Avalanche (AVAX) Technical Analysis: Resistance Zone Rejection, Pullback Likely?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Avalanche (AVAX) Technical Analysis: Resistance Zone Rejection, Pullback Likely?

Avalanche (AVAX), the popular layer-1 blockchain platform, has recently encountered resistance, leading many analysts to predict a potential pullback. This article delves into the technical analysis of AVAX, examining key price action, indicators, and potential future price movements. Understanding these factors is crucial for both seasoned and novice investors navigating the volatile cryptocurrency market.

Recent Price Action and Key Resistance Levels:

AVAX has shown significant growth in recent months, fueled by [mention specific catalysts like partnerships, upgrades, or market trends]. However, its ascent has been halted at a crucial resistance zone between $[price] and $[price]. This resistance level has been repeatedly tested, indicating a strong selling pressure at these price points. The recent rejection of this resistance zone suggests a potential bearish correction is underway.

Technical Indicators Pointing Towards a Pullback:

Several technical indicators reinforce the possibility of an AVAX pullback:

- Relative Strength Index (RSI): The RSI is currently showing [RSI value], suggesting the asset is in [oversold/overbought] territory. An RSI above 70 typically signals overbought conditions, indicating a potential price correction.

- Moving Averages: The [short-term moving average] has crossed below the [long-term moving average], a bearish crossover often indicating a shift in momentum. This bearish signal suggests a potential downward trend.

- MACD (Moving Average Convergence Divergence): The MACD is [mention current MACD status, e.g., showing a bearish crossover, or negative divergence]. This further supports the possibility of a price decline.

Support Levels to Watch:

While a pullback seems likely, identifying potential support levels is vital for investors. Key support levels to watch for AVAX include $[price] and $[price]. A break below these levels could signal a more significant price correction.

Potential Scenarios and Trading Strategies:

Based on the current technical analysis, several scenarios are possible:

- Scenario 1: Short-Term Pullback: AVAX experiences a short-term pullback, consolidating around the support levels mentioned above before resuming its upward trend. This scenario would be favorable for investors looking to accumulate more AVAX at lower prices.

- Scenario 2: Deeper Correction: If the support levels break, a deeper correction could occur, potentially leading to lower price levels. Investors should be prepared for such a scenario and manage their risk accordingly.

Trading strategies should always consider risk management: Stop-loss orders are crucial in mitigating potential losses during market volatility. Investors should also diversify their portfolios and avoid investing more than they can afford to lose.

Disclaimer: This analysis is solely for informational purposes and does not constitute financial advice. The cryptocurrency market is highly volatile, and investing in cryptocurrencies carries significant risk. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Keywords: Avalanche, AVAX, Technical Analysis, Cryptocurrency, Price Prediction, Resistance, Support, Pullback, RSI, Moving Averages, MACD, Trading Strategy, Crypto Investment, Blockchain, Layer-1 Blockchain.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Avalanche (AVAX) Technical Analysis: Resistance Zone Rejection, Pullback Likely?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

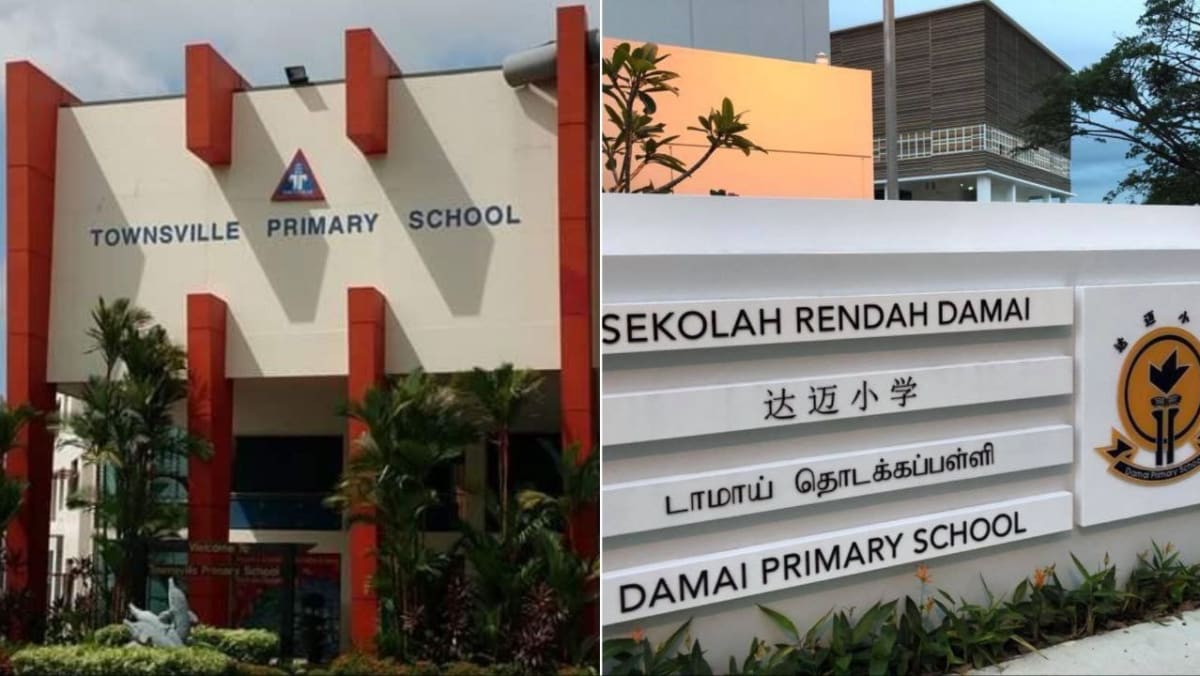

2029 Relocation For Damai Primary School Addressing Townsvilles Education Needs

May 15, 2025

2029 Relocation For Damai Primary School Addressing Townsvilles Education Needs

May 15, 2025 -

Worst Decision Mum Recounts Ryanair Experience From Tenerife

May 15, 2025

Worst Decision Mum Recounts Ryanair Experience From Tenerife

May 15, 2025 -

Entregas Sospechosas Y Presentimientos Investigacion Del Caso Valeria Marquez

May 15, 2025

Entregas Sospechosas Y Presentimientos Investigacion Del Caso Valeria Marquez

May 15, 2025 -

Where To Watch Gauff Vs Andreeva In Rome Quarterfinal Match Preview

May 15, 2025

Where To Watch Gauff Vs Andreeva In Rome Quarterfinal Match Preview

May 15, 2025 -

Steam Data Breach Over 89 Million Accounts Potentially Compromised

May 15, 2025

Steam Data Breach Over 89 Million Accounts Potentially Compromised

May 15, 2025

Latest Posts

-

Understanding Trauma Through Superheroes The Case Of Dcs Doom Patrol

May 15, 2025

Understanding Trauma Through Superheroes The Case Of Dcs Doom Patrol

May 15, 2025 -

James Gunns Exciting Update On The New Superman Trailer

May 15, 2025

James Gunns Exciting Update On The New Superman Trailer

May 15, 2025 -

When Is Eurovision 2025 Irelands Bid And Voting Breakdown

May 15, 2025

When Is Eurovision 2025 Irelands Bid And Voting Breakdown

May 15, 2025 -

Trumps Qatar Talks Follow Syrian Meeting A Diplomatic Deep Dive

May 15, 2025

Trumps Qatar Talks Follow Syrian Meeting A Diplomatic Deep Dive

May 15, 2025 -

Microsofts Binned Windows 11 Start Menu Ideas Why The Changes Were For The Best

May 15, 2025

Microsofts Binned Windows 11 Start Menu Ideas Why The Changes Were For The Best

May 15, 2025