Australia's Economic Future: The Impact Of Slowing Chinese Growth And US Instability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australia's Economic Future: Navigating the Choppy Waters of Global Uncertainty

Australia's economic outlook is increasingly complex, caught in the crosscurrents of slowing Chinese growth and escalating US political and economic instability. For a nation heavily reliant on resource exports to China and deeply intertwined with the US-led global order, these headwinds pose significant challenges. Understanding these challenges and Australia's potential responses is crucial for navigating the uncertain future.

The Looming Shadow of Slowing Chinese Growth

China, Australia's largest trading partner, is experiencing a slowdown in its economic growth. This deceleration, driven by factors including a struggling property sector and weakening consumer demand, directly impacts Australia's export-oriented economy. Key Australian industries, particularly mining and agriculture, are acutely vulnerable. Reduced demand for iron ore, coal, and agricultural products translates to lower export revenues, impacting jobs and government revenue.

- Impact on Resource Sector: The mining industry, a cornerstone of the Australian economy, faces reduced demand for its key exports. This necessitates diversification and a focus on value-added processing to mitigate the risks.

- Agricultural Exports: Similarly, the agricultural sector, reliant on Chinese demand for products like beef, dairy, and wine, faces uncertainty. Increased competition and potential trade barriers further exacerbate the challenges.

- Tourism Sector: The slowdown in Chinese tourist arrivals also negatively impacts the Australian tourism sector, a significant contributor to the economy.

The Ripple Effect of US Instability

Beyond China, the political and economic uncertainty in the United States also casts a long shadow over Australia's future. Geopolitical tensions, inflation, and potential economic downturns in the US have significant global ramifications.

- Global Market Volatility: US economic instability creates volatility in global financial markets, impacting Australian investment and asset prices. This uncertainty can deter foreign investment and hinder economic growth.

- Trade Relations: While Australia maintains a strong alliance with the US, any significant economic downturn in the US could indirectly impact trade relations and investment flows.

- Inflationary Pressures: Rising inflation in the US further complicates the Australian economic landscape, potentially leading to increased import costs and inflationary pressures domestically.

Australia's Strategic Response: Diversification and Innovation

Australia needs to adopt a proactive and multifaceted strategy to mitigate these risks. Diversification of trading partners and a shift towards value-added exports are crucial.

- Strengthening Trade Ties with Other Asian Nations: Exploring and expanding trade relationships with other Asian economies, including India, Japan, and South Korea, can help reduce reliance on China.

- Investing in Innovation and Technology: Investing in research and development, particularly in renewable energy and technology sectors, can foster economic growth and create new export opportunities.

- Enhancing Domestic Demand: Stimulating domestic consumption and investment can reduce reliance on export-led growth and enhance economic resilience.

- Fiscal Prudence: Maintaining sound fiscal policy and managing government debt effectively are vital for navigating economic uncertainty.

Conclusion: A Path Forward Through Strategic Adaptation

Australia's economic future hinges on its ability to adapt to the changing global landscape. While challenges posed by slowing Chinese growth and US instability are significant, proactive policy responses, including diversification, innovation, and prudent fiscal management, can pave the way for sustained economic growth and prosperity. The nation's success will depend on its agility, strategic foresight, and commitment to long-term economic resilience in an increasingly uncertain world.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australia's Economic Future: The Impact Of Slowing Chinese Growth And US Instability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Post Game Analysis Kepler Chats With T Mac And Kruk Following Phillies Nationals Game

May 03, 2025

Post Game Analysis Kepler Chats With T Mac And Kruk Following Phillies Nationals Game

May 03, 2025 -

Google Chatbot Introduces Advertising For Ai Startup Consultations

May 03, 2025

Google Chatbot Introduces Advertising For Ai Startup Consultations

May 03, 2025 -

Wwe Cuts Jakara Jackson And Gallus Coffey Wolfgang And Mark Released

May 03, 2025

Wwe Cuts Jakara Jackson And Gallus Coffey Wolfgang And Mark Released

May 03, 2025 -

Australias Security Landscape A Looming Nightmare For The Next Government

May 03, 2025

Australias Security Landscape A Looming Nightmare For The Next Government

May 03, 2025 -

Devin Haney Vs Jose Ramirez Full Fight Card And Viewing Guide

May 03, 2025

Devin Haney Vs Jose Ramirez Full Fight Card And Viewing Guide

May 03, 2025

Latest Posts

-

Post Cardinals Goldschmidts Grand Slams Shock Baseball A Yankees Story

May 03, 2025

Post Cardinals Goldschmidts Grand Slams Shock Baseball A Yankees Story

May 03, 2025 -

The Good The Bad And The Preposterous A Look At Aaron Judges Year

May 03, 2025

The Good The Bad And The Preposterous A Look At Aaron Judges Year

May 03, 2025 -

Paul Goldschmidts Five Rbi Powerhouse Performance Leads Cardinals

May 03, 2025

Paul Goldschmidts Five Rbi Powerhouse Performance Leads Cardinals

May 03, 2025 -

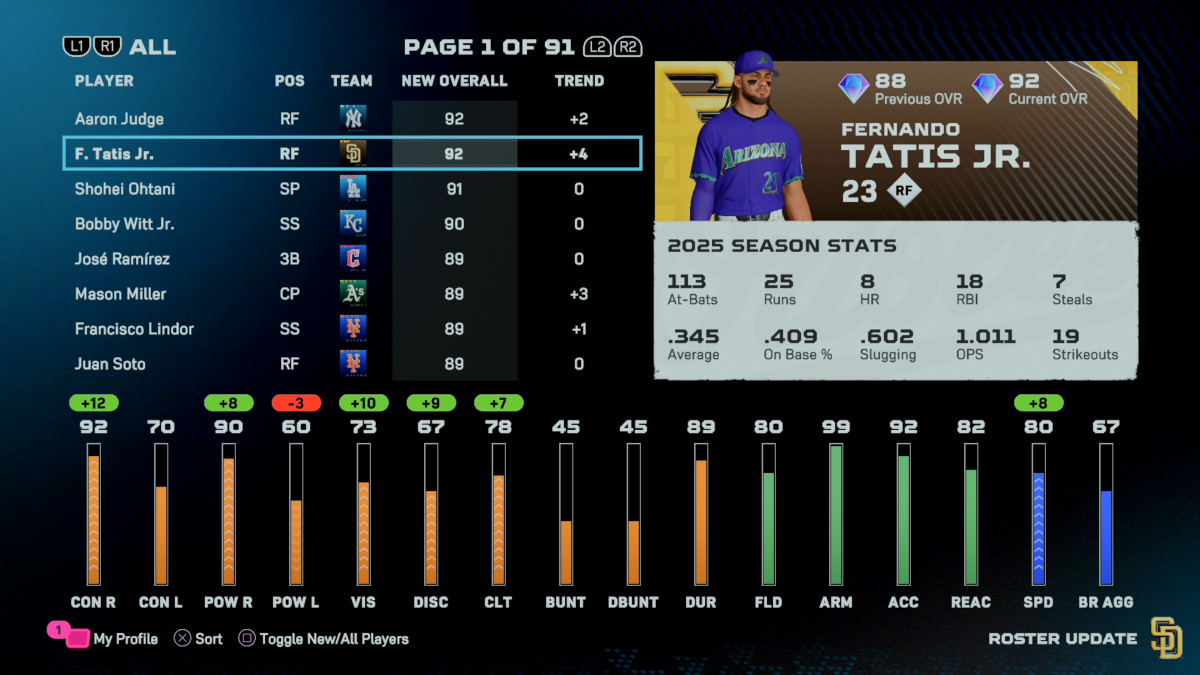

Mlb The Show 25 Fernando Tatis Jr Receives Massive Diamond Dynasty Rating Boost

May 03, 2025

Mlb The Show 25 Fernando Tatis Jr Receives Massive Diamond Dynasty Rating Boost

May 03, 2025 -

Best Password Manager Google Dominates Tech Radar Pro Reader Preferences

May 03, 2025

Best Password Manager Google Dominates Tech Radar Pro Reader Preferences

May 03, 2025