Ardoino Defends Tether's Operations: A Contrast To Traditional Banking

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ardoino Defends Tether's Operations: A Stark Contrast to Traditional Banking?

Paolo Ardoino, the Chief Technology Officer of Tether, the world's largest stablecoin issuer, has once again stepped into the spotlight to defend the company's operations and address lingering concerns about its reserves. His recent statements paint a picture of Tether as a technologically advanced, transparent entity – a stark contrast, he argues, to the opaque practices of traditional banking. But are his claims justified? Let's delve into the details.

Ardoino's defense hinges on highlighting Tether's commitment to transparency and its innovative approach to managing its reserves. He emphasizes the company's regular attestations, arguing these provide a level of accountability unmatched by many traditional banks. While critics point to the limitations of these attestations, Ardoino counters that they represent a significant step towards greater transparency in the often-secretive world of finance.

Transparency: A Double-Edged Sword?

The heart of Ardoino's argument lies in the assertion that Tether's operations are far more auditable and transparent than those of traditional banks. He argues that the complexities of traditional banking systems often obfuscate the true nature of their assets and liabilities, making it difficult for outsiders to assess their true financial health. In contrast, Tether, he claims, is actively working towards greater transparency, though the full picture remains debated.

- Regular Attestations: Tether regularly publishes attestations from accounting firms, detailing its reserves. While these don't represent a full audit, they offer a snapshot of the company's holdings.

- Technological Innovation: Ardoino points to Tether's utilization of blockchain technology as a key differentiator, allowing for greater traceability and accountability in its operations.

- Public Scrutiny: Tether has faced intense scrutiny from regulators and the public, forcing it to address concerns and implement changes aimed at increasing transparency.

The Critics' Counterarguments

Despite Ardoino's confident assertions, critics remain unconvinced. Many argue that the attestations are insufficient, failing to provide a complete picture of Tether's reserves and their composition. Questions persist about the nature of these reserves and the potential risks associated with them. The lack of a full, independent audit remains a major point of contention.

Furthermore, while blockchain technology offers certain benefits in terms of traceability, it doesn't automatically equate to full transparency. The underlying assets backing Tether remain a subject of ongoing debate and investigation.

The Future of Tether and Stablecoin Regulation

The debate surrounding Tether's operations highlights the broader challenges facing the stablecoin industry. As stablecoins become increasingly integrated into the global financial system, regulators are scrambling to catch up, developing frameworks to ensure consumer protection and financial stability. The ongoing scrutiny of Tether's operations serves as a case study for the regulatory challenges that lie ahead.

Ardoino's defense is a crucial piece in this ongoing conversation. While his arguments showcase Tether's efforts towards greater transparency and its commitment to technological innovation, the lingering questions regarding its reserves and the need for a more comprehensive audit demonstrate that the road to complete transparency remains long and arduous. The future of Tether, and indeed the stablecoin landscape, will likely be shaped by the ongoing regulatory scrutiny and the company's ability to convincingly address the concerns of its critics. The contrast with traditional banking may be stark, but the ultimate judgment will depend on future actions and regulatory developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ardoino Defends Tether's Operations: A Contrast To Traditional Banking. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Anshul Kambojs Ipl Debut Csks Latest Addition Faces Kkr At Chepauk

Apr 12, 2025

Anshul Kambojs Ipl Debut Csks Latest Addition Faces Kkr At Chepauk

Apr 12, 2025 -

Understanding The 2025 Cash App Settlement Your 2 500 Payment

Apr 12, 2025

Understanding The 2025 Cash App Settlement Your 2 500 Payment

Apr 12, 2025 -

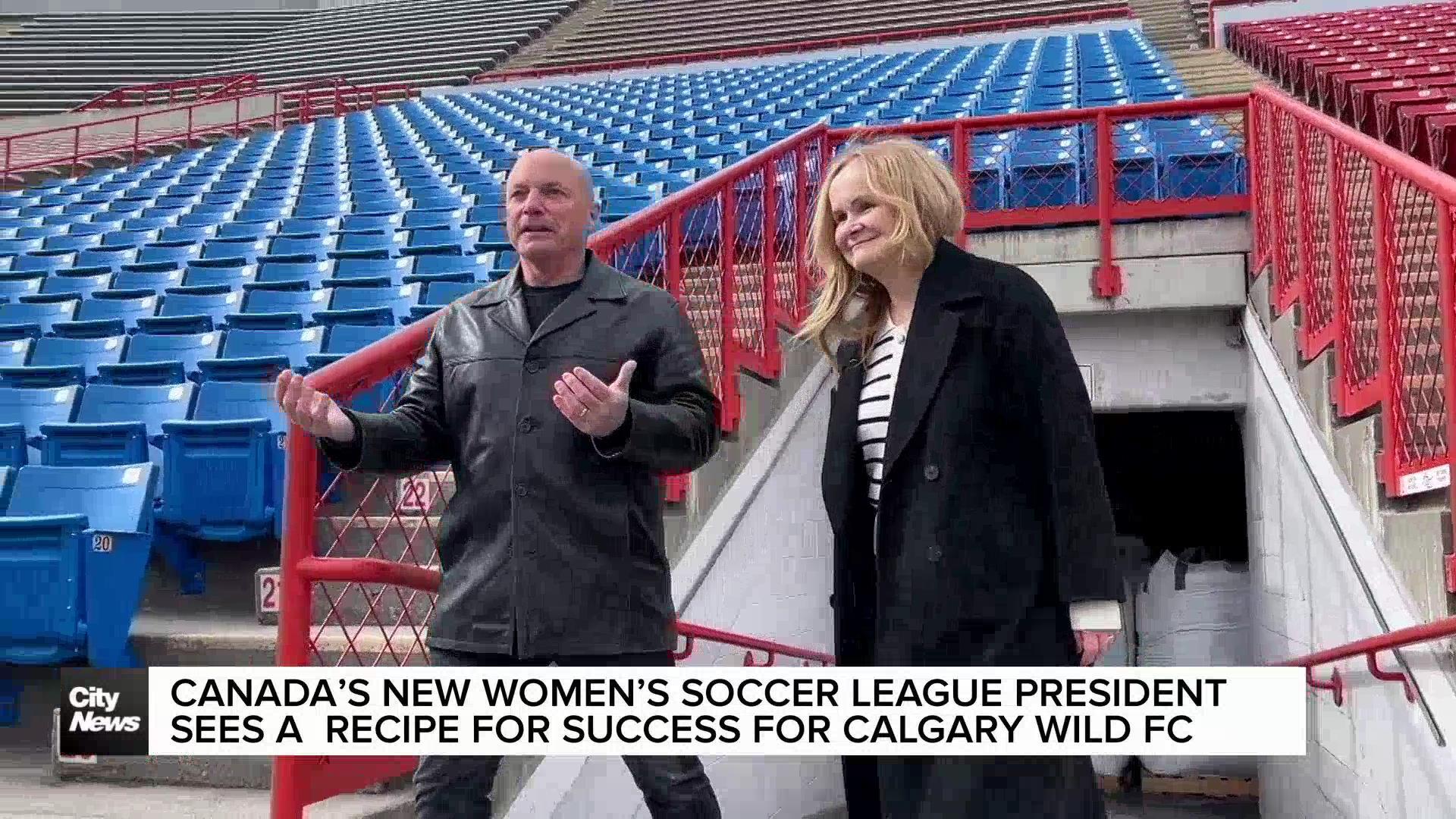

Northern Super League President Calgary Wild Poised For A Winning Season

Apr 12, 2025

Northern Super League President Calgary Wild Poised For A Winning Season

Apr 12, 2025 -

Clemson Spring Football And Masters Week Podcast Featuring Klubnik Woodaz And Immelman

Apr 12, 2025

Clemson Spring Football And Masters Week Podcast Featuring Klubnik Woodaz And Immelman

Apr 12, 2025 -

Spanish Basketball Prospects Mara And Two Others Target Ncaa Domination

Apr 12, 2025

Spanish Basketball Prospects Mara And Two Others Target Ncaa Domination

Apr 12, 2025