April's Bitcoin And Ethereum ETF Outflows Exceed March's

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

April's Bitcoin and Ethereum ETF Outflows Exceed March's: A Sign of Market Uncertainty?

Bitcoin and Ethereum exchange-traded funds (ETFs) saw significantly higher outflows in April than in March, sparking concerns about investor sentiment within the cryptocurrency market. This trend, following a period of relative stability, suggests a potential shift in investor confidence and warrants closer examination. While the crypto market has shown resilience in the face of regulatory uncertainty and macroeconomic headwinds, these outflow figures raise questions about the near-term future.

April's Exodus: A Deeper Dive into ETF Outflows

Data from multiple sources reveals a substantial increase in outflows from both Bitcoin and Ethereum ETFs in April. While precise figures vary slightly depending on the data provider, the consensus points to a considerably larger amount withdrawn compared to March. This surge in outflows represents a notable shift in investor behavior, moving away from the relative calm observed the previous month. Several factors could be contributing to this trend, including:

-

Regulatory Uncertainty: Ongoing regulatory scrutiny of cryptocurrencies, particularly in the United States, continues to create uncertainty for investors. The lack of clear regulatory frameworks can discourage investment and prompt investors to secure profits.

-

Macroeconomic Factors: Global economic instability, including persistent inflation and rising interest rates, continues to impact investor risk appetite. Cryptocurrencies, often viewed as a riskier asset class, may be among the first to see divestment during periods of economic uncertainty.

-

Market Volatility: The inherent volatility of the cryptocurrency market remains a significant factor. Even minor price fluctuations can trigger profit-taking and trigger significant outflows from ETFs.

Comparing March and April: A Tale of Two Months

March saw a relatively modest level of outflows from Bitcoin and Ethereum ETFs. This was interpreted by some analysts as a sign of stabilization after a period of significant price volatility. However, April's dramatic increase in outflows suggests that this period of stability was short-lived and that investor confidence remains fragile. The stark contrast between the two months highlights the dynamic and unpredictable nature of the cryptocurrency market.

What Does This Mean for the Future of Bitcoin and Ethereum ETFs?

The increased outflows in April raise crucial questions about the long-term viability and attractiveness of Bitcoin and Ethereum ETFs. While these ETFs provide a relatively convenient way for investors to gain exposure to cryptocurrencies, the recent trend suggests that some investors are hesitant to maintain their positions in the current climate.

Future predictions remain difficult. The cryptocurrency market is highly sensitive to both regulatory developments and macroeconomic conditions. Any significant shift in either of these areas could have a profound impact on investor sentiment and subsequently, ETF outflows.

Investors should carefully consider their risk tolerance before investing in cryptocurrency ETFs. The inherent volatility of the market means that significant losses are possible, and it's crucial to have a well-defined investment strategy.

Staying Informed: The Importance of Market Monitoring

Staying informed about the latest market trends and regulatory developments is crucial for navigating the complexities of the cryptocurrency market. Regularly monitoring news sources, analyst reports, and regulatory announcements will help investors make informed decisions and mitigate potential risks. The current outflow trend underscores the importance of diligent market monitoring and a cautious approach to investing in cryptocurrencies. The future trajectory of Bitcoin and Ethereum ETF performance remains uncertain, dependent on a confluence of factors beyond simple price action.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on April's Bitcoin And Ethereum ETF Outflows Exceed March's. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Enges Rennen Erwartet Rahm Kaempft Um Seinen Wahlkreis

Apr 13, 2025

Enges Rennen Erwartet Rahm Kaempft Um Seinen Wahlkreis

Apr 13, 2025 -

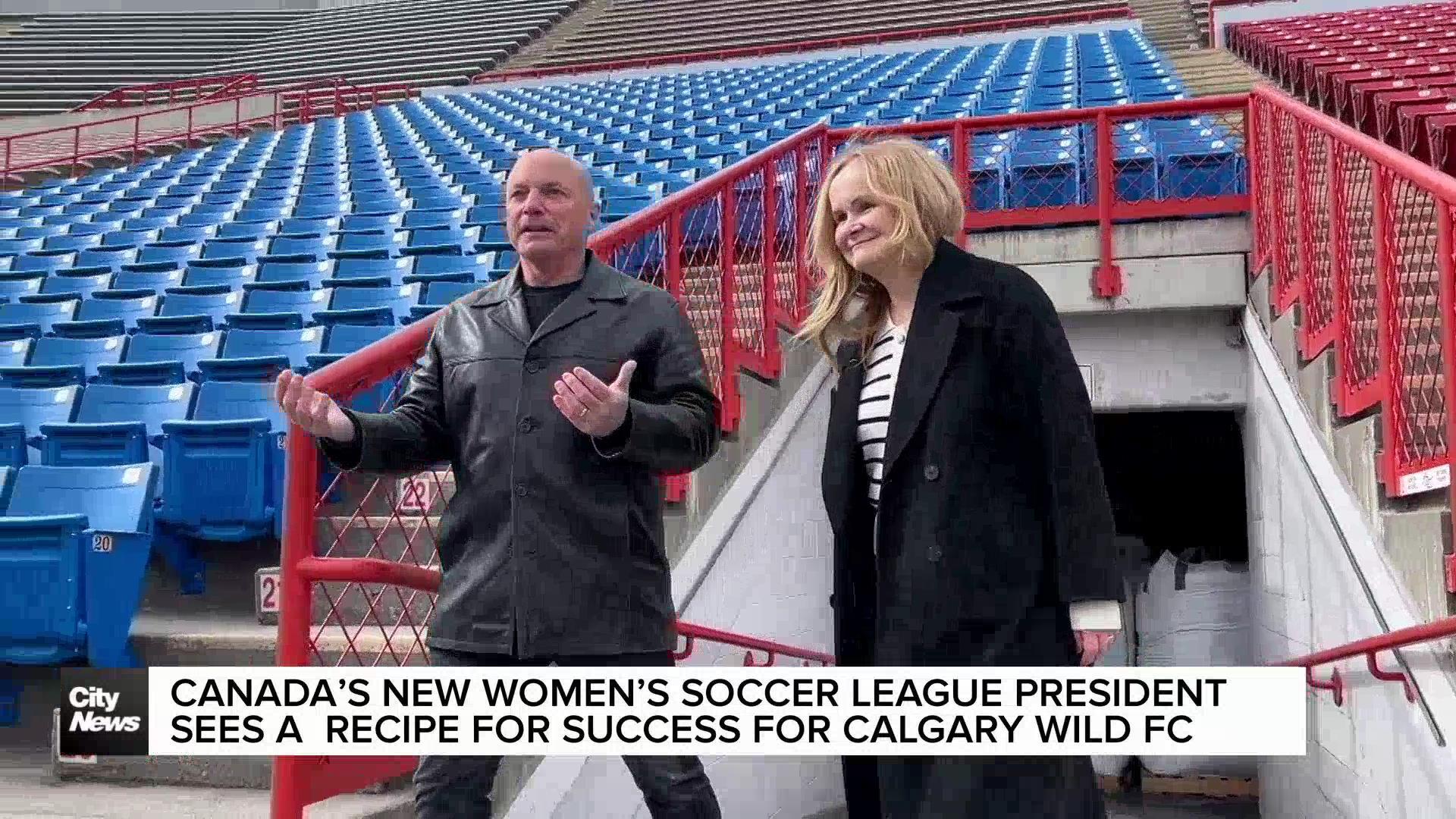

Calgary Wilds Future A Northern Super League Presidents Perspective

Apr 13, 2025

Calgary Wilds Future A Northern Super League Presidents Perspective

Apr 13, 2025 -

Technical Analysis Xrps Failed Breakout Signals Further Price Drop

Apr 13, 2025

Technical Analysis Xrps Failed Breakout Signals Further Price Drop

Apr 13, 2025 -

Sweets Scor Sidesteps Play To Earn Risks With Focus On Nhl Mls Partnerships

Apr 13, 2025

Sweets Scor Sidesteps Play To Earn Risks With Focus On Nhl Mls Partnerships

Apr 13, 2025 -

Shared Discontent What Everyones Saying About The Masters

Apr 13, 2025

Shared Discontent What Everyones Saying About The Masters

Apr 13, 2025