Australia To Avoid Global Recession? Treasurer Highlights Key Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australia to Avoid Global Recession? Treasurer Highlights Key Concerns

Australia's economy is facing a turbulent global landscape, but could it dodge the looming global recession? Treasurer Jim Chalmers recently delivered a speech outlining key economic concerns and the government's strategies to navigate these challenging times. While optimism remains, significant hurdles lie ahead.

The global economic outlook is undeniably grim. High inflation, soaring interest rates, and the ongoing war in Ukraine are casting a long shadow over international markets. Many prominent economists predict a global recession in 2023 or 2024. However, Chalmers suggests Australia might be better positioned than many other developed nations to weather the storm.

Key Concerns Highlighted by the Treasurer:

-

Inflation: Persistent high inflation remains the biggest domestic challenge. While the Reserve Bank of Australia (RBA) is aggressively raising interest rates to curb inflation, the impact on consumers and businesses is significant. Chalmers acknowledged the pain felt by households grappling with rising living costs.

-

Global Uncertainty: The war in Ukraine, ongoing supply chain disruptions, and potential energy crises in Europe pose significant risks to the Australian economy. These external factors are beyond the government's direct control but have a considerable impact on trade and investment.

-

Falling Commodity Prices: Australia's reliance on commodity exports makes it vulnerable to fluctuations in global commodity markets. A decline in prices could significantly impact national income and government revenue.

-

Housing Market Slowdown: The RBA's interest rate hikes are already cooling the Australian housing market, with house prices experiencing a noticeable decline in several major cities. This slowdown could impact consumer confidence and economic activity.

Australia's Potential Resilience:

Despite these challenges, Chalmers pointed to several factors that might help Australia avoid a recession:

-

Strong Labor Market: Australia currently boasts a remarkably strong labor market with low unemployment. This robust employment sector provides a crucial buffer against economic downturns.

-

High Commodity Prices (Historically): While commodity prices are falling, they remain relatively high compared to historical averages. This provides some insulation against the global economic slowdown.

-

Government Spending: The government's planned investments in infrastructure projects are aimed at stimulating economic activity and creating jobs.

-

RBA's Measured Approach: The RBA's gradual approach to interest rate hikes aims to navigate a fine line between curbing inflation and avoiding a sharp economic contraction.

Looking Ahead:

While the Treasurer's comments offer a degree of cautious optimism, the road ahead is far from certain. The global economic landscape remains unpredictable, and unforeseen events could easily disrupt Australia's positive trajectory. The government's ability to effectively manage inflation and navigate global uncertainty will be crucial in determining Australia's economic fate in the coming months and years. Close monitoring of key economic indicators, such as inflation rates, employment figures, and consumer confidence, will be essential to gauge the success of the government's strategies. The coming months will be critical in determining whether Australia can truly avoid the global recessionary trend.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australia To Avoid Global Recession? Treasurer Highlights Key Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

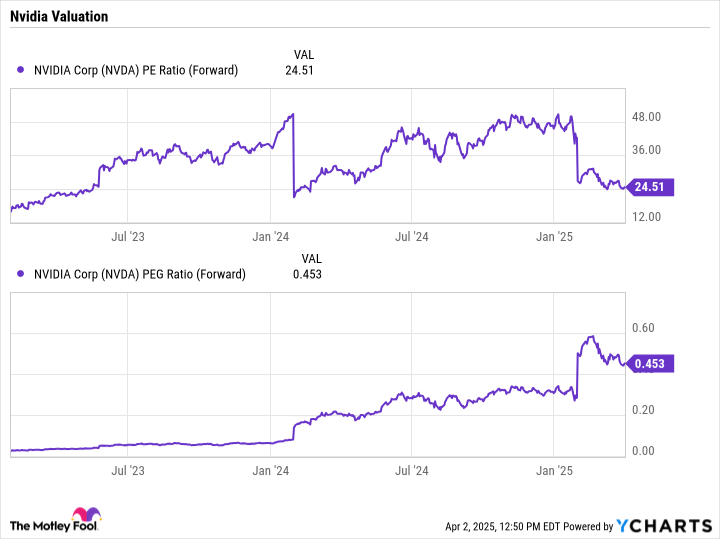

Is Nvidia Stock A Buy 3 Reasons To Add It To Your Portfolio

Apr 08, 2025

Is Nvidia Stock A Buy 3 Reasons To Add It To Your Portfolio

Apr 08, 2025 -

Sinopsis Lengkap Cinta Yasmin Eps 264 Kisah Galang Dan Ajeng

Apr 08, 2025

Sinopsis Lengkap Cinta Yasmin Eps 264 Kisah Galang Dan Ajeng

Apr 08, 2025 -

Uk Faces 111bn Revenue Gap Following Reeves Non Dom Tax Crackdown

Apr 08, 2025

Uk Faces 111bn Revenue Gap Following Reeves Non Dom Tax Crackdown

Apr 08, 2025 -

Live Updates Market Collapse As Dow Futures Plummet 1300 Points

Apr 08, 2025

Live Updates Market Collapse As Dow Futures Plummet 1300 Points

Apr 08, 2025 -

Web3 Gaming Insights Why Declining Asset Prices Dont Tell The Whole Game Fi Story

Apr 08, 2025

Web3 Gaming Insights Why Declining Asset Prices Dont Tell The Whole Game Fi Story

Apr 08, 2025