Arbitrum (ARB) Technical Analysis: Downtrend Broken, 44% Upside Potential?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Arbitrum (ARB) Technical Analysis: Downtrend Broken, 44% Upside Potential?

The cryptocurrency market is notoriously volatile, but some coins show signs of potential turning points. Arbitrum (ARB), the Layer-2 scaling solution for Ethereum, has recently exhibited a significant price shift, prompting many analysts to question whether the downtrend has finally been broken. Could a 44% upside be on the horizon? Let's delve into the technical analysis and explore the possibilities.

Breaking Down the Arbitrum Price Action

After a prolonged period of bearish price action, ARB has shown signs of life. The recent price surge has broken through key resistance levels, suggesting a potential shift in market sentiment. This breakout, combined with increasing trading volume, strengthens the argument for a bullish reversal. Several technical indicators are aligning to support this theory.

Key Technical Indicators Pointing to Upside Potential:

-

Relative Strength Index (RSI): The RSI, a momentum indicator, has moved above oversold levels, indicating that selling pressure is waning. This bullish divergence from the price action itself strengthens the possibility of further price appreciation.

-

Moving Averages: The 50-day and 200-day moving averages are showing signs of a bullish crossover, a classic technical indicator of a potential uptrend. This confluence of moving averages adds weight to the argument for a sustained price increase.

-

Volume Confirmation: The increase in trading volume accompanying the price surge confirms the strength of the bullish move. High volume breakouts are generally considered more reliable indicators of a trend reversal than low-volume breakouts.

-

Support and Resistance Levels: The price has decisively broken through significant resistance levels, suggesting that further upside potential is present. The previous resistance levels are now acting as support, providing further backing for the bullish outlook.

Potential Challenges and Risks:

While the technical analysis paints a promising picture, it's crucial to acknowledge potential risks. The cryptocurrency market remains highly volatile and subject to unexpected shifts driven by regulatory changes, market sentiment, and overall macroeconomic factors.

-

Market Sentiment: A sudden shift in overall market sentiment could negatively impact ARB's price, regardless of its technical strength.

-

Competition: The Layer-2 scaling solution space is becoming increasingly competitive, and the success of ARB will depend on its ability to maintain its market share and continue to innovate.

The 44% Upside Projection: A Realistic Estimate?

The 44% upside potential is based on several technical factors, including the breakout from resistance levels, the bullish indicators mentioned above, and the projected target price based on Fibonacci retracement levels. However, it's important to remember that this is just a projection, and the actual price movement could differ significantly.

Conclusion: Proceed with Caution and Due Diligence

The technical analysis suggests a potential bullish trend for Arbitrum (ARB), with a possible 44% upside. However, the cryptocurrency market is inherently unpredictable. Investors should always conduct their own thorough research, manage their risk effectively, and only invest what they can afford to lose. This analysis should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions. Stay informed about market trends and developments to make well-informed choices regarding your investment portfolio.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Arbitrum (ARB) Technical Analysis: Downtrend Broken, 44% Upside Potential?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

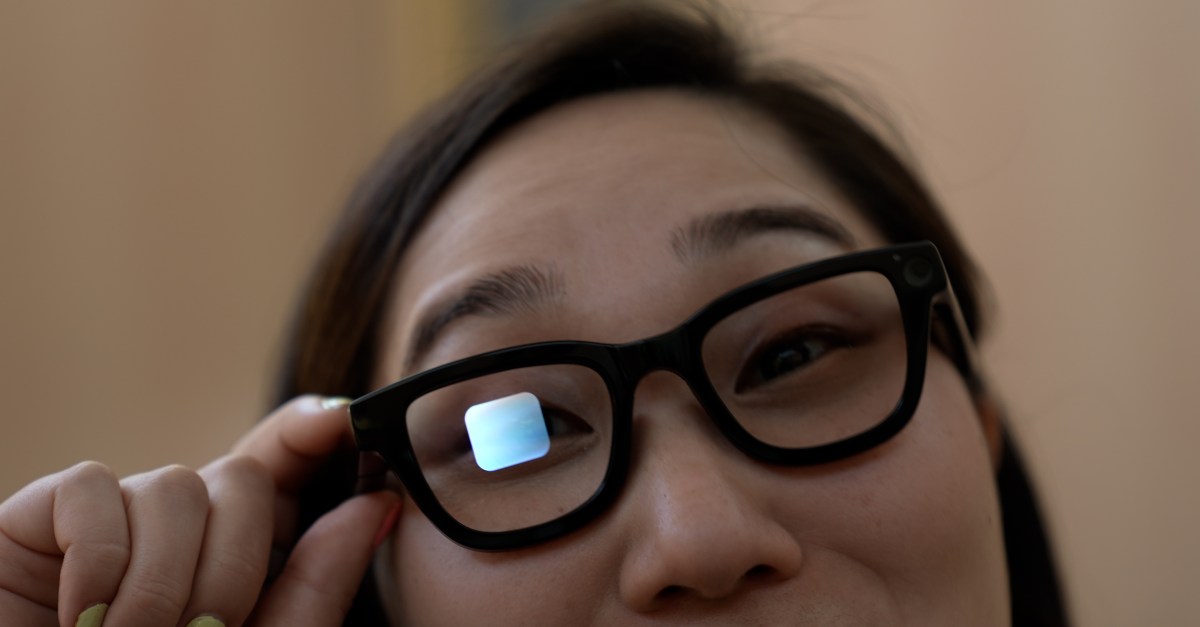

Review Googles Prototype Ai Smart Glasses Functionality And Design

May 23, 2025

Review Googles Prototype Ai Smart Glasses Functionality And Design

May 23, 2025 -

Hester Peirce Challenges Sec Many Nfts Even Royalty Paying Ones Avoid Securities Classification

May 23, 2025

Hester Peirce Challenges Sec Many Nfts Even Royalty Paying Ones Avoid Securities Classification

May 23, 2025 -

Stephen A Smith On Okc Thunder Western Conference Finals And Championship Chances

May 23, 2025

Stephen A Smith On Okc Thunder Western Conference Finals And Championship Chances

May 23, 2025 -

Slash Your Energy Costs Octopus Energys New Tariff Offers 200 Savings

May 23, 2025

Slash Your Energy Costs Octopus Energys New Tariff Offers 200 Savings

May 23, 2025 -

Technical Analysis Xrp Btc Pairs Golden Cross Suggests Upcoming Xrp Rally

May 23, 2025

Technical Analysis Xrp Btc Pairs Golden Cross Suggests Upcoming Xrp Rally

May 23, 2025

Latest Posts

-

Secure Your Accounts Automatic Password Change With Chromes Credential Manager

May 23, 2025

Secure Your Accounts Automatic Password Change With Chromes Credential Manager

May 23, 2025 -

Elon Musks Bold Prediction A Million Driverless Teslas By 2026

May 23, 2025

Elon Musks Bold Prediction A Million Driverless Teslas By 2026

May 23, 2025 -

Tesla Optimus Video Humanoid Robot Performs Cooking Cleaning And Waste Removal

May 23, 2025

Tesla Optimus Video Humanoid Robot Performs Cooking Cleaning And Waste Removal

May 23, 2025 -

Can Laos Overcome Economic Challenges A Look At Its Development

May 23, 2025

Can Laos Overcome Economic Challenges A Look At Its Development

May 23, 2025 -

Whats Inside Sgas Lavish 10 000 Mvp Gift Baskets For Teammates

May 23, 2025

Whats Inside Sgas Lavish 10 000 Mvp Gift Baskets For Teammates

May 23, 2025