Artificial Intelligence: The Future Of IRS Employment After Mass Layoffs?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Artificial Intelligence: Reshaping the Future of IRS Employment After Mass Layoffs?

The Internal Revenue Service (IRS) recently announced significant layoffs, sparking widespread concern about the future of IRS employment. However, alongside the job losses, a quiet revolution is brewing: the increasing integration of artificial intelligence (AI). This raises a critical question: will AI ultimately replace human workers, or will it reshape the landscape of IRS employment, creating new opportunities while eliminating others?

The recent layoffs, attributed to budget cuts and restructuring, have left many wondering about the long-term implications for IRS employees. However, the IRS's increasing investment in AI technologies suggests a potential shift in the nature of employment within the agency. This isn't necessarily a bleak outlook; instead, it presents a complex scenario where AI could streamline operations and create new, specialized roles.

How AI is Transforming IRS Operations:

The IRS is increasingly utilizing AI for various tasks, including:

- Automated Tax Audits: AI algorithms can analyze vast datasets to identify potential discrepancies and inconsistencies in tax returns, significantly speeding up the audit process. This automation reduces the need for manual review of simple cases, allowing human agents to focus on more complex situations requiring nuanced judgment.

- Improved Customer Service: AI-powered chatbots and virtual assistants can handle routine inquiries, providing instant answers to frequently asked questions, freeing up human agents to address more challenging customer service issues.

- Fraud Detection: AI's ability to detect patterns and anomalies makes it a powerful tool in identifying and preventing tax fraud. Advanced algorithms can analyze large volumes of data to identify suspicious activities and flag them for human investigation.

- Streamlined Data Processing: AI can automate the processing of tax returns and other documents, significantly improving efficiency and reducing processing times.

The Future of IRS Employment in the Age of AI:

While some roles may become automated, the integration of AI is likely to create new job opportunities within the IRS. These roles will require specialized skills in areas such as:

- AI Development and Maintenance: Experts will be needed to develop, implement, and maintain the AI systems used by the IRS.

- Data Science and Analytics: Professionals with expertise in analyzing large datasets will be crucial for interpreting AI-generated insights and informing decision-making.

- AI Ethics and Compliance: Ensuring the ethical and responsible use of AI will require specialists to address potential biases and ensure compliance with regulations.

- Human-AI Collaboration: The most successful IRS employees of the future will be those who can effectively collaborate with AI systems, leveraging their strengths to improve efficiency and accuracy.

Challenges and Opportunities:

The transition to an AI-driven IRS presents challenges. Retraining programs will be crucial to equip existing employees with the skills needed for new roles. Addressing concerns about job security and potential displacement of workers is also paramount. However, the potential benefits are significant. AI can lead to increased efficiency, reduced errors, improved service delivery, and enhanced fraud detection, ultimately benefiting both taxpayers and the IRS.

Conclusion:

The future of IRS employment is not solely defined by recent layoffs. The agency's embrace of AI presents both challenges and opportunities. While some roles may be automated, the integration of AI is likely to create new, specialized roles requiring expertise in AI development, data science, and human-AI collaboration. Successful adaptation will require proactive retraining initiatives and a focus on reskilling the workforce to meet the evolving demands of a technologically advanced IRS. The key lies in embracing the transformative potential of AI to create a more efficient and effective tax system while ensuring a just and equitable transition for IRS employees.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Artificial Intelligence: The Future Of IRS Employment After Mass Layoffs?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Womens Tri Series Final Ind W Vs Sl W Crucial Pitch And Weather Forecast

May 12, 2025

Womens Tri Series Final Ind W Vs Sl W Crucial Pitch And Weather Forecast

May 12, 2025 -

Jayson Tatum Silences Critics Celtics Secure Victory In New York

May 12, 2025

Jayson Tatum Silences Critics Celtics Secure Victory In New York

May 12, 2025 -

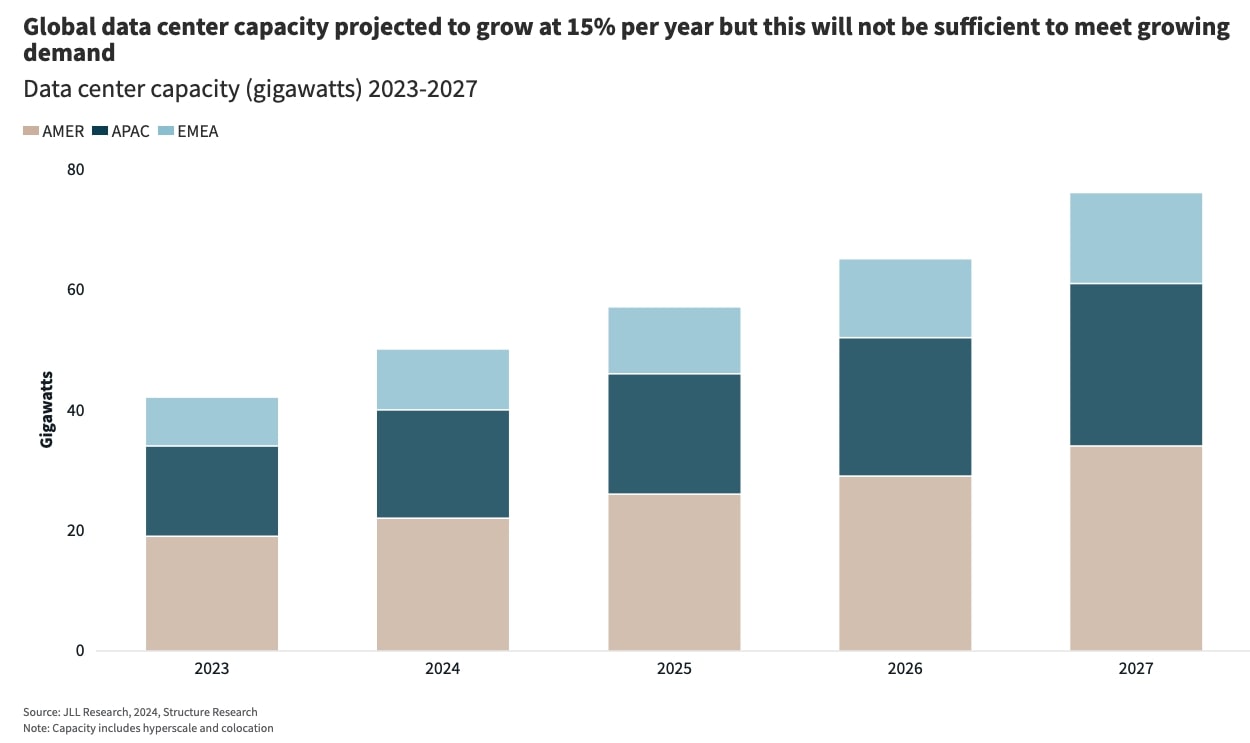

Navigating The Shifting Landscape Global Ai Data Center Growth In 2024

May 12, 2025

Navigating The Shifting Landscape Global Ai Data Center Growth In 2024

May 12, 2025 -

Couple Goals Millie Bobby Browns Birthday Surprise For Husband Jake Bongiovi

May 12, 2025

Couple Goals Millie Bobby Browns Birthday Surprise For Husband Jake Bongiovi

May 12, 2025 -

Capitals Coach Carberys Words Ignite Tensions With Carolina

May 12, 2025

Capitals Coach Carberys Words Ignite Tensions With Carolina

May 12, 2025

Latest Posts

-

From Mystery To Understanding How Mapping Mars Changed Everything

May 12, 2025

From Mystery To Understanding How Mapping Mars Changed Everything

May 12, 2025 -

Afl Trade Speculation A New Direction For The No 1 Draft Pick

May 12, 2025

Afl Trade Speculation A New Direction For The No 1 Draft Pick

May 12, 2025 -

Mission Impossible Dead Reckoning Part One Early Box Office Success

May 12, 2025

Mission Impossible Dead Reckoning Part One Early Box Office Success

May 12, 2025 -

3 Ton Stonehenge Components Traced To Earlier Structures

May 12, 2025

3 Ton Stonehenge Components Traced To Earlier Structures

May 12, 2025 -

Golden State Warriors Defeat Minnesota Timberwolves May 10 2025 Game Summary

May 12, 2025

Golden State Warriors Defeat Minnesota Timberwolves May 10 2025 Game Summary

May 12, 2025