AVAX Price Analysis: Avalanche Faces Resistance, Potential Pullback Ahead

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AVAX Price Analysis: Avalanche Faces Resistance, Potential Pullback Ahead

Avalanche (AVAX), the popular Layer-1 blockchain platform, is currently facing significant resistance, hinting at a potential price pullback in the near future. While the project boasts impressive technological advancements and a burgeoning ecosystem, current market dynamics suggest caution for investors. This analysis delves into the key factors influencing AVAX's price and explores what investors can expect in the coming days and weeks.

Technical Analysis: Key Resistance Levels and Indicators

The AVAX price has been consolidating around the crucial resistance level of $[Insert Current Price or Relevant Price Range Here]. This resistance has proven challenging to overcome, leading to a period of sideways trading. Technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), are showing signs of bearish momentum.

- RSI: The RSI is currently [Insert RSI Value Here], indicating [Overbought/Oversold/Neutral] conditions. A reading above 70 often signals overbought conditions, suggesting a potential price correction.

- MACD: The MACD is [Insert MACD Status Here, e.g., showing a bearish crossover], further supporting the possibility of a price pullback.

These technical signals, combined with the persistent resistance at $[Insert Price Range Again], paint a cautious picture for AVAX in the short term.

Fundamental Factors: Ecosystem Growth vs. Market Sentiment

Despite the technical challenges, Avalanche's underlying fundamentals remain strong. The platform continues to attract developers, with a growing number of decentralized applications (dApps) being built on its network. Recent partnerships and collaborations also contribute to its long-term potential. However, the current bearish sentiment in the broader cryptocurrency market is significantly impacting AVAX's price. The overall market downturn is impacting investor confidence, leading to selling pressure across the board.

Potential Pullback Scenarios and Support Levels

A pullback from the current resistance level is a plausible scenario. Investors should be aware of potential support levels at $[Insert Support Price Levels Here]. A break below these support levels could trigger a more significant price decline. However, strong support could lead to a period of consolidation before another attempt to break the resistance.

What This Means for Investors:

The current situation presents a mixed bag for AVAX investors. While the long-term prospects for Avalanche remain positive, the short-term outlook appears more uncertain. Investors should carefully consider their risk tolerance and investment strategy.

- Short-term traders: Might consider taking profits or reducing exposure given the potential for a pullback.

- Long-term holders: Should likely remain unfazed, focusing on the project's long-term growth potential. Dollar-cost averaging (DCA) could be a viable strategy for accumulating more AVAX at lower prices during a potential dip.

Conclusion: Navigating the Uncertainty

The AVAX price analysis indicates a potential pullback, primarily driven by technical resistance and the broader market sentiment. While Avalanche's fundamental strengths remain, cautious optimism is warranted in the short term. Investors should monitor key technical indicators and support levels closely to make informed decisions. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions. The cryptocurrency market is inherently volatile, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AVAX Price Analysis: Avalanche Faces Resistance, Potential Pullback Ahead. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Hot Wheels Metal Mario Design Specs And Pre Order Information

May 15, 2025

New Hot Wheels Metal Mario Design Specs And Pre Order Information

May 15, 2025 -

Beyond The Prodigy Coco Gauff And The Mouratoglou Mentorship

May 15, 2025

Beyond The Prodigy Coco Gauff And The Mouratoglou Mentorship

May 15, 2025 -

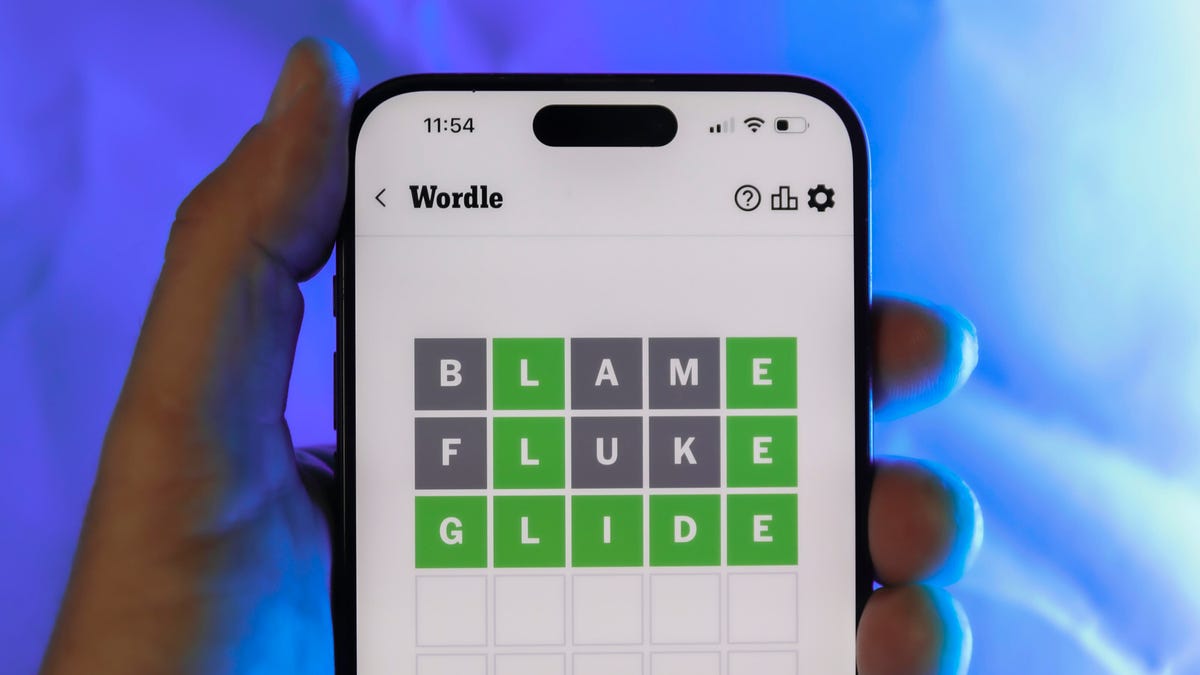

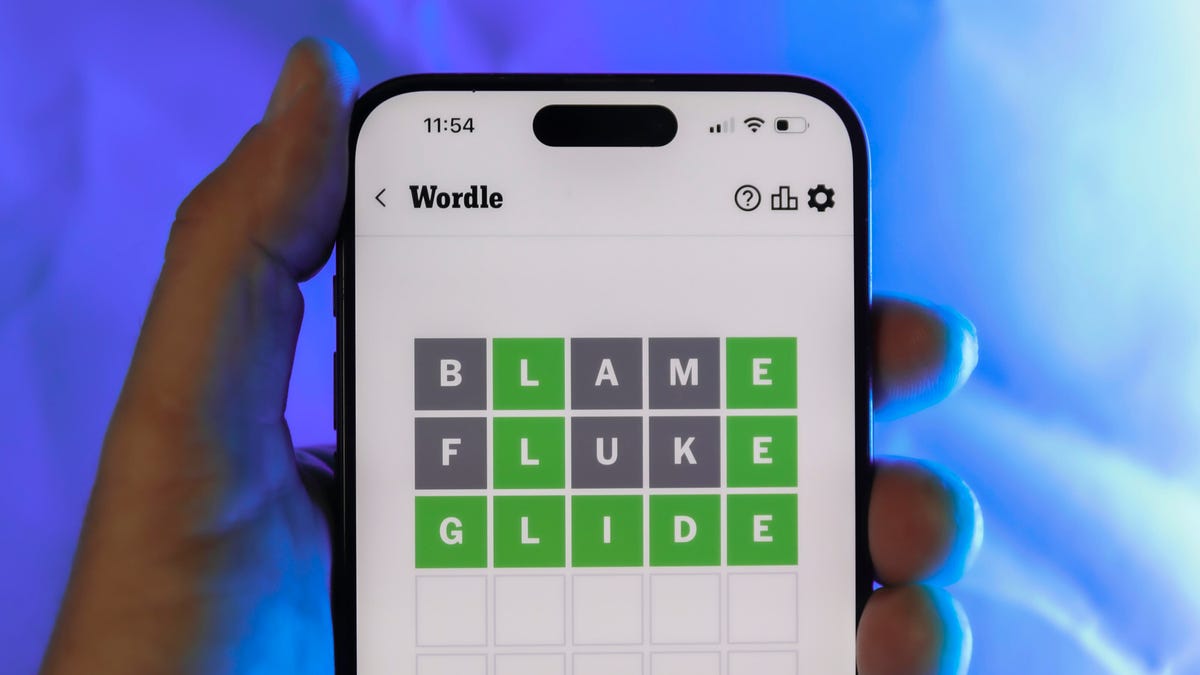

Wordle Puzzle 1425 Solution May 14th Hints And Answer

May 15, 2025

Wordle Puzzle 1425 Solution May 14th Hints And Answer

May 15, 2025 -

The Future Of Ev Analyzing The Strategic Importance Of Teslas Dojo And 4680 Cells

May 15, 2025

The Future Of Ev Analyzing The Strategic Importance Of Teslas Dojo And 4680 Cells

May 15, 2025 -

Us President Trump Syria Sanctions Iran Deal And A Path To Regional Stability

May 15, 2025

Us President Trump Syria Sanctions Iran Deal And A Path To Regional Stability

May 15, 2025

Latest Posts

-

Wordle Hints Answer And Help For May 14 1425

May 15, 2025

Wordle Hints Answer And Help For May 14 1425

May 15, 2025 -

Second Largest Layoff In Microsoft History 6 000 Employees Impacted

May 15, 2025

Second Largest Layoff In Microsoft History 6 000 Employees Impacted

May 15, 2025 -

Giro D Italia 2025 Stage 5 Preview Explosive Climbs Ahead

May 15, 2025

Giro D Italia 2025 Stage 5 Preview Explosive Climbs Ahead

May 15, 2025 -

Winnipegs Scorching Summer Ac Battles Between Landlords And Tenants

May 15, 2025

Winnipegs Scorching Summer Ac Battles Between Landlords And Tenants

May 15, 2025 -

Impact Of Reduced Tariffs On Imports From China During The Trump Presidency

May 15, 2025

Impact Of Reduced Tariffs On Imports From China During The Trump Presidency

May 15, 2025