Avery Shenfeld (CIBC) On The Bank Of Canada And Canada's Economic Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CIBC's Avery Shenfeld: Navigating Canada's Economic Crossroads

Canada's economic future is a topic of intense debate, and the pronouncements of leading economists carry significant weight. Avery Shenfeld, Chief Economist at CIBC, is one such voice, offering insightful commentary on the Bank of Canada's actions and their implications for the Canadian economy. His recent analysis paints a nuanced picture, suggesting a path forward fraught with both challenges and opportunities.

The Bank of Canada's Tightrope Walk:

Shenfeld's perspective emphasizes the delicate balancing act the Bank of Canada faces. The central bank is tasked with managing inflation while simultaneously avoiding a hard landing for the Canadian economy. Recent interest rate hikes, while aimed at curbing inflation, also risk triggering a recession. Shenfeld's analysis delves into the complexities of this situation, highlighting the potential trade-offs involved.

Inflation's Persistent Grip:

One key aspect of Shenfeld's analysis focuses on the persistent nature of inflation in Canada. He acknowledges the progress made in bringing inflation down from its peak, but cautions against premature celebration. Underlying inflationary pressures remain, fueled by factors such as strong wage growth and persistent supply chain disruptions. He stresses the need for continued vigilance and strategic monetary policy adjustments.

Housing Market Slowdown and its Ripple Effects:

The Canadian housing market, a significant driver of the national economy, has experienced a noticeable slowdown. Shenfeld's commentary examines the impact of this slowdown on broader economic activity. He explores the interconnectedness of the housing sector with other parts of the economy, highlighting the potential for ripple effects across various industries. This includes the potential impact on consumer spending and investment.

Navigating Uncertainty: A Look Ahead

Shenfeld's outlook for the Canadian economy isn't purely pessimistic. While acknowledging the challenges, he points to potential positive factors, such as a resilient labor market and strong exports. However, he stresses the importance of careful policy management and adapting to evolving economic circumstances. His analysis suggests that the Bank of Canada’s actions will be crucial in determining whether Canada avoids a recession and navigates this period of uncertainty effectively.

Key Takeaways from Shenfeld's Analysis:

- Inflation remains a concern: While progress has been made, underlying inflationary pressures persist.

- Housing market slowdown: The cooling housing market has significant ripple effects throughout the economy.

- Balancing act for the Bank of Canada: The central bank needs to carefully manage interest rates to avoid a recession while controlling inflation.

- Resilient labor market: A strong labor market provides a buffer against economic downturn.

- Global economic uncertainty: Canada's economic outlook is intertwined with global economic conditions.

Conclusion:

Avery Shenfeld's analysis provides valuable insight into the intricate dynamics of the Canadian economy. His considered perspective, balancing cautious optimism with realistic assessments of the challenges ahead, offers a roadmap for navigating the complex economic landscape. By understanding the nuances of his analysis, policymakers, investors, and ordinary Canadians alike can better prepare for the economic future. Following his commentary provides a key window into the ongoing discussions and strategies surrounding Canada's economic stability and growth. His expertise allows for a more informed understanding of the Bank of Canada's role and its impact on all Canadians.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Avery Shenfeld (CIBC) On The Bank Of Canada And Canada's Economic Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

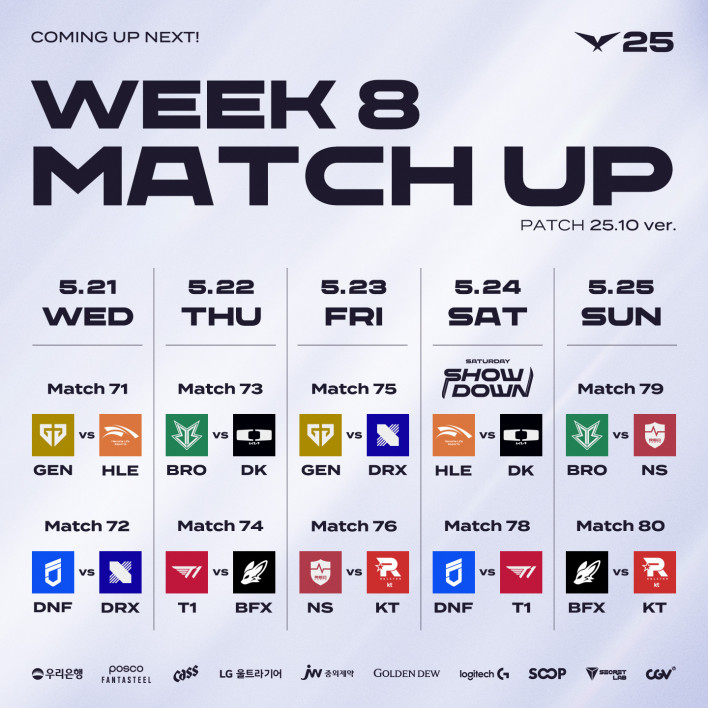

Hle Vs Gen G And Dplus Kia Lck Showdown In The Post 25 10 Landscape

May 24, 2025

Hle Vs Gen G And Dplus Kia Lck Showdown In The Post 25 10 Landscape

May 24, 2025 -

Birmingham Prides New Location A Celebration Of Heritage

May 24, 2025

Birmingham Prides New Location A Celebration Of Heritage

May 24, 2025 -

Countryfile Star Anita Rani Makes Candid Admission Following Divorce

May 24, 2025

Countryfile Star Anita Rani Makes Candid Admission Following Divorce

May 24, 2025 -

Shai Gilgeous Alexander Nba Mvp And Thunders Rise To The Top

May 24, 2025

Shai Gilgeous Alexander Nba Mvp And Thunders Rise To The Top

May 24, 2025 -

Tonights Euro Millions Draw Winning Numbers And Thunderball Results May 23rd

May 24, 2025

Tonights Euro Millions Draw Winning Numbers And Thunderball Results May 23rd

May 24, 2025