Australian Dollar Forecast: Navigating The US-China Trade War Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australian Dollar Forecast: Navigating the US-China Trade War Uncertainty

The Australian dollar (AUD), often dubbed the "Aussie," is a commodity currency heavily influenced by global economic conditions. Its fortunes are inextricably linked to the health of the Chinese economy, a major trading partner for Australia. Therefore, the ongoing US-China trade war casts a long shadow over the AUD's future, creating significant uncertainty for investors and businesses alike. This article delves into the current state of the AUD, exploring the key factors impacting its forecast and offering insights for navigating this turbulent period.

The Impact of the US-China Trade War on the Australian Dollar

The US-China trade war's effect on the AUD is multifaceted. China's demand for Australian commodities, particularly iron ore and coal, is a crucial driver of the Aussie's value. Escalating trade tensions disrupt global supply chains, impacting commodity prices and, consequently, Australia's export revenue. A weakening Chinese economy, a direct result of the trade war, leads to reduced demand for these commodities, putting downward pressure on the AUD.

- Reduced Commodity Demand: Tariffs and trade restrictions hinder China's import capacity, directly affecting demand for Australian exports.

- Global Economic Slowdown: The trade war contributes to a general global economic slowdown, impacting investor confidence and causing capital flight from emerging markets, including Australia.

- Increased Uncertainty: The unpredictable nature of the trade war makes it challenging for businesses to plan and invest, further impacting the AUD's stability.

Other Factors Influencing the Australian Dollar Forecast

While the US-China trade war is a dominant force, other factors also play a significant role in shaping the AUD's forecast:

- Reserve Bank of Australia (RBA) Monetary Policy: The RBA's interest rate decisions are crucial. Lower interest rates can weaken the AUD, making it less attractive to foreign investors, while higher rates can strengthen it.

- Domestic Economic Performance: Australia's domestic economic health, including employment rates, inflation, and consumer spending, significantly influences the AUD's strength. Strong domestic performance generally supports a stronger currency.

- Global Market Sentiment: Broader global market sentiment, driven by factors such as geopolitical events and global risk appetite, can impact investor flows into the AUD.

Australian Dollar Forecast: Short-Term and Long-Term Perspectives

Predicting the AUD's future is inherently challenging given the complexity of global economic dynamics. However, considering the current landscape:

- Short-Term Outlook: The short-term outlook remains uncertain. A resolution to the US-China trade war could trigger a significant AUD rally. However, continued escalation or prolonged uncertainty could lead to further depreciation.

- Long-Term Outlook: The long-term outlook depends heavily on the resolution of the trade war and the subsequent recovery of the global economy. Australia's diversified economy and strong institutional framework offer some resilience, suggesting a potential for long-term recovery.

Navigating the Uncertainty: Strategies for Investors

Navigating the uncertainty requires a cautious and diversified approach:

- Diversify Investments: Spread your investments across different asset classes to mitigate risk.

- Stay Informed: Keep abreast of economic developments and geopolitical events that could affect the AUD.

- Consider Hedging Strategies: Employ hedging strategies to protect against potential AUD depreciation.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized investment strategy tailored to your risk tolerance and financial goals.

Conclusion:

The Australian dollar's future remains intertwined with the evolving US-China trade war. While uncertainty persists, understanding the key drivers impacting the AUD and employing sound investment strategies are crucial for navigating this period effectively. Careful monitoring of global economic developments, coupled with a diversified investment approach, will be essential for maximizing opportunities and minimizing risks in this dynamic environment. The ongoing situation necessitates constant vigilance and adaptability from investors and businesses alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australian Dollar Forecast: Navigating The US-China Trade War Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nrl Round 5 Key Injuries And Late Team News For Manly Sea Eagles

Apr 07, 2025

Nrl Round 5 Key Injuries And Late Team News For Manly Sea Eagles

Apr 07, 2025 -

Analisis Dampak Tarif Trump Terhadap Pasar Saham Harga Minyak Dan Tingkat Inflasi

Apr 07, 2025

Analisis Dampak Tarif Trump Terhadap Pasar Saham Harga Minyak Dan Tingkat Inflasi

Apr 07, 2025 -

Declaring A Trade War Winners Losers And Global Economic Fallout

Apr 07, 2025

Declaring A Trade War Winners Losers And Global Economic Fallout

Apr 07, 2025 -

From Starter To Reserve Examining The Reasons Behind Kai Jones Bench Assignment

Apr 07, 2025

From Starter To Reserve Examining The Reasons Behind Kai Jones Bench Assignment

Apr 07, 2025 -

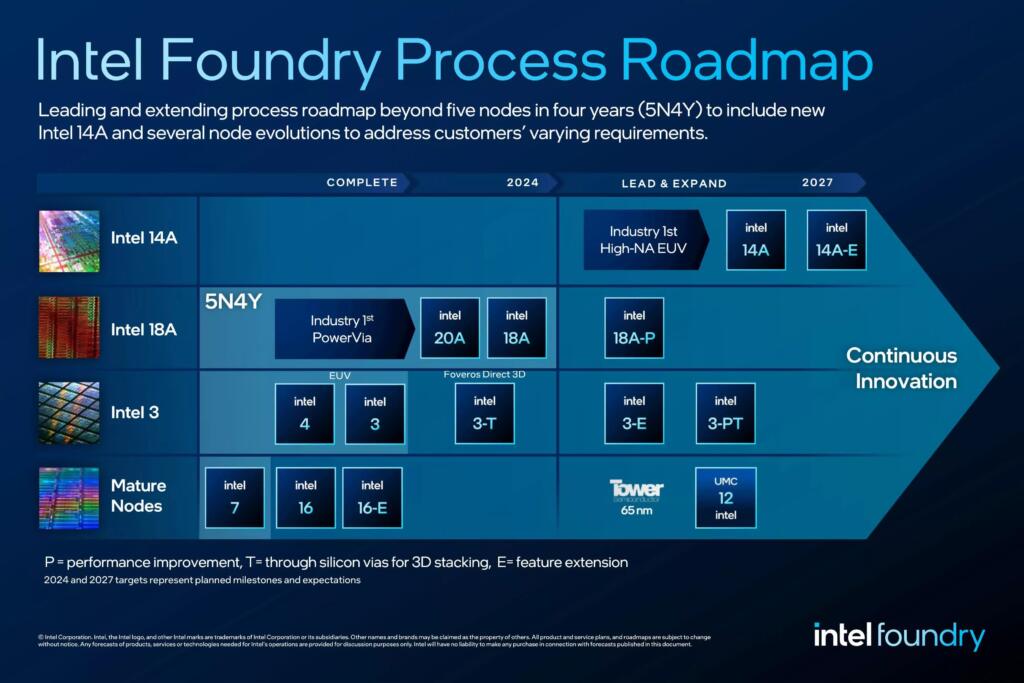

Intels 18 Angstrom Chips Second Half 2025 Production Launch

Apr 07, 2025

Intels 18 Angstrom Chips Second Half 2025 Production Launch

Apr 07, 2025