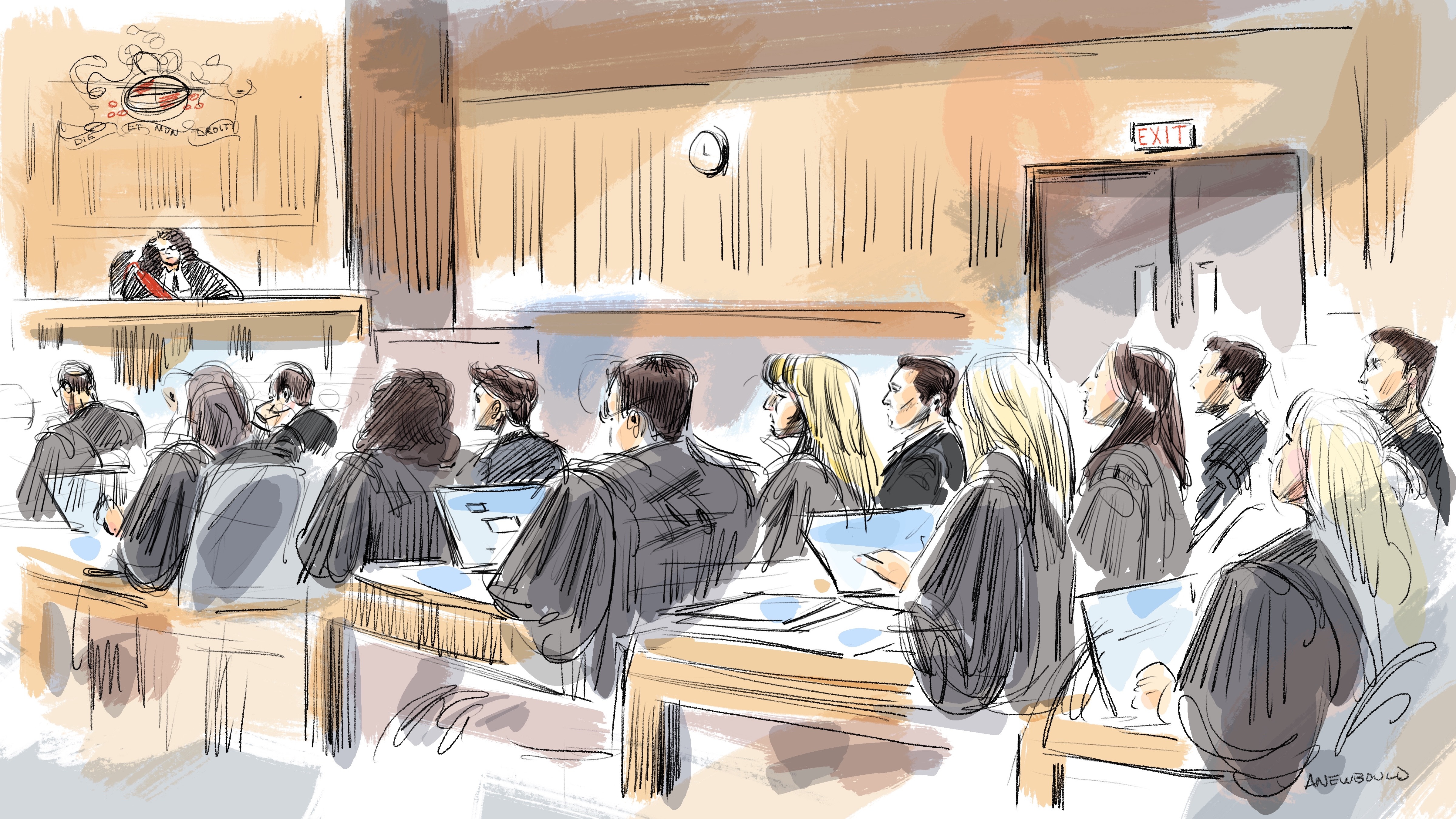

Westhead On London Hockey Trial Judges Decision To Discharge Jury Explained

May 16, 2025

Westhead On London Hockey Trial Judges Decision To Discharge Jury Explained

May 16, 2025 -

Official The Diplomat Returns For A Fourth Season On Netflix

May 16, 2025

Official The Diplomat Returns For A Fourth Season On Netflix

May 16, 2025 -

Improve Focus And Productivity A Step By Step Guide To Using I Phone Screen Time

May 16, 2025

Improve Focus And Productivity A Step By Step Guide To Using I Phone Screen Time

May 16, 2025 -

Collingwood Fans Rejoice Complete 2025 Afl Fixture Announced

May 16, 2025

Collingwood Fans Rejoice Complete 2025 Afl Fixture Announced

May 16, 2025