Automation Anxiety: The IRS And The Potential For AI-Driven Workforce Replacement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Automation Anxiety: The IRS and the Potential for AI-Driven Workforce Replacement

The Internal Revenue Service (IRS), a behemoth of bureaucratic processes, is facing a potential seismic shift: the encroachment of artificial intelligence (AI). While AI promises increased efficiency and accuracy in tax processing, a looming question hangs heavy in the air: will automation lead to widespread job displacement within the IRS workforce? The anxiety is palpable, and the potential consequences far-reaching.

This isn't just about replacing human workers with machines; it's about the future of public service and the ethical implications of deploying AI on such a large scale. The IRS, responsible for collecting trillions of dollars annually and enforcing tax laws, employs hundreds of thousands of people. The prospect of AI-driven job losses fuels legitimate concerns about economic disruption and the need for retraining and reskilling initiatives.

The Allure of AI in Tax Processing

The IRS faces immense challenges: a massive backlog of tax returns, increasingly complex tax codes, and a persistent struggle against tax fraud. AI offers potential solutions:

- Automated Tax Return Processing: AI algorithms can quickly and accurately process simple tax returns, freeing up human agents to handle more complex cases.

- Fraud Detection: AI can analyze vast datasets to identify patterns indicative of fraudulent activity, significantly improving the IRS's ability to combat tax evasion.

- Improved Customer Service: AI-powered chatbots can provide instant answers to frequently asked questions, reducing wait times and improving taxpayer satisfaction.

- Enhanced Audit Efficiency: AI can help identify high-risk taxpayers for audit, streamlining the audit process and improving resource allocation.

These benefits are undeniable, but the path to implementation is fraught with challenges.

The Human Cost of Automation: Addressing Workforce Displacement

The potential for job displacement is the most significant concern. While some roles may become obsolete, others will evolve to require new skills. The IRS needs to proactively address this transition:

- Reskilling and Retraining Programs: Investing in robust training programs is crucial to equip employees with the skills needed to work alongside AI and in emerging roles within the IRS. This might include data analysis, AI management, or cybersecurity.

- Transparency and Communication: Open communication with employees about the impact of automation is essential to build trust and mitigate anxiety.

- Support for Displaced Workers: Providing severance packages, outplacement services, and assistance with job searching is vital for those whose roles are eliminated.

- Focus on Human-AI Collaboration: Rather than viewing AI as a replacement for human workers, the IRS should focus on integrating AI to augment human capabilities, creating a more efficient and effective workforce.

Navigating the Ethical Minefield

Beyond workforce implications, ethical considerations are paramount:

- Data Privacy: AI systems will handle sensitive taxpayer data, raising concerns about data security and privacy breaches. Robust security measures are essential.

- Algorithmic Bias: AI algorithms can perpetuate existing biases if not carefully designed and monitored. The IRS must ensure fairness and equity in AI-driven decisions.

- Accountability: Determining accountability for errors or biases in AI systems is a significant challenge. Clear guidelines and oversight mechanisms are needed.

The integration of AI within the IRS is inevitable. The key to success lies in carefully managing the transition, prioritizing ethical considerations, and investing in the workforce. Failing to do so risks not only widespread job displacement but also damage to public trust and the effectiveness of the tax system itself. The future of the IRS, and indeed the future of work in many sectors, depends on navigating this complex landscape with foresight and responsibility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Automation Anxiety: The IRS And The Potential For AI-Driven Workforce Replacement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Berkshire Hathaway 2024 Acompanhe Ao Vivo Pela Agora Info Money Todos Os Detalhes Da Reuniao Anual

May 11, 2025

Berkshire Hathaway 2024 Acompanhe Ao Vivo Pela Agora Info Money Todos Os Detalhes Da Reuniao Anual

May 11, 2025 -

Nicky Rods Brother Excluded From Craig Jones B Team Details Of The Incident

May 11, 2025

Nicky Rods Brother Excluded From Craig Jones B Team Details Of The Incident

May 11, 2025 -

Two Simple Changes To Improve Your Cats Cattery Experience

May 11, 2025

Two Simple Changes To Improve Your Cats Cattery Experience

May 11, 2025 -

Ind W Vs Sl W Live Score Harmanpreet Kaurs India Aim For Dominant Victory

May 11, 2025

Ind W Vs Sl W Live Score Harmanpreet Kaurs India Aim For Dominant Victory

May 11, 2025 -

Sri Lanka Women Vs India Women Pitch And Weather Analysis For The Final

May 11, 2025

Sri Lanka Women Vs India Women Pitch And Weather Analysis For The Final

May 11, 2025

Latest Posts

-

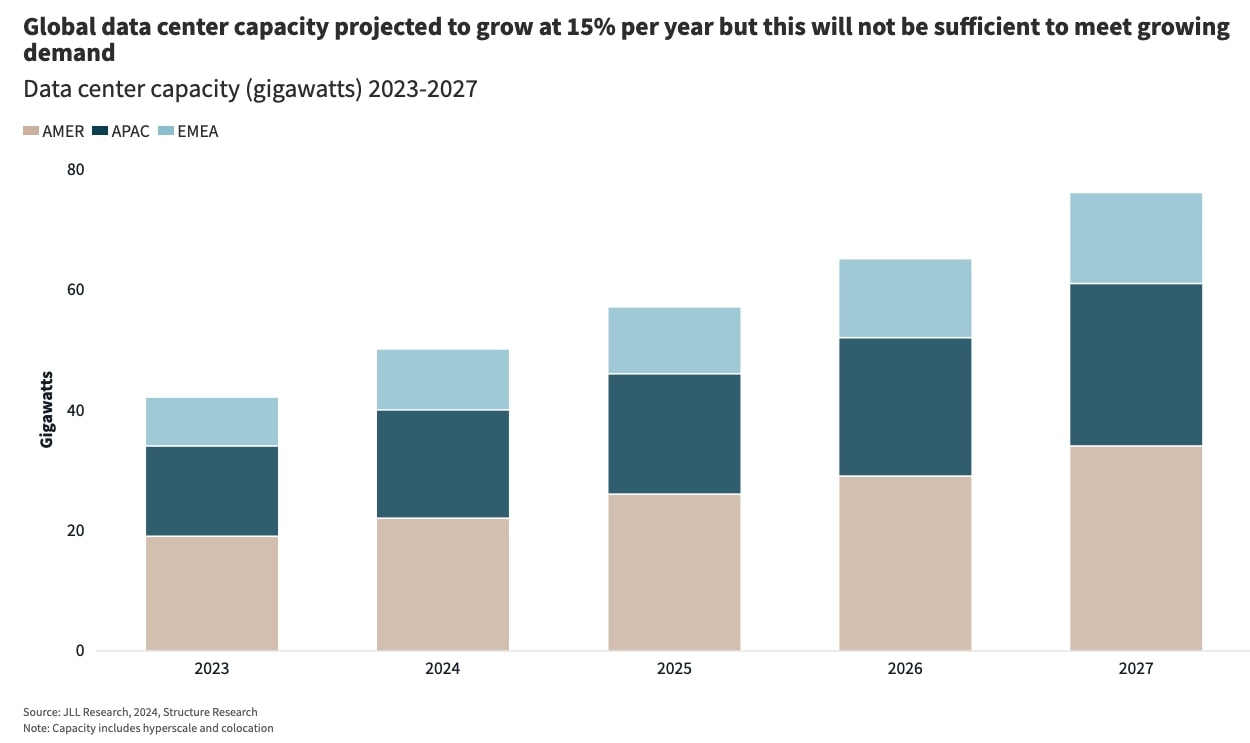

The Future Of Global Ai Data Centers Trends And Challenges

May 12, 2025

The Future Of Global Ai Data Centers Trends And Challenges

May 12, 2025 -

A12 Road Closure Emergency Situation Leads To Severe Congestion

May 12, 2025

A12 Road Closure Emergency Situation Leads To Severe Congestion

May 12, 2025 -

Lewenberg On Raptors Lottery Odds And Long Term Potential

May 12, 2025

Lewenberg On Raptors Lottery Odds And Long Term Potential

May 12, 2025 -

Tragic Loss Singaporean Cricket Coach Arjun Menon Killed In Malawi

May 12, 2025

Tragic Loss Singaporean Cricket Coach Arjun Menon Killed In Malawi

May 12, 2025 -

Slept With Everyone Eva Longorias Comments And The Future Of Desperate Housewives

May 12, 2025

Slept With Everyone Eva Longorias Comments And The Future Of Desperate Housewives

May 12, 2025