Australian Dollar Freefall: The Impact Of The US-China Trade Dispute

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australian Dollar Freefall: The Impact of the US-China Trade Dispute

The Australian dollar has plummeted in recent weeks, experiencing its most significant downturn in years. This dramatic freefall is largely attributed to the escalating US-China trade dispute, highlighting Australia's vulnerability to global economic shifts and its close ties to China's economic health. The implications for Australian businesses, consumers, and the broader economy are profound and warrant close examination.

Understanding the Connection: Australia, China, and the US Trade War

Australia's economy is heavily reliant on exports, with China being its largest trading partner. A significant portion of Australian exports, including iron ore, coal, and agricultural products, are destined for the Chinese market. The ongoing trade war between the US and China creates uncertainty and dampens global economic growth, directly impacting demand for Australian commodities. As Chinese growth slows, so too does demand for Australian goods, leading to a decrease in export revenue and a weakening of the Australian dollar (AUD).

The Mechanisms of the AUD's Decline:

Several factors contribute to the AUD's current weakness:

- Reduced Demand for Australian Exports: The slowdown in the Chinese economy, fueled by the trade war, directly reduces demand for Australian commodities. This decreased demand translates into lower export revenue, impacting the Australian current account and putting downward pressure on the AUD.

- Investor Sentiment: The uncertainty surrounding the US-China trade war discourages international investment in Australia. Investors are hesitant to commit capital to a market perceived as increasingly risky, further weakening the AUD.

- Safe-Haven Currencies: During periods of global economic uncertainty, investors often flock to "safe-haven" currencies like the US dollar (USD) and Japanese yen (JPY). This increased demand for safer assets leads to a relative decrease in demand for the AUD.

- Interest Rate Differentials: The Reserve Bank of Australia's (RBA) monetary policy plays a role. If the RBA lowers interest rates to stimulate the economy, this can make the AUD less attractive to international investors compared to countries with higher interest rates.

Impact on the Australian Economy:

The falling AUD has both positive and negative consequences for Australia:

- Positive Impacts: A weaker AUD can boost export competitiveness, making Australian goods cheaper for international buyers. This can help to offset some of the decline in demand from China. It also benefits tourism, as it makes Australia a more attractive destination for international visitors.

- Negative Impacts: A weaker AUD increases the cost of imported goods, leading to higher inflation for Australian consumers. Businesses reliant on imported materials will also face increased costs, potentially impacting profitability and investment. Furthermore, a prolonged period of AUD weakness can erode consumer and business confidence.

Looking Ahead: Predicting the Future of the AUD

Predicting the future trajectory of the AUD is challenging, given the ongoing uncertainty surrounding the US-China trade dispute and the global economic climate. However, several factors will likely influence its future performance:

- Resolution (or Escalation) of the US-China Trade War: A resolution to the trade dispute would likely lead to a strengthening of the AUD. Conversely, further escalation could result in further declines.

- RBA Monetary Policy: The RBA's decisions regarding interest rates will significantly impact the AUD's attractiveness to investors.

- Global Economic Growth: Stronger global economic growth would generally benefit the AUD, while a global slowdown would likely exacerbate its weakness.

The Australian dollar's freefall is a clear indication of the interconnectedness of the global economy and the significant impact of major geopolitical events. While a weaker AUD may offer some benefits in terms of export competitiveness, the potential negative impacts on inflation, consumer confidence, and business investment cannot be ignored. The coming months will be crucial in determining the extent of the AUD's decline and its ultimate impact on the Australian economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australian Dollar Freefall: The Impact Of The US-China Trade Dispute. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hong Kong Stocks Plunge Triggering Asia Pacific Market Sell Off Amid Trade War Fears

Apr 07, 2025

Hong Kong Stocks Plunge Triggering Asia Pacific Market Sell Off Amid Trade War Fears

Apr 07, 2025 -

Kai Jones Moves To The Bench Impact On The Team And His Future Prospects

Apr 07, 2025

Kai Jones Moves To The Bench Impact On The Team And His Future Prospects

Apr 07, 2025 -

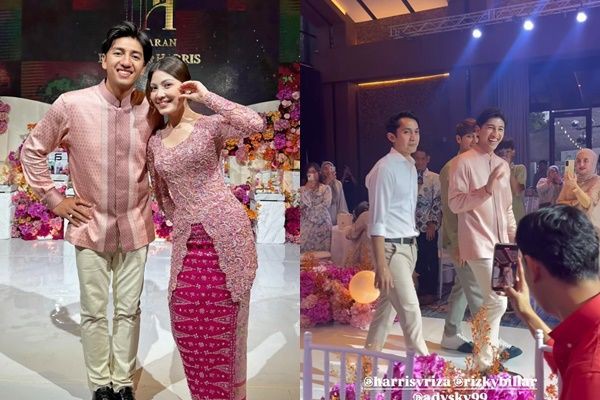

Detail Lamaran Harris Vriza Dan Haviza Devi Di Medan Gaun Dekorasi Dan Momen Spesial

Apr 07, 2025

Detail Lamaran Harris Vriza Dan Haviza Devi Di Medan Gaun Dekorasi Dan Momen Spesial

Apr 07, 2025 -

Hamster Kombat After One Year Web3 Gamings Unexpected Success

Apr 07, 2025

Hamster Kombat After One Year Web3 Gamings Unexpected Success

Apr 07, 2025 -

Mass Brawl Disrupts Saints And Power Afl Match Hogans Controversial Act

Apr 07, 2025

Mass Brawl Disrupts Saints And Power Afl Match Hogans Controversial Act

Apr 07, 2025