Assessing Circle's True Value: Analyzing Ripple's $5 Billion Bid And Market Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Assessing Circle's True Value: Analyzing Ripple's $5 Billion Bid and Market Impact

Ripple's surprising $5 billion bid for Circle has sent shockwaves through the cryptocurrency market, sparking intense debate about Circle's true valuation and the potential implications for the broader crypto landscape. The offer, if successful, would represent a significant consolidation of power within the stablecoin sector and raise important questions about regulatory oversight and market competition. This article delves into the details of the bid, analyzes Circle's current market position, and explores the potential long-term consequences.

Circle: A Stablecoin Giant Under Scrutiny

Circle, a prominent player in the digital currency ecosystem, is best known for its USD Coin (USDC) stablecoin, a major competitor to Tether (USDT). USDC boasts significant market capitalization and is widely used in DeFi applications and institutional trading. However, Circle's financial health and regulatory compliance have been under scrutiny in recent months, leading to some uncertainty surrounding its valuation.

Ripple's Strategic Gamble: Why $5 Billion?

Ripple's aggressive bid raises several key questions. Is the offer genuinely reflective of Circle's intrinsic value, or is it a strategic maneuver designed to gain a competitive edge in the stablecoin market? Several factors could be at play:

- Consolidation of Market Power: Acquiring Circle would grant Ripple significant control over a large portion of the stablecoin market, potentially impacting trading volume and liquidity.

- Enhanced Regulatory Compliance: A merger could streamline regulatory compliance efforts, a critical concern for both companies given the increasing scrutiny of the crypto industry by global regulators.

- Synergies and Cross-Platform Integration: Integrating Circle's technology and user base with Ripple's existing infrastructure could create significant operational synergies and new revenue streams.

- Strategic Investment: Ripple might see Circle as an undervalued asset with significant long-term growth potential, positioning itself for future expansion in the burgeoning digital payments space.

Market Reaction and Expert Opinions:

The market's response to Ripple's bid has been mixed. While some analysts view the offer as a bullish signal for the stablecoin market, others express concerns about potential monopolistic practices and regulatory hurdles. Many experts are currently divided on whether the $5 billion price tag accurately reflects Circle's true worth, citing factors like fluctuating market conditions and the inherent volatility of the cryptocurrency sector. The deal's ultimate success hinges not only on securing shareholder approval but also navigating the complex regulatory landscape.

The Road Ahead: Regulatory Uncertainty and Market Implications

The proposed acquisition faces significant regulatory challenges. Antitrust concerns and the scrutiny of stablecoin regulations in various jurisdictions will play a crucial role in determining the deal's fate. The outcome will have profound implications for the future of the stablecoin market, potentially influencing competition, innovation, and the overall stability of the cryptocurrency ecosystem.

Conclusion: Unpacking the Ripple-Circle Deal

Ripple's $5 billion bid for Circle is a landmark event that demands careful analysis. While the offer presents strategic advantages for Ripple, the true value of Circle remains a subject of intense debate. The deal's success depends heavily on navigating regulatory challenges and securing shareholder approval. The outcome will undeniably shape the future trajectory of the stablecoin market and the broader cryptocurrency industry, potentially ushering in a new era of consolidation and increased regulatory scrutiny. Further developments will be crucial in fully assessing the impact of this momentous transaction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Assessing Circle's True Value: Analyzing Ripple's $5 Billion Bid And Market Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alex Alexeyev Arrested Pepper Spray Altercation And Public Intoxication In Arlington Va

May 20, 2025

Alex Alexeyev Arrested Pepper Spray Altercation And Public Intoxication In Arlington Va

May 20, 2025 -

Find Out Now National Lottery Set For Life Winning Numbers May 19 Monday

May 20, 2025

Find Out Now National Lottery Set For Life Winning Numbers May 19 Monday

May 20, 2025 -

Survivor Quebec Tout Sur Le Plus Grand Conseil De Tribu De L Histoire

May 20, 2025

Survivor Quebec Tout Sur Le Plus Grand Conseil De Tribu De L Histoire

May 20, 2025 -

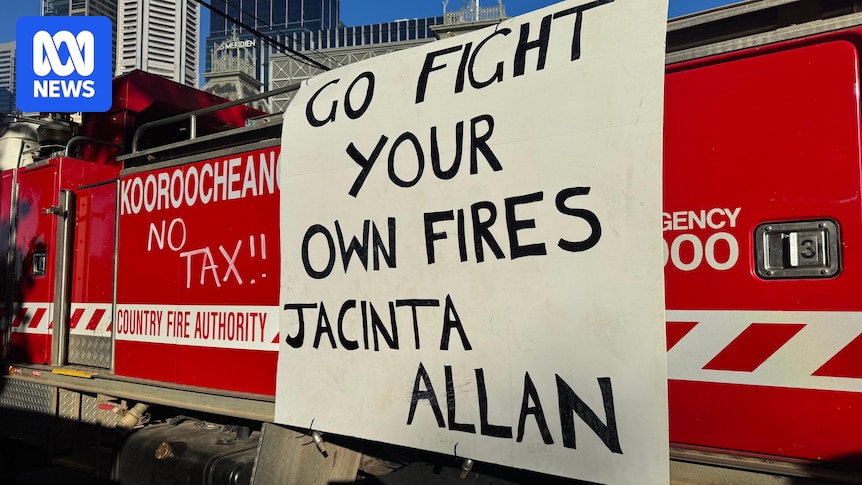

Victorian Budget 2024 Firefighters And Farmers Unite In Levy Protest

May 20, 2025

Victorian Budget 2024 Firefighters And Farmers Unite In Levy Protest

May 20, 2025 -

High And Low Reviews Assessing Spike Lees Adaptation Of Kurosawa

May 20, 2025

High And Low Reviews Assessing Spike Lees Adaptation Of Kurosawa

May 20, 2025