Assessing The Risks And Rewards Of Investing In Amazon Today

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Assessing the Risks and Rewards of Investing in Amazon Today

Amazon. The name conjures images of ubiquitous online shopping, cloud computing dominance, and a seemingly unstoppable juggernaut of innovation. But is now the right time to invest in this behemoth of the tech world? The answer, as with any investment, is complex, weighing potential rewards against significant risks. This article delves into the current state of Amazon, analyzing the factors that make it an attractive investment while acknowledging the challenges it faces.

The Allure of Amazon: A Look at the Rewards

Amazon's appeal as an investment is multifaceted, rooted in its consistent growth and diversification across multiple lucrative sectors.

-

E-commerce Dominance: Amazon remains the undisputed king of online retail. Its vast marketplace, Prime subscription service, and efficient logistics network provide a formidable barrier to entry for competitors. This core business continues to generate substantial revenue and profits, forming a solid foundation for future growth.

-

AWS: A Cloud Computing Colossus: Amazon Web Services (AWS) is the leading provider of cloud computing infrastructure. Its market share dwarfs competitors, offering a consistently high-margin revenue stream and immense future potential as cloud adoption continues to accelerate across industries. This segment is a key driver of Amazon's overall profitability.

-

Expanding into New Markets: Amazon isn't resting on its laurels. Its ongoing expansion into areas like advertising, digital media (Prime Video, Audible), and grocery delivery (Whole Foods Market) showcases its strategic ambition and potential for future revenue streams. This diversification mitigates risk by reducing reliance on any single sector.

-

Strong Brand Recognition and Loyalty: The Amazon brand enjoys unparalleled recognition and loyalty worldwide. This brand power translates into significant competitive advantages, ensuring continued customer acquisition and retention.

Navigating the Challenges: Understanding the Risks

While the rewards are enticing, investing in Amazon also presents considerable risks:

-

Valuation Concerns: Amazon's current market capitalization reflects significant investor optimism. Some analysts argue that the stock is overvalued, leaving little room for further substantial growth in the short term.

-

Increased Competition: While Amazon maintains a dominant position, competition is intensifying, particularly in e-commerce and cloud computing. Rivals are aggressively challenging Amazon's market share, demanding ongoing investment in innovation and marketing to maintain its competitive edge.

-

Regulatory Scrutiny: Amazon faces increasing regulatory scrutiny regarding antitrust concerns, data privacy, and labor practices. Negative regulatory outcomes could significantly impact its profitability and future growth.

-

Economic Volatility: Amazon, like any large company, is susceptible to broader economic downturns. A recession could dampen consumer spending and negatively affect its revenue growth.

Making an Informed Decision: Weighing the Pros and Cons

Investing in Amazon requires a careful assessment of your personal risk tolerance and investment goals. The company presents a compelling long-term growth story, fueled by its dominance in key sectors and ongoing diversification. However, its high valuation and potential regulatory challenges necessitate a cautious approach.

Consider these factors before investing:

-

Your Time Horizon: Amazon is a long-term investment. Short-term volatility should be anticipated and factored into your investment strategy.

-

Diversification: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risk.

-

Professional Advice: Consult with a qualified financial advisor before making any investment decisions.

Amazon's future is far from certain, but its current position and potential for future growth make it a compelling, albeit risky, investment opportunity. Conduct thorough research, understand the risks involved, and make a decision that aligns with your individual financial goals and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Assessing The Risks And Rewards Of Investing In Amazon Today. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Secure Ideas Meets Stringent Security Standards Crest And Cmmc Certified

Apr 08, 2025

Secure Ideas Meets Stringent Security Standards Crest And Cmmc Certified

Apr 08, 2025 -

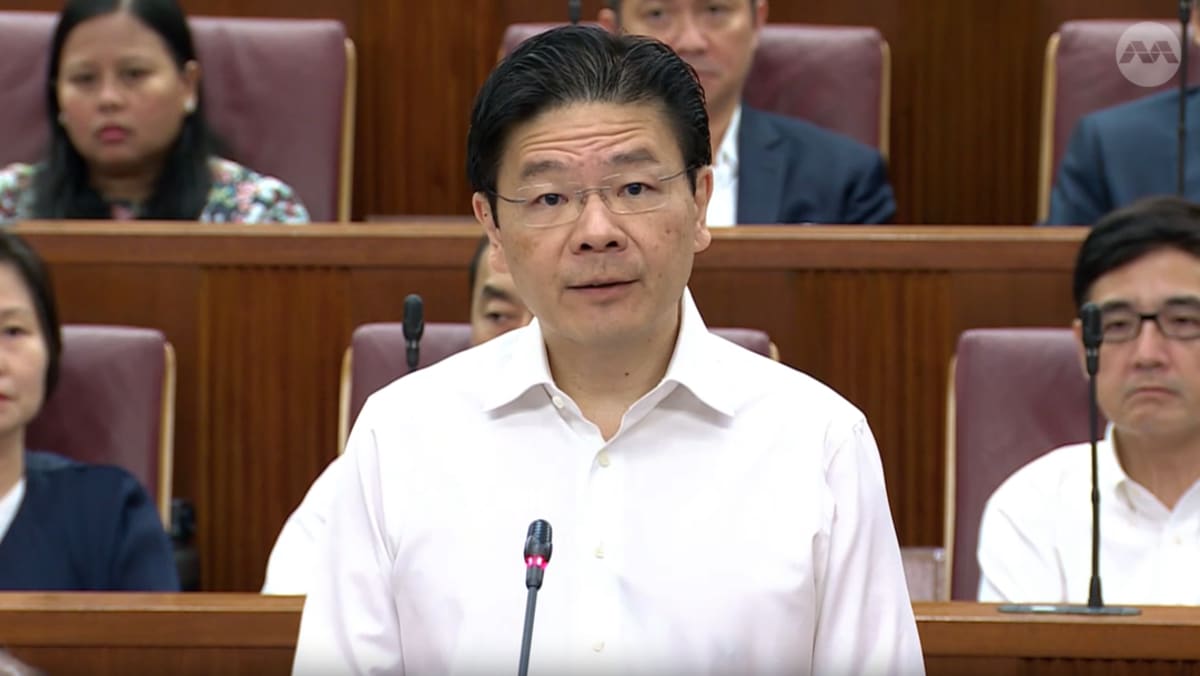

Trump Tariffs Singapore Pm Announces Support For Businesses And Workers

Apr 08, 2025

Trump Tariffs Singapore Pm Announces Support For Businesses And Workers

Apr 08, 2025 -

Tradizione E Innovazione La Sampdoria Cerca La Via D Uscita Nel Ricordo

Apr 08, 2025

Tradizione E Innovazione La Sampdoria Cerca La Via D Uscita Nel Ricordo

Apr 08, 2025 -

China Vs As Ancaman Dan Peluang Dalam Konflik Perdagangan Internasional

Apr 08, 2025

China Vs As Ancaman Dan Peluang Dalam Konflik Perdagangan Internasional

Apr 08, 2025 -

Bulldogs Football Major Coaching Change Announced

Apr 08, 2025

Bulldogs Football Major Coaching Change Announced

Apr 08, 2025