Arbitrum (ARB) Price Analysis: 10% Decline Signals Potential All-Time Low

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Arbitrum (ARB) Price Analysis: 10% Decline Signals Potential All-Time Low

The Arbitrum (ARB) price has plummeted by over 10% in the last 24 hours, sending shockwaves through the crypto community and raising concerns about a potential all-time low. This significant drop follows a period of relative stability, leaving many investors wondering what the future holds for this prominent layer-2 scaling solution on Ethereum. This price analysis delves into the reasons behind this sharp decline and explores potential scenarios for ARB's future price trajectory.

The Sudden Dip: Understanding the ARB Price Crash

The cryptocurrency market is notoriously volatile, but Arbitrum's recent 10% drop is noteworthy. While pinpointing a single cause is difficult, several factors likely contributed to this downturn:

-

Broader Market Sentiment: The overall crypto market has experienced a period of consolidation and uncertainty recently. Negative sentiment surrounding regulatory concerns and macroeconomic factors often impacts even strong altcoins like ARB. The correlation between Bitcoin's price and altcoin performance is undeniable, and a Bitcoin downturn frequently drags down the rest of the market.

-

Profit-Taking: After a period of relative price stability, many investors may have decided to take profits, leading to a sell-off that amplified the negative momentum. This is a common phenomenon in the crypto world, where short-term gains are often quickly realized.

-

Lack of Catalysts: Without significant positive news or developments, ARB may have become susceptible to downward pressure. The absence of major updates or partnerships can lead to a decrease in investor confidence and subsequent selling.

-

Technical Analysis Signals: Many technical indicators may have suggested a potential price drop, leading to a self-fulfilling prophecy. Bearish signals, such as falling volume and broken support levels, can trigger further selling.

Potential for an All-Time Low?

The significant drop raises the question: could ARB hit a new all-time low? While predicting the future of cryptocurrency prices is inherently speculative, the current situation warrants caution. Several factors point to the possibility:

-

Continued Market Weakness: If the broader crypto market continues its downward trend, ARB is likely to follow suit. A prolonged bear market could push ARB to explore lower price ranges.

-

Increased Selling Pressure: Further negative news or a lack of positive developments could intensify selling pressure, driving the price lower.

-

Technical Breakdowns: If key support levels are breached, it could trigger further cascading selling, potentially leading to a new all-time low.

What Should Investors Do?

The current situation demands a cautious approach. Investors should:

-

Assess Risk Tolerance: Before making any investment decisions, carefully assess your risk tolerance. The cryptocurrency market is extremely volatile, and losses are possible.

-

Diversify Portfolio: Diversifying your investments across various assets is crucial to mitigate risk. Don't put all your eggs in one basket.

-

Conduct Thorough Research: Before investing in any cryptocurrency, conduct thorough research and understand the underlying technology and potential risks.

-

Consider Long-Term Strategy: If you believe in Arbitrum's long-term potential, a long-term strategy may be appropriate. However, be prepared for volatility along the way.

Conclusion:

The 10% decline in Arbitrum's price is a significant event that demands attention. While an all-time low is a possibility, it's not a certainty. Investors should proceed with caution, conduct thorough research, and make informed decisions based on their own risk tolerance and investment goals. The crypto market remains volatile, and staying informed is crucial for navigating its complexities. This situation underscores the importance of staying updated on market trends and fundamental analysis before making any investment decisions in the dynamic world of Arbitrum (ARB) and other cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Arbitrum (ARB) Price Analysis: 10% Decline Signals Potential All-Time Low. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Understanding The India Pakistan Conflict Key Facts About The Recent Strike

May 07, 2025

Understanding The India Pakistan Conflict Key Facts About The Recent Strike

May 07, 2025 -

David Beckham On Lamine Yamal A Barcelona Star In The Making

May 07, 2025

David Beckham On Lamine Yamal A Barcelona Star In The Making

May 07, 2025 -

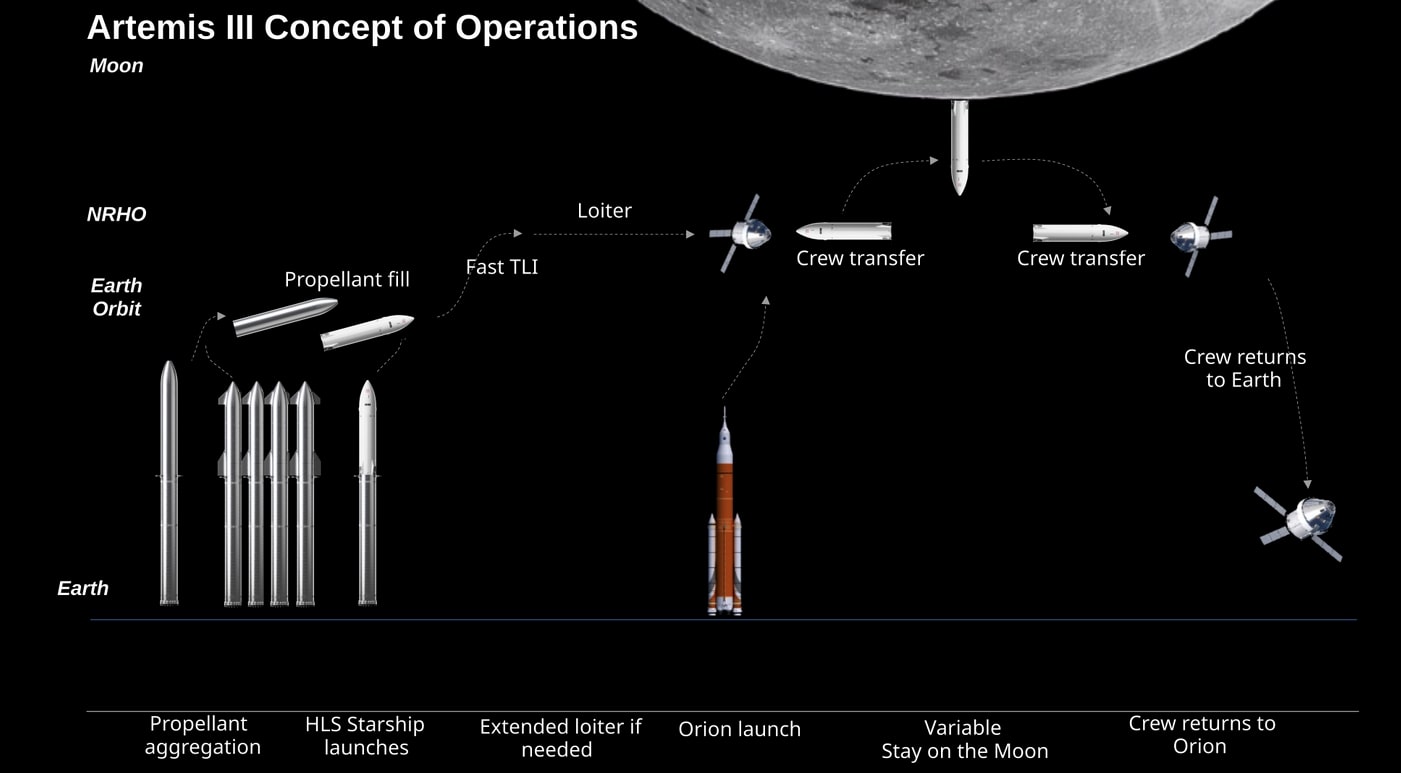

Are Federal Budget Overruns Out Of Control The Case Of Nasa

May 07, 2025

Are Federal Budget Overruns Out Of Control The Case Of Nasa

May 07, 2025 -

Hamstring Injury Ends Currys Game 1 Impact On Warriors Playoff Run

May 07, 2025

Hamstring Injury Ends Currys Game 1 Impact On Warriors Playoff Run

May 07, 2025 -

David Fifita Seeks New Nrl Home Titans Star In Talks With Rival Teams

May 07, 2025

David Fifita Seeks New Nrl Home Titans Star In Talks With Rival Teams

May 07, 2025

Latest Posts

-

Dodgers Shohei Ohtani Agent Confirms Massive Endorsement Earnings

May 10, 2025

Dodgers Shohei Ohtani Agent Confirms Massive Endorsement Earnings

May 10, 2025 -

Blame Game Heats Up India And Pakistans Military Confrontation

May 10, 2025

Blame Game Heats Up India And Pakistans Military Confrontation

May 10, 2025 -

Celtics Stars Anger Erupts Teams Second 20 Point Lead Collapse This Season

May 10, 2025

Celtics Stars Anger Erupts Teams Second 20 Point Lead Collapse This Season

May 10, 2025 -

Thunders Game 1 Dominance More Proof Of Bulls Caruso Trade Loss

May 10, 2025

Thunders Game 1 Dominance More Proof Of Bulls Caruso Trade Loss

May 10, 2025 -

Will Tax Hikes On The Rich Pay For Trumps Proposed Spending Cuts

May 10, 2025

Will Tax Hikes On The Rich Pay For Trumps Proposed Spending Cuts

May 10, 2025