Aussie Dollar Plunges Amidst Intensifying US-China Trade War

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Aussie Dollar Plunges Amidst Intensifying US-China Trade War

The Australian dollar took a significant dive today, plummeting to its lowest point against the US dollar in several months. This sharp decline is directly attributed to the escalating trade war between the United States and China, leaving investors deeply concerned about the global economic outlook and Australia's exposure to the conflict. The Aussie, often considered a "proxy" for Chinese economic growth due to Australia's significant trade relationship with its northern neighbour, is feeling the full force of the uncertainty.

Understanding the Connection: Australia and the US-China Trade War

Australia's economy is heavily reliant on exports to China, particularly commodities like iron ore and coal. The ongoing trade tensions between the US and China create a ripple effect, impacting global demand for these resources and consequently, the Australian dollar. As the trade war intensifies, fears of reduced Chinese demand are driving investors to seek safer havens, leading to a sell-off in the Aussie.

Key Factors Contributing to the Aussie Dollar's Plunge:

- Increased Trade Tariffs: The ongoing imposition and threat of further tariffs between the US and China disrupt global supply chains and dampen overall economic growth. This directly affects demand for Australian exports.

- Global Economic Uncertainty: The trade war fuels uncertainty in the global market, causing investors to become risk-averse and move away from currencies perceived as riskier, like the Australian dollar.

- Reduced Commodity Prices: The decreased demand for Australian commodities, driven by the trade war, leads to lower prices, negatively impacting Australia's terms of trade and further weakening the Aussie.

- Interest Rate Expectations: The Reserve Bank of Australia (RBA) is closely monitoring the economic situation. If the trade war continues to negatively impact the economy, further interest rate cuts might be on the cards, potentially further weakening the Aussie dollar.

What This Means for Australian Businesses and Consumers:

The weakening Aussie dollar has both positive and negative implications. While it might benefit exporters by making their products more competitive globally, it also increases the cost of imported goods, potentially leading to higher inflation for Australian consumers. Businesses heavily reliant on imports will face increased costs, impacting profitability and potentially leading to price increases.

Looking Ahead: Predicting the Future of the Aussie Dollar

The future trajectory of the Australian dollar remains highly dependent on the evolution of the US-China trade war. Any signs of de-escalation or a trade deal could lead to a recovery, while further escalation will likely continue to put downward pressure on the currency. Experts are closely monitoring developments and urging investors to exercise caution. The RBA's policy response will also play a crucial role in shaping the Aussie dollar's performance in the coming months. It's a volatile situation, and investors need to stay informed and adapt their strategies accordingly. The situation remains fluid, demanding constant vigilance and informed decision-making from all stakeholders.

Keywords: Aussie dollar, Australian dollar, US-China trade war, currency exchange rate, global economy, commodity prices, iron ore, coal, RBA, interest rates, inflation, exports, imports, economic uncertainty, investment, risk-averse

This article aims to provide a comprehensive overview of the current situation and is not financial advice. Consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Aussie Dollar Plunges Amidst Intensifying US-China Trade War. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Itzulia Basque Country Stage 1 Time Trial Start Lists And Predicted Times

Apr 07, 2025

Itzulia Basque Country Stage 1 Time Trial Start Lists And Predicted Times

Apr 07, 2025 -

Augusta National Postpones Opening Due To Inclement Weather

Apr 07, 2025

Augusta National Postpones Opening Due To Inclement Weather

Apr 07, 2025 -

Trade War Fallout Aussie Dollar Plummets On Renewed Us China Tensions

Apr 07, 2025

Trade War Fallout Aussie Dollar Plummets On Renewed Us China Tensions

Apr 07, 2025 -

Catching The 2025 March Madness Finals A Viewers Guide

Apr 07, 2025

Catching The 2025 March Madness Finals A Viewers Guide

Apr 07, 2025 -

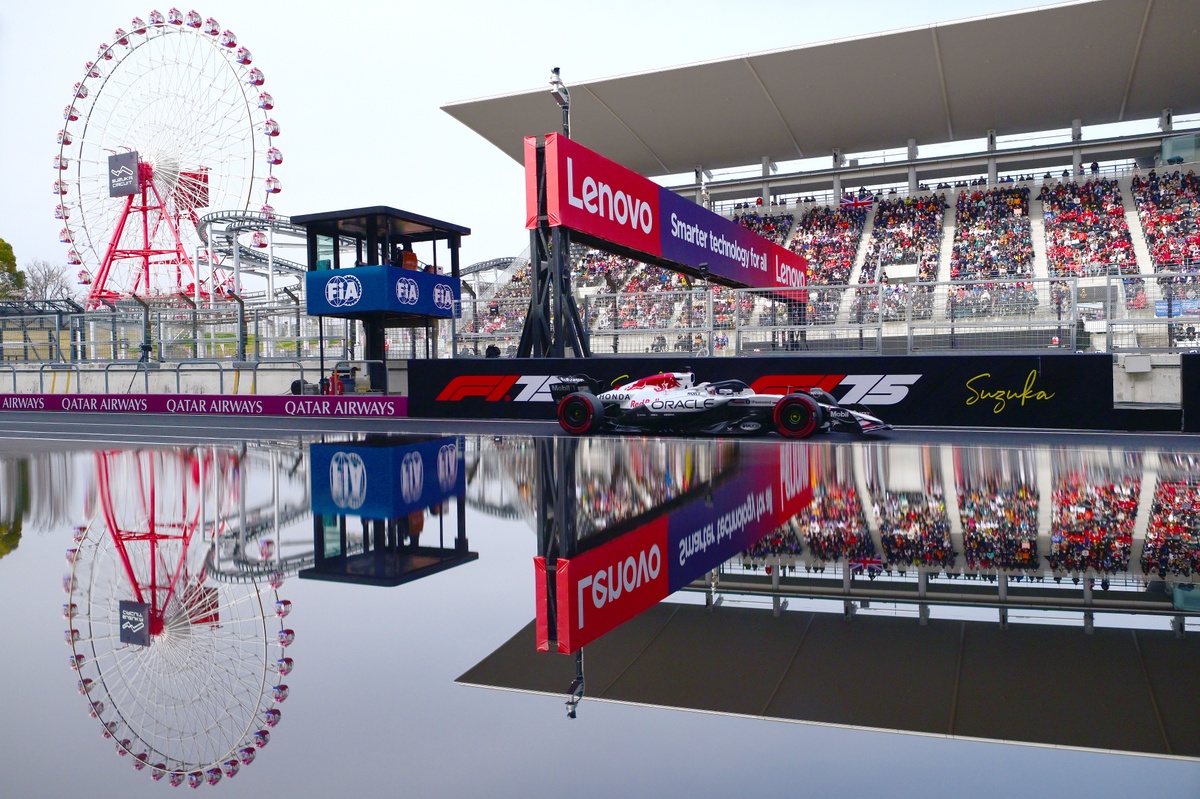

F1 Japanese Grand Prix Real Time Updates And Race Day Commentary

Apr 07, 2025

F1 Japanese Grand Prix Real Time Updates And Race Day Commentary

Apr 07, 2025