Are Lloyds, Halifax, And Nationwide's Outdated Systems Causing Frequent Online Banking Outages?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Lloyds, Halifax, and Nationwide's Outdated Systems Causing Frequent Online Banking Outages?

Frustration is mounting among customers of Lloyds, Halifax, and Nationwide building societies, as reports of online banking outages become increasingly frequent. While the banks cite various reasons for these disruptions, many are questioning whether outdated IT infrastructure is the underlying culprit, leaving millions facing inconvenience and impacting financial management.

The recent surge in reported outages has sparked intense debate. Social media is ablaze with complaints from customers unable to access their accounts, pay bills, or transfer funds – crucial functions that underpin modern financial lives. These disruptions aren't isolated incidents; they're becoming a recurring pattern, prompting questions about the robustness and reliability of these major banks' online services.

The Case for Outdated Systems

Many experts believe that aging IT systems are a significant contributing factor to these recurring outages. Maintaining legacy systems is costly and complex, making upgrades and maintenance a slow and potentially risky process. These older systems may struggle to cope with the increasing demands of modern online banking, leading to instability and vulnerability.

- Lack of Scalability: Older systems might not be designed to handle the peak loads experienced during busy periods, resulting in service failures.

- Security Vulnerabilities: Outdated software often lacks the latest security patches, increasing the risk of cyberattacks and data breaches which, in turn, can lead to temporary shutdowns.

- Integration Challenges: Integrating new technologies with legacy systems can be challenging and error-prone, increasing the likelihood of disruptions.

- Maintenance Difficulties: Finding specialists with the expertise to maintain aging systems is becoming increasingly difficult and expensive.

The lack of transparency from the banks themselves further fuels speculation. While official statements often attribute outages to "technical issues," a lack of specific detail leaves customers feeling uninformed and increasingly distrustful.

What the Banks Say

Lloyds Banking Group, which includes Lloyds Bank and Halifax, typically attributes outages to "planned maintenance" or "unforeseen technical problems." Nationwide has offered similar explanations, often emphasizing their commitment to resolving issues quickly. However, the frequency of these incidents raises concerns about the effectiveness of their ongoing maintenance and upgrade strategies. A more detailed breakdown of the causes, timelines for improvements, and investment plans in modernizing their infrastructure would go a long way in rebuilding customer trust.

The Impact on Customers

The consequences of these outages extend beyond mere inconvenience. Customers face:

- Missed bill payments: Leading to late fees and potential damage to credit scores.

- Delayed salary payments: Causing financial hardship.

- Inability to manage finances: Making budgeting and financial planning challenging.

- Erosion of trust: Damaging customer loyalty and potentially driving customers to competitors.

Looking Ahead: The Need for Modernization

The recurring online banking outages affecting Lloyds, Halifax, and Nationwide highlight the urgent need for modernization within the UK banking sector. Investing in robust, scalable, and secure IT infrastructure is not merely a cost; it's an investment in customer satisfaction, financial stability, and the long-term success of these institutions. Increased transparency and clear communication regarding upgrade plans are crucial to reassure customers and rebuild their trust in these vital financial services. Failure to address these underlying issues could lead to further disruptions, reputational damage, and potentially significant financial losses. The question remains: will these banks act decisively to prevent future outages, or will customers continue to suffer the consequences of outdated systems?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Lloyds, Halifax, And Nationwide's Outdated Systems Causing Frequent Online Banking Outages?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

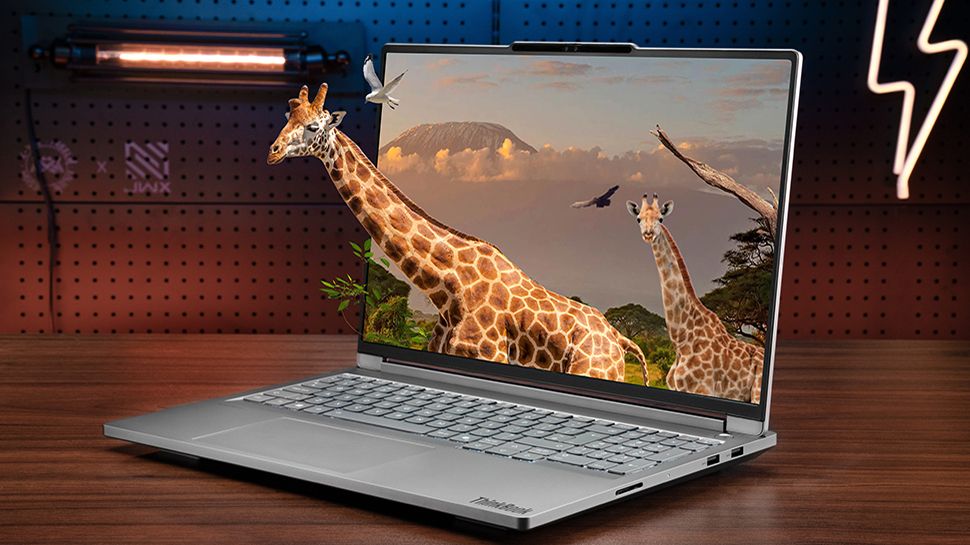

Think Book 3 D Lenovos Attempt At A Glasses Free 3 D Comeback

Mar 04, 2025

Think Book 3 D Lenovos Attempt At A Glasses Free 3 D Comeback

Mar 04, 2025 -

Warren Buffett Y Apple Detalles De La Venta Y Disminucion De La Participacion

Mar 04, 2025

Warren Buffett Y Apple Detalles De La Venta Y Disminucion De La Participacion

Mar 04, 2025 -

Barcelonas Mwc 2025 In Depth Analysis Of The Tech Showcases

Mar 04, 2025

Barcelonas Mwc 2025 In Depth Analysis Of The Tech Showcases

Mar 04, 2025 -

Stripes 91 5 B Valuation A Deep Dive Into Stablecoin Technology And Its Impact

Mar 04, 2025

Stripes 91 5 B Valuation A Deep Dive Into Stablecoin Technology And Its Impact

Mar 04, 2025 -

Assista Ao Vivo Reuniao Anual Da Berkshire Hathaway 2024 Cobertura Completa Da Agora Info Money

Mar 04, 2025

Assista Ao Vivo Reuniao Anual Da Berkshire Hathaway 2024 Cobertura Completa Da Agora Info Money

Mar 04, 2025