Are Outdated Systems Causing UK Banking Outages At Lloyds, Halifax, And Nationwide?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Outdated Systems Behind the Recent UK Banking Outages at Lloyds, Halifax, and Nationwide?

The recent spate of outages affecting major UK banks like Lloyds, Halifax, and Nationwide has left millions of customers frustrated and sparked a crucial question: are outdated IT systems to blame? While official statements often cite "technical issues," the frequency and scale of these disruptions are raising concerns about the underlying infrastructure supporting these financial giants. This article delves into the potential role of legacy systems in these outages and explores the implications for the future of UK banking.

A Pattern of Disruptions:

The string of outages isn't a new phenomenon. Lloyds Banking Group, which includes Halifax, has experienced several significant service disruptions in recent years. Similarly, Nationwide Building Society has also reported its share of technical difficulties. While each incident may have unique causes, the recurring nature of these problems suggests a deeper, systemic issue.

The Legacy System Problem:

Many large banks, including those mentioned above, rely on core banking systems that are decades old. These "legacy systems" were built using outdated technologies and often lack the flexibility and scalability needed to handle the demands of modern digital banking. This reliance on legacy systems presents several challenges:

- Maintenance Difficulties: Maintaining and updating these aging systems is expensive and complex. Finding specialists with expertise in these outdated technologies is increasingly difficult.

- Security Vulnerabilities: Older systems often lack the robust security features of modern platforms, making them more vulnerable to cyberattacks and data breaches.

- Integration Challenges: Integrating new technologies and services with legacy systems is often a significant undertaking, leading to delays and potential instability.

- Scalability Issues: Legacy systems may struggle to handle peak demand, leading to outages during periods of high transaction volume.

The Customer Impact:

These outages have significant consequences for customers:

- Financial Inconvenience: Customers are unable to access their accounts, make payments, or complete other essential banking transactions.

- Loss of Trust: Repeated outages erode customer confidence in the reliability and security of these institutions.

- Reputational Damage: For the banks involved, these outages can lead to reputational damage and loss of business.

What's the Solution?

Modernizing core banking systems is a complex and costly undertaking. However, the continued reliance on outdated infrastructure poses significant risks. Banks need to invest in:

- System Upgrades: Gradually replacing legacy systems with modern, cloud-based platforms.

- Improved Cybersecurity: Implementing robust security measures to protect customer data.

- Increased Investment in IT: Allocating sufficient resources to maintain and upgrade IT infrastructure.

- Transparency and Communication: Improving communication with customers during outages to manage expectations and minimize disruption.

The Future of UK Banking:

The future of UK banking hinges on the ability of these institutions to adapt to the changing technological landscape. Ignoring the need for modernization poses a significant threat to both the banks and their customers. The frequency of recent outages serves as a stark reminder of the urgent need for investment in robust and reliable IT infrastructure. The question isn't just if these systems need updating, but when decisive action will be taken to prevent future disruptions and maintain customer trust. The ongoing situation will undoubtedly be closely scrutinized by regulators and customers alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Outdated Systems Causing UK Banking Outages At Lloyds, Halifax, And Nationwide?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Xiaomi 15 Ultra Camera Performance A Comprehensive Review

Mar 04, 2025

Xiaomi 15 Ultra Camera Performance A Comprehensive Review

Mar 04, 2025 -

3 Altcoins Predicted For Significant Growth In March 2025 Investment Outlook

Mar 04, 2025

3 Altcoins Predicted For Significant Growth In March 2025 Investment Outlook

Mar 04, 2025 -

Lancamento De Criptomoeda Em Rede Social Termina Em Desastre Queda De 98

Mar 04, 2025

Lancamento De Criptomoeda Em Rede Social Termina Em Desastre Queda De 98

Mar 04, 2025 -

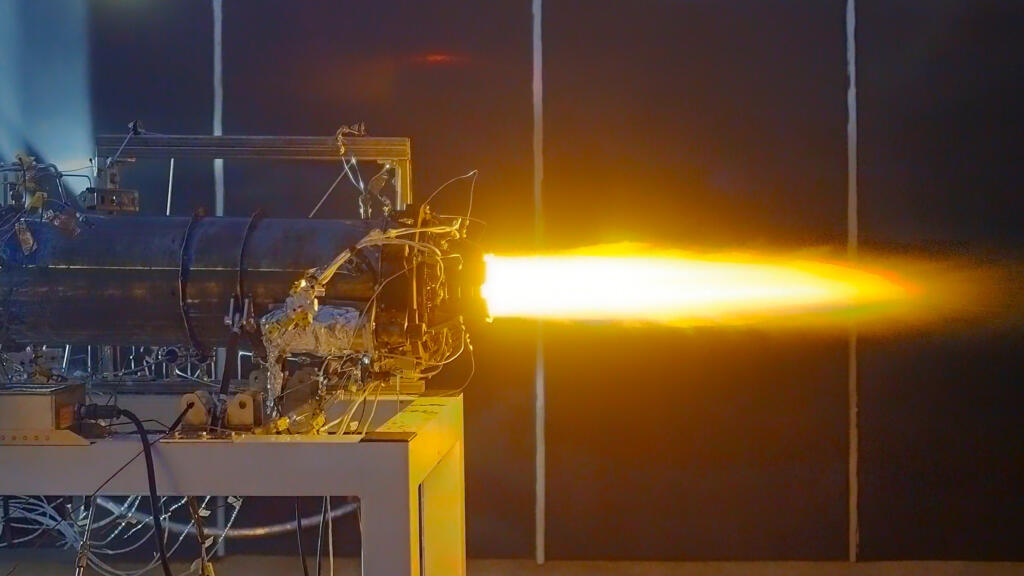

Space Propulsion Advance Venus Aerospace Completes First Ignition Of Vdr 2 Rotating Detonation Rocket Engine

Mar 04, 2025

Space Propulsion Advance Venus Aerospace Completes First Ignition Of Vdr 2 Rotating Detonation Rocket Engine

Mar 04, 2025 -

Dicas Para Ter Uma Casa Na Praia Ou No Campo Sem Comprar Opcoes De Locacao E Cotas

Mar 04, 2025

Dicas Para Ter Uma Casa Na Praia Ou No Campo Sem Comprar Opcoes De Locacao E Cotas

Mar 04, 2025