Aussie Dollar Crisis: Tears On Wall Street

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Aussie Dollar Crisis: Tears on Wall Street – Is the Aussie's Fall a Sign of Broader Economic Woes?

The Australian dollar's dramatic plummet is sending shockwaves through Wall Street, leaving investors reeling and prompting urgent questions about the global economic outlook. The Aussie's recent freefall, hitting its lowest point against the US dollar in [insert timeframe, e.g., a decade], has sparked widespread concern, with analysts scrambling to understand the underlying causes and predict the potential fallout. Is this a localized issue, or a canary in the coal mine signaling a broader global economic crisis?

The Aussie Dollar's Plunge: A Deep Dive into the Causes

Several factors contribute to the current Aussie dollar crisis. While pinpointing a single culprit is impossible, the confluence of these events paints a concerning picture:

-

China's Economic Slowdown: Australia's economy is heavily reliant on exports to China, particularly in commodities like iron ore and coal. China's recent economic struggles, including a weakening property market and sluggish industrial growth, have significantly dampened demand for Australian exports, weakening the Aussie dollar.

-

Rising Interest Rates: The Reserve Bank of Australia (RBA)'s aggressive interest rate hikes, aimed at curbing inflation, have inadvertently increased borrowing costs, impacting business investment and consumer spending. This has further contributed to the Aussie dollar's decline.

-

Global Economic Uncertainty: The ongoing war in Ukraine, persistent inflation in many developed nations, and supply chain disruptions continue to create a volatile global economic environment. This uncertainty is driving investors towards safer havens like the US dollar, further pressuring the Australian currency.

-

Political Instability (If Applicable): Mention any relevant political factors impacting investor confidence, such as potential changes in government or policy uncertainty. This section should be tailored to reflect current events.

Impact on Wall Street and Global Markets

The Aussie dollar crisis is not just an Australian problem. Its ramifications are felt globally, particularly on Wall Street:

-

Increased Volatility: The Aussie's decline fuels uncertainty in global markets, leading to increased volatility in stock prices and other assets.

-

Impact on Investments: Investors with significant holdings in Australian assets are facing substantial losses due to the currency's devaluation.

-

Ripple Effect on Commodity Prices: The weakening Aussie dollar impacts the price of Australian commodities, affecting global supply chains and potentially contributing to inflationary pressures in other countries.

What Lies Ahead for the Aussie Dollar?

Predicting the future of the Australian dollar is challenging. However, several scenarios are possible:

-

A Gradual Recovery: If China's economy stabilizes and global economic uncertainty eases, the Aussie dollar could gradually recover its value.

-

Further Decline: Continued economic headwinds in China, persistent global uncertainty, and further interest rate hikes could lead to a more prolonged and significant decline.

-

Government Intervention: The Australian government might intervene to stabilize the currency through various policy measures, though such interventions are often complex and their effectiveness varies.

Conclusion: Navigating Uncertain Waters

The Aussie dollar crisis highlights the interconnectedness of global economies. The fall of the Australian dollar serves as a stark reminder of the fragility of global markets and the potential for unforeseen economic shocks. Investors and policymakers alike must closely monitor the situation and adapt their strategies to navigate these uncertain waters. The coming weeks and months will be crucial in determining the extent of the crisis and its long-term impact on the global economy. Stay informed and consult with financial professionals for personalized guidance during these volatile times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Aussie Dollar Crisis: Tears On Wall Street. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sistem Pembuatan Undang Undang Di Dpr Lebih Dari Sekadar Beberapa Individu

Apr 07, 2025

Sistem Pembuatan Undang Undang Di Dpr Lebih Dari Sekadar Beberapa Individu

Apr 07, 2025 -

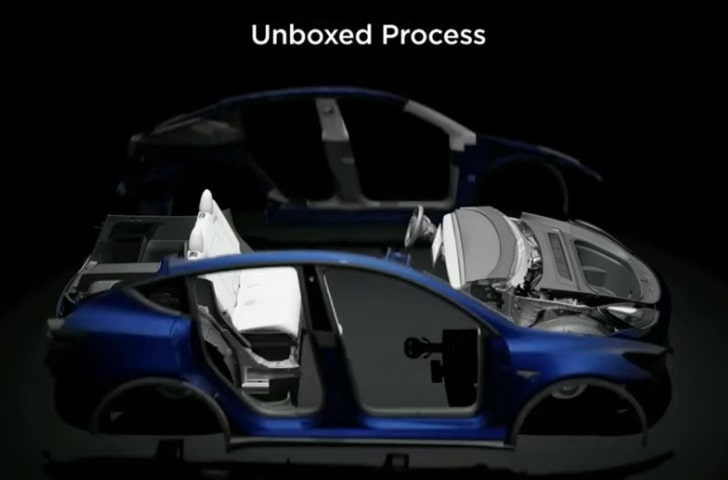

Teslas Cybercab Revolutionary Manufacturing Mirroring Space Xs Starship Reusability

Apr 07, 2025

Teslas Cybercab Revolutionary Manufacturing Mirroring Space Xs Starship Reusability

Apr 07, 2025 -

Fha Loan Residency Requirements Recent Modifications Explained

Apr 07, 2025

Fha Loan Residency Requirements Recent Modifications Explained

Apr 07, 2025 -

Will Kawhi Leonard Play Clippers Stars Injury Status Uncertain For Doubleheader

Apr 07, 2025

Will Kawhi Leonard Play Clippers Stars Injury Status Uncertain For Doubleheader

Apr 07, 2025 -

Jumbo Dan Qodrat 2 Persaingan Ketat Di Bioskop Usai Raih 1 Juta Penonton

Apr 07, 2025

Jumbo Dan Qodrat 2 Persaingan Ketat Di Bioskop Usai Raih 1 Juta Penonton

Apr 07, 2025