Arbitrum (ARB) In Freefall: Bearish Market Sends Price Down 10%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Arbitrum (ARB) in Freefall: Bearish Market Sends Price Down 10%

The cryptocurrency market's recent downturn has dealt a significant blow to Arbitrum (ARB), the popular layer-2 scaling solution for Ethereum. In a dramatic price plunge, ARB plummeted over 10% in the last 24 hours, leaving investors reeling and sparking concerns about the future of the project. This sharp decline underscores the volatility inherent in the crypto space and highlights the impact of broader market trends on even established altcoins.

What Triggered Arbitrum's Price Drop?

Several factors contributed to Arbitrum's steep fall. The most significant is the overall bearish sentiment gripping the cryptocurrency market. Bitcoin, the dominant cryptocurrency, has seen considerable price pressure, dragging down altcoins like ARB in its wake. This broader market downturn is fueled by a combination of macroeconomic factors, including persistent inflation and rising interest rates, which are discouraging risk-on investments.

Beyond the general market malaise, specific concerns surrounding Arbitrum's tokenomics and future development might have also played a role. While Arbitrum boasts impressive technology and adoption rates, the market's reaction to recent announcements or lack thereof could have contributed to selling pressure. A lack of significant bullish news or updates can often lead to profit-taking and a subsequent price correction.

Technical Analysis: A Look at the Charts

Technical analysis of ARB charts reveals a classic bearish pattern. The price has broken below key support levels, indicating a potential continuation of the downtrend. Traders are closely watching key indicators like Relative Strength Index (RSI) and Moving Averages (MA) for signs of potential reversal or further decline. The current situation suggests a strong bearish momentum, but experienced traders are always looking for signs of a bottoming out.

Should Investors Be Worried?

The significant price drop is undoubtedly concerning for ARB investors. However, it's crucial to remember that cryptocurrency markets are notoriously volatile. Short-term price fluctuations are common, and a 10% drop, while substantial, doesn't necessarily signal the end of Arbitrum's potential.

- Long-term perspective: Many analysts maintain a long-term bullish outlook for Arbitrum, citing its strong technology and growing adoption within the decentralized finance (DeFi) ecosystem. The current dip could be viewed as a buying opportunity for long-term investors with a high risk tolerance.

- Fundamental analysis: It’s crucial to assess the fundamental strength of the project. Arbitrum's technological advantages and partnerships remain significant factors that could drive future growth.

- Diversification: As always, diversification is key in the crypto market. Don't put all your eggs in one basket.

The Road Ahead for Arbitrum

The coming weeks will be crucial in determining the trajectory of Arbitrum's price. Market sentiment, regulatory developments, and any significant announcements from the Arbitrum team will all play a role. Investors should closely monitor these factors and make informed decisions based on their risk tolerance and investment goals. The current situation highlights the importance of thorough due diligence and risk management in the volatile world of cryptocurrencies. While the 10% drop is a setback, the long-term prospects for Arbitrum, based on its technological merits, remain a subject of ongoing discussion and speculation among market analysts.

Keywords: Arbitrum, ARB, cryptocurrency, price drop, bearish market, altcoins, Ethereum, layer-2 scaling, DeFi, tokenomics, volatility, investment, crypto trading, technical analysis, market sentiment, blockchain, crypto news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Arbitrum (ARB) In Freefall: Bearish Market Sends Price Down 10%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Genius Act And Stablecoins Navigating The New Regulatory Frontier In The Us

May 07, 2025

The Genius Act And Stablecoins Navigating The New Regulatory Frontier In The Us

May 07, 2025 -

Kyle Harrisons Mlb Debut Imminent Giants Dfa Lou Trivino

May 07, 2025

Kyle Harrisons Mlb Debut Imminent Giants Dfa Lou Trivino

May 07, 2025 -

Space X Starship Program Setback Details On The Static Fire Incident

May 07, 2025

Space X Starship Program Setback Details On The Static Fire Incident

May 07, 2025 -

Nrl Rumours David Fifitas Potential Exit From The Gold Coast Titans

May 07, 2025

Nrl Rumours David Fifitas Potential Exit From The Gold Coast Titans

May 07, 2025 -

Sharpe And Ochocincos Bold Prediction Edwards Eliminates Curry

May 07, 2025

Sharpe And Ochocincos Bold Prediction Edwards Eliminates Curry

May 07, 2025

Latest Posts

-

Cadillac Celestiq First Drive Is The 360 000 Price Tag Justified

May 08, 2025

Cadillac Celestiq First Drive Is The 360 000 Price Tag Justified

May 08, 2025 -

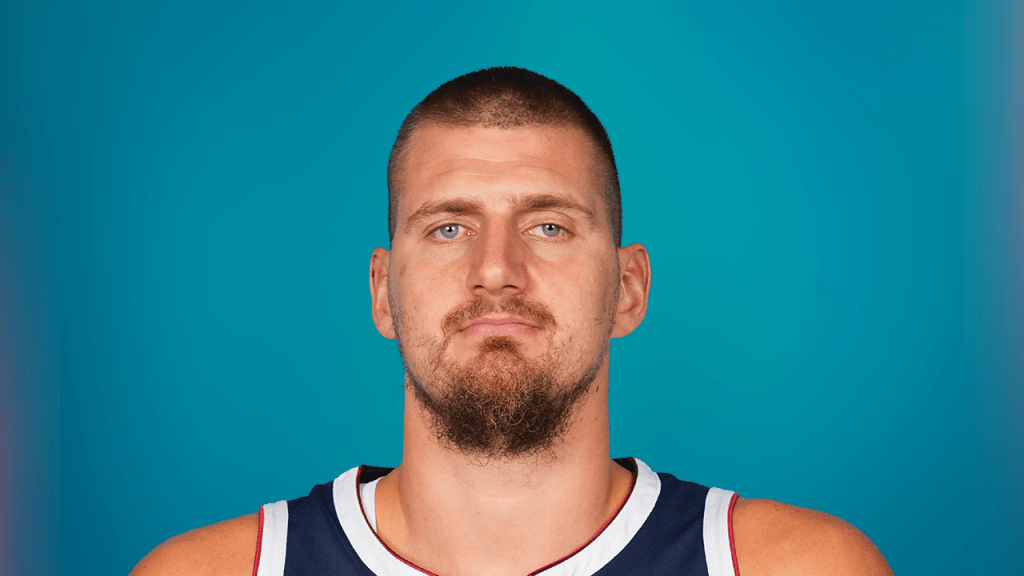

Free Throw Merchant Jokics Amusing Response To Criticisms From Fans

May 08, 2025

Free Throw Merchant Jokics Amusing Response To Criticisms From Fans

May 08, 2025 -

Modular Mini Pc Falls Short Assessing Value And Competitiveness

May 08, 2025

Modular Mini Pc Falls Short Assessing Value And Competitiveness

May 08, 2025 -

Chuwi Minibook X 10 5 Inch Convertible Laptop Under 1kg With 512 Gb Ssd

May 08, 2025

Chuwi Minibook X 10 5 Inch Convertible Laptop Under 1kg With 512 Gb Ssd

May 08, 2025 -

Dont Tax Bluey The Fight Against Us Film Tariffs Heats Up

May 08, 2025

Dont Tax Bluey The Fight Against Us Film Tariffs Heats Up

May 08, 2025