Arthur Hayes Predicts $1 Million Bitcoin: Fed Panic And Treasury Meltdown Fuel Crypto Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Arthur Hayes Predicts $1 Million Bitcoin: Fed Panic and Treasury Meltdown Fuel Crypto Surge

Bitcoin's price has seen significant volatility lately, and renowned crypto trader Arthur Hayes's latest prediction has sent shockwaves through the market. He boldly forecasts a Bitcoin price of $1 million, fueled by what he sees as impending financial turmoil stemming from the Federal Reserve's actions and a potential US Treasury meltdown. This audacious prediction has ignited a fervent debate within the cryptocurrency community and beyond, prompting investors to re-evaluate their portfolios and consider the potential implications.

The Hayes Hypothesis: A Perfect Storm for Bitcoin?

Hayes, the former CEO of BitMEX, isn't known for shying away from controversial opinions. His prediction isn't based on mere speculation; rather, he points to several key factors converging to create a potentially explosive scenario for Bitcoin:

- The Federal Reserve's Interest Rate Hikes: Hayes argues that the aggressive interest rate hikes implemented by the Federal Reserve to combat inflation are unsustainable in the long run. He believes this policy will ultimately lead to a significant economic downturn, eroding trust in fiat currencies.

- The US Treasury's Debt Ceiling Crisis: The ongoing debate surrounding the US debt ceiling further fuels Hayes's concerns. A potential failure to raise the debt ceiling could trigger a financial crisis, potentially causing a massive flight to safety towards alternative assets like Bitcoin.

- Bitcoin's Scarcity and Decentralization: Hayes highlights Bitcoin's inherent scarcity – a fixed supply of 21 million coins – as a key differentiator from fiat currencies susceptible to inflationary pressures. He also emphasizes its decentralized nature, making it resistant to government manipulation.

These factors, according to Hayes, combine to create a "perfect storm" that could propel Bitcoin's price to unprecedented levels. He envisions a scenario where investors, fearing the collapse of traditional financial systems, flock to Bitcoin as a safe haven asset, driving its price exponentially higher.

A Skeptical Market? Not Entirely.

While some dismiss Hayes's prediction as overly optimistic or even reckless, many within the crypto community are taking notice. The current market volatility, characterized by both significant gains and losses, already reflects a degree of uncertainty and anxiety about the global economic outlook. The increasing adoption of Bitcoin by institutional investors further supports the argument that Bitcoin is evolving beyond its early adopter phase and becoming a mainstream asset.

Several analysts believe that while a $1 million Bitcoin may be a long-term prospect, the underlying factors highlighted by Hayes are indeed significant and warrant careful consideration. The current geopolitical climate, combined with ongoing inflation and economic uncertainty, creates an environment ripe for alternative investment strategies.

What Does This Mean for Investors?

Hayes's prediction, while extreme, serves as a potent reminder of the potential volatility and transformative power of the cryptocurrency market. It highlights the importance of:

- Diversification: Investors should maintain a diversified portfolio, balancing traditional assets with alternative investments like Bitcoin.

- Risk Management: Understanding the inherent risks associated with cryptocurrencies is crucial. Investing only what you can afford to lose is paramount.

- Long-Term Perspective: The cryptocurrency market is known for its volatility. A long-term investment strategy is generally recommended over short-term trading.

The future of Bitcoin remains uncertain, but Arthur Hayes's bold prediction underscores the ongoing evolution of the cryptocurrency landscape and its potential to disrupt traditional finance. Whether or not Bitcoin reaches $1 million remains to be seen, but the conversation sparked by his prediction is a vital one for investors and market observers alike. The potential for significant upheaval in global financial markets warrants careful monitoring and strategic planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Arthur Hayes Predicts $1 Million Bitcoin: Fed Panic And Treasury Meltdown Fuel Crypto Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pga Championship 2025 Day 1 Live Updates Leaderboard And Expert Predictions

May 16, 2025

Pga Championship 2025 Day 1 Live Updates Leaderboard And Expert Predictions

May 16, 2025 -

The Future Of Tesla Understanding The Strategic Importance Of Dojo And 4680 Cell Production

May 16, 2025

The Future Of Tesla Understanding The Strategic Importance Of Dojo And 4680 Cell Production

May 16, 2025 -

Three Ton Stonehenge Blocks Possible Origins In Earlier Structures Revealed

May 16, 2025

Three Ton Stonehenge Blocks Possible Origins In Earlier Structures Revealed

May 16, 2025 -

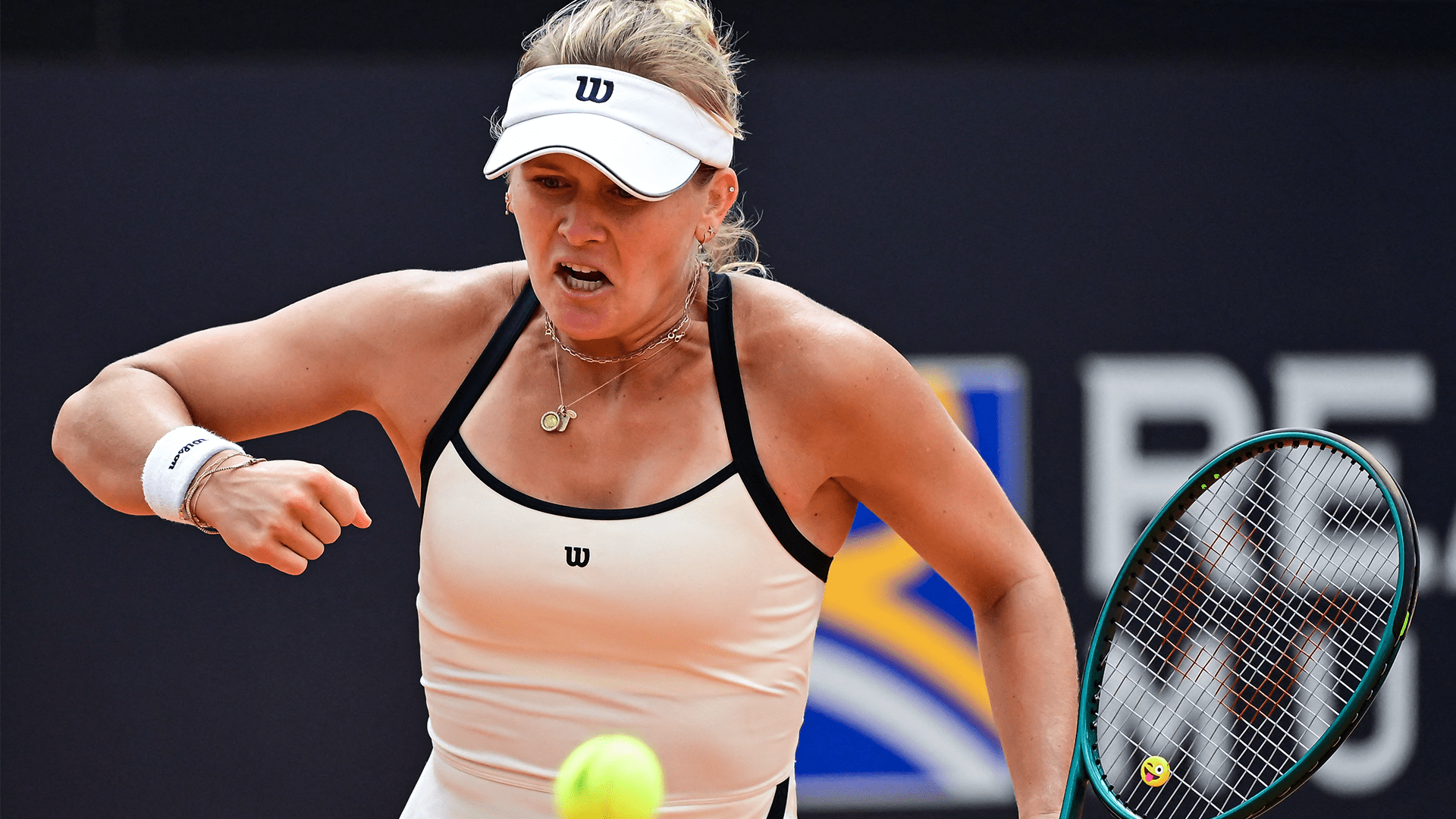

Peyton Stearns Opens Up About Coaching Change After Rome Tweet

May 16, 2025

Peyton Stearns Opens Up About Coaching Change After Rome Tweet

May 16, 2025 -

Nasas James Webb Space Telescope Evidence Of Frozen Water In New Star System

May 16, 2025

Nasas James Webb Space Telescope Evidence Of Frozen Water In New Star System

May 16, 2025